Welcome to our comprehensive guide on crafting a powerful accountant resume.

Whether you're an experienced professional looking to advance your career or a recent graduate entering the accounting field, a well-crafted resume is essential for showcasing your skills, qualifications, and accomplishments.

On this page, we provide expert resume examples, tips, sample resumes, and proven strategies to help you create a standout accountant resume that grabs the attention of hiring managers and lands you the job interviews you deserve.

What you can read in this article

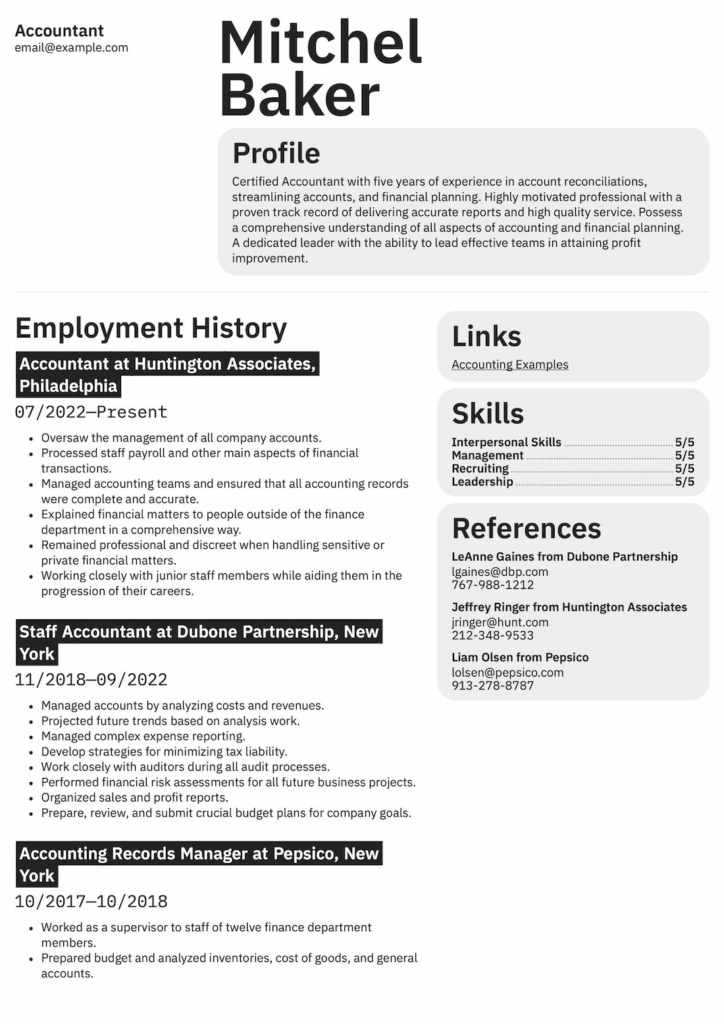

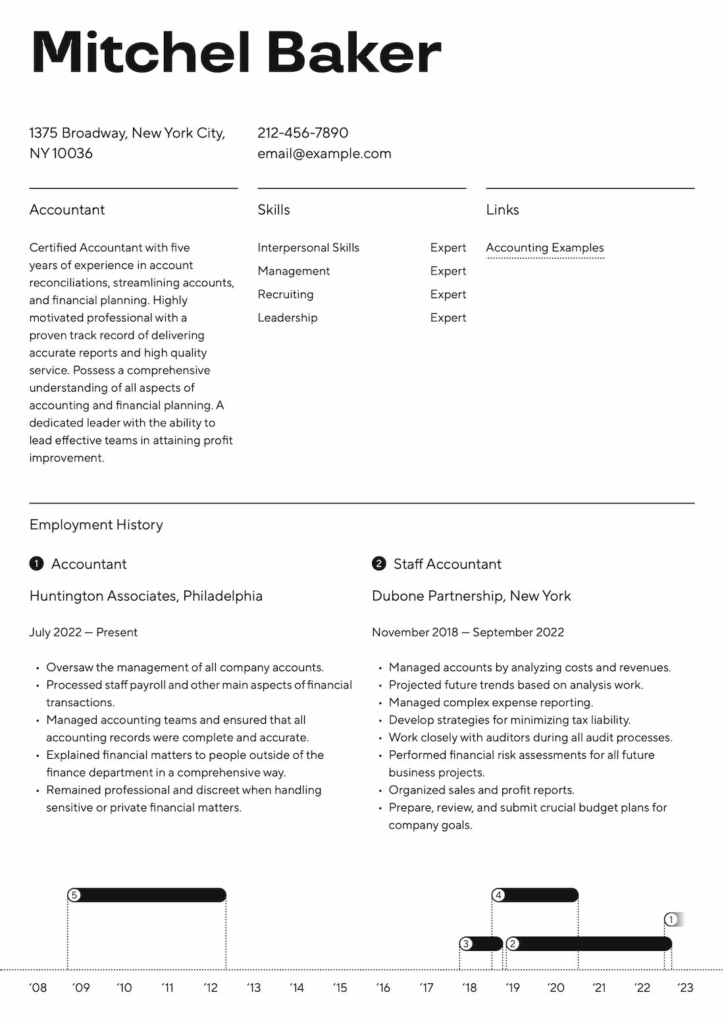

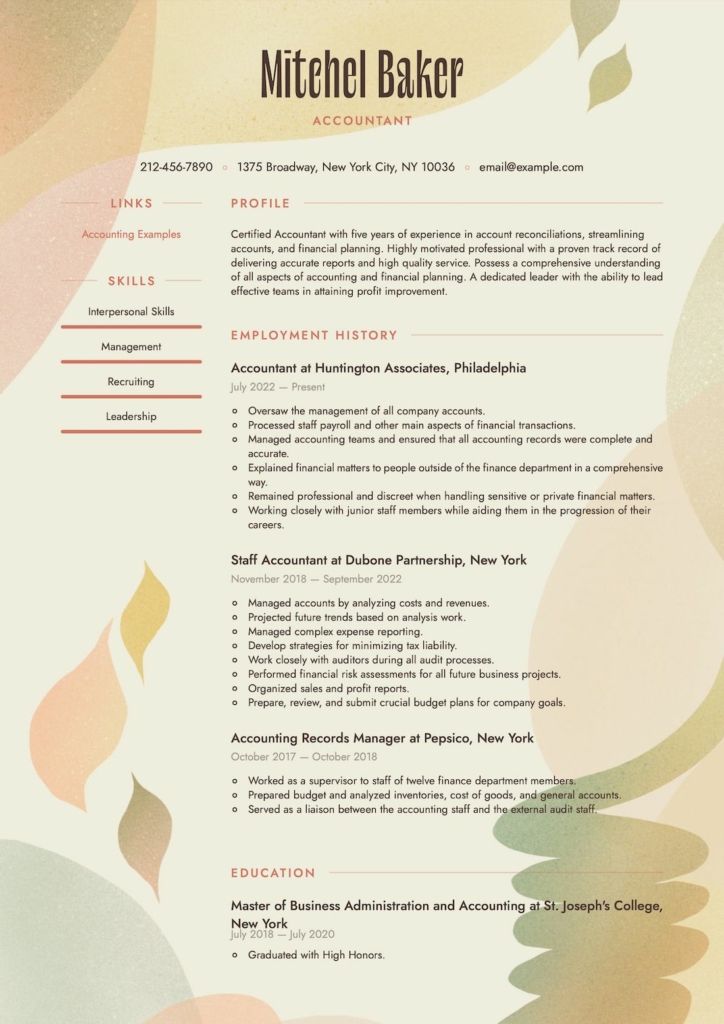

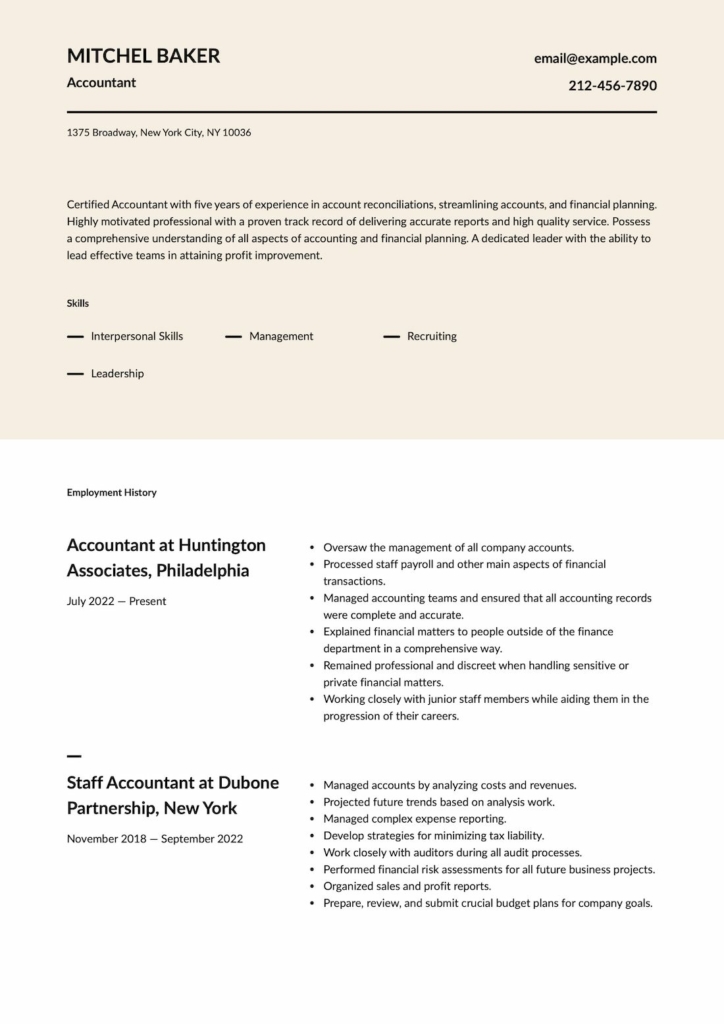

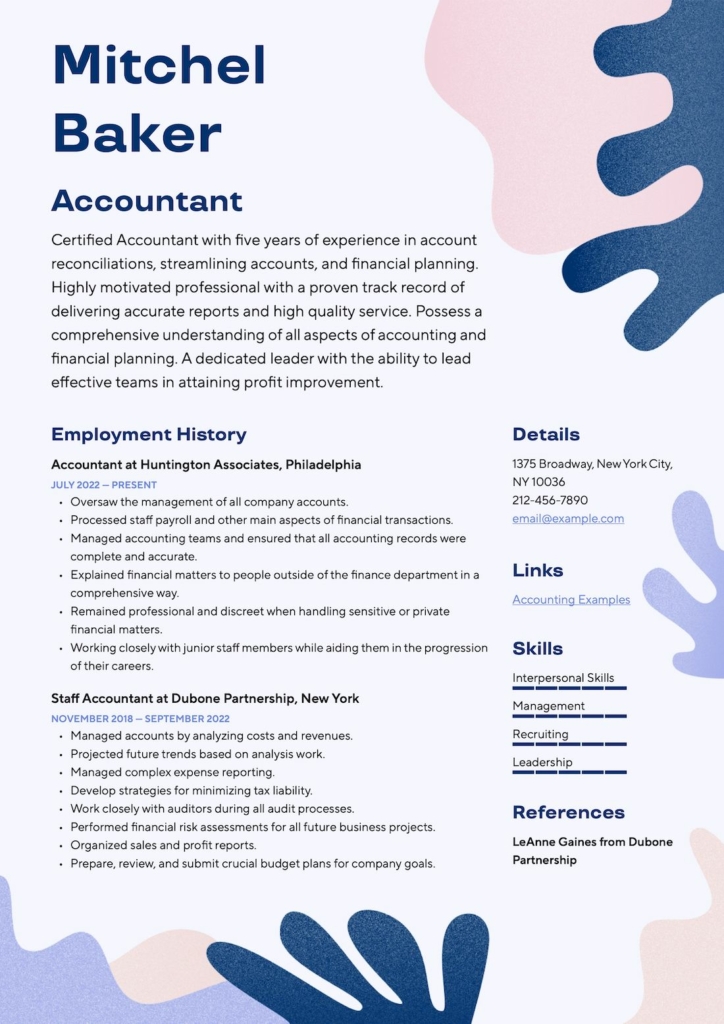

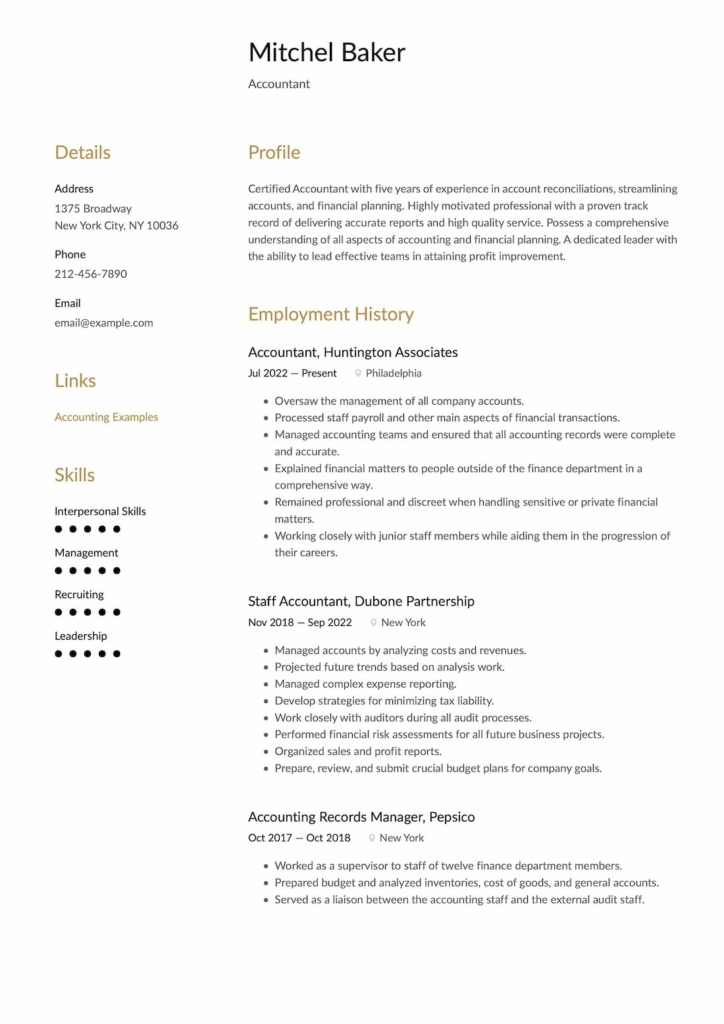

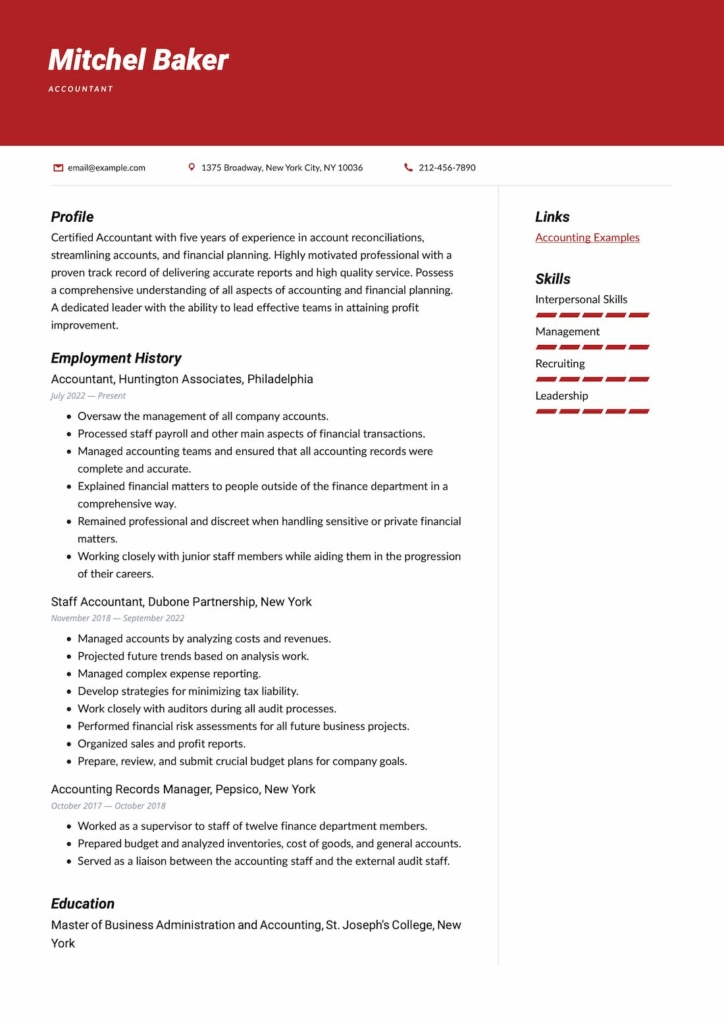

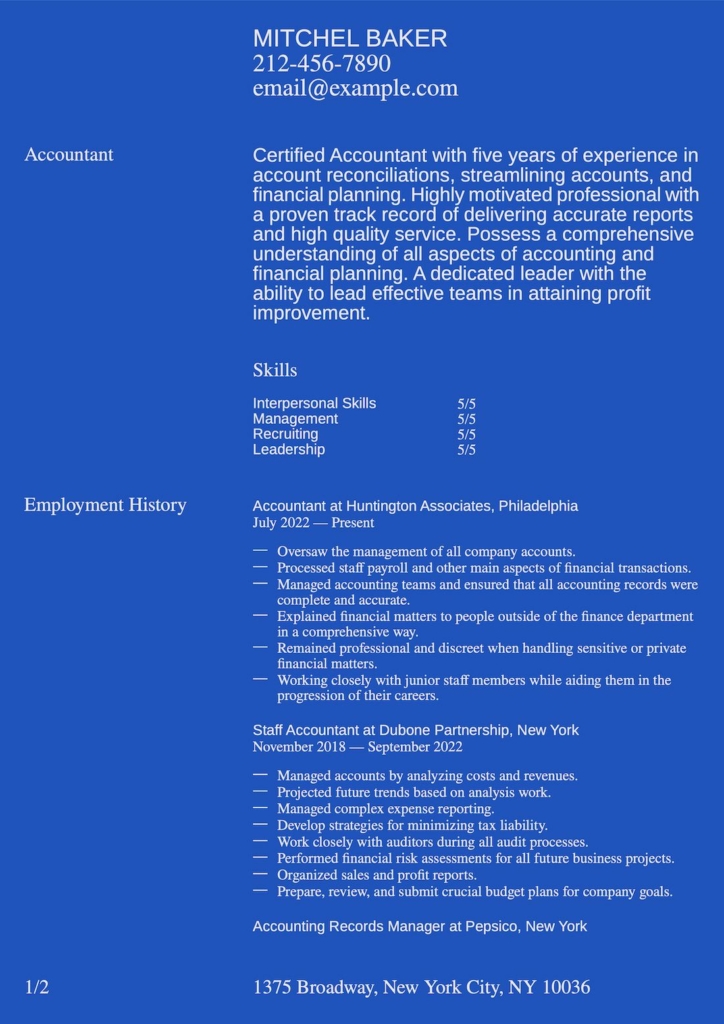

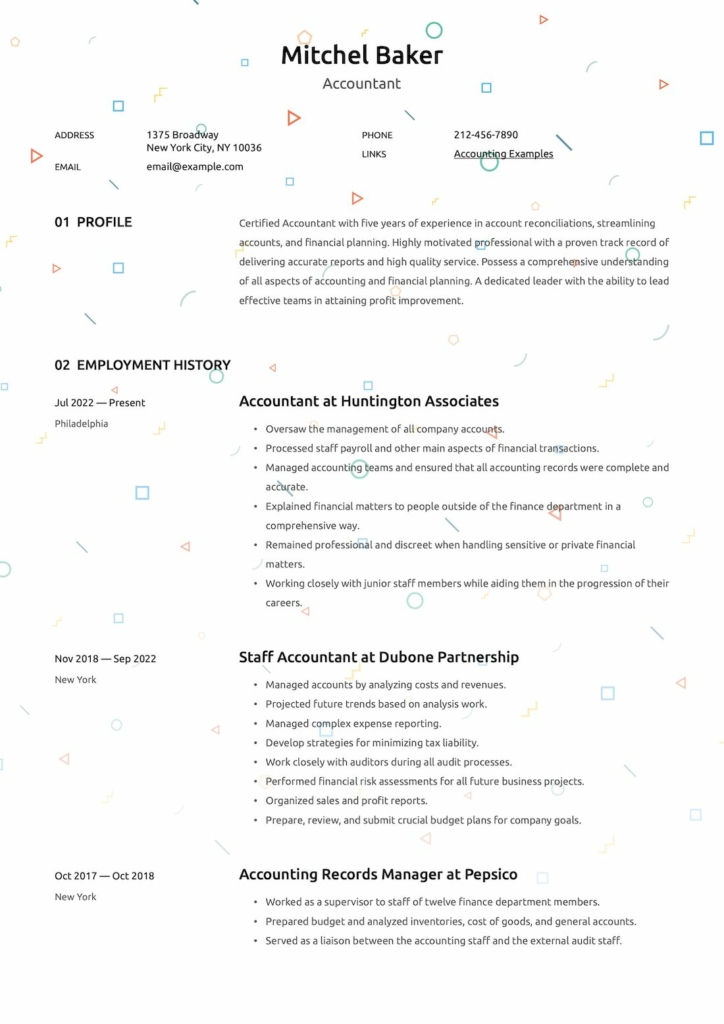

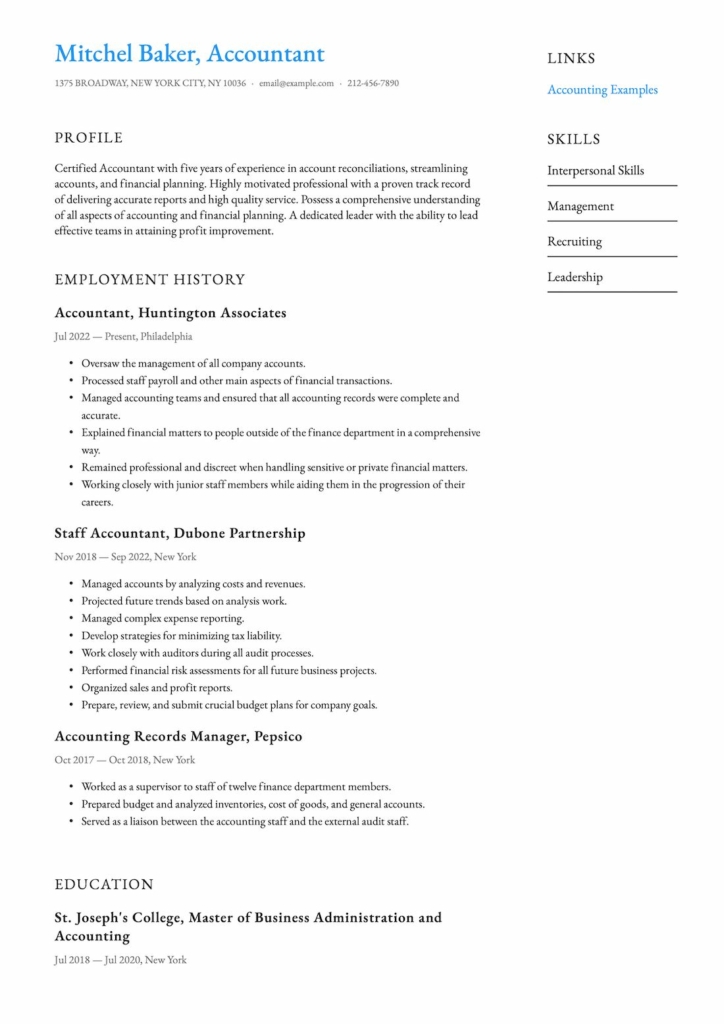

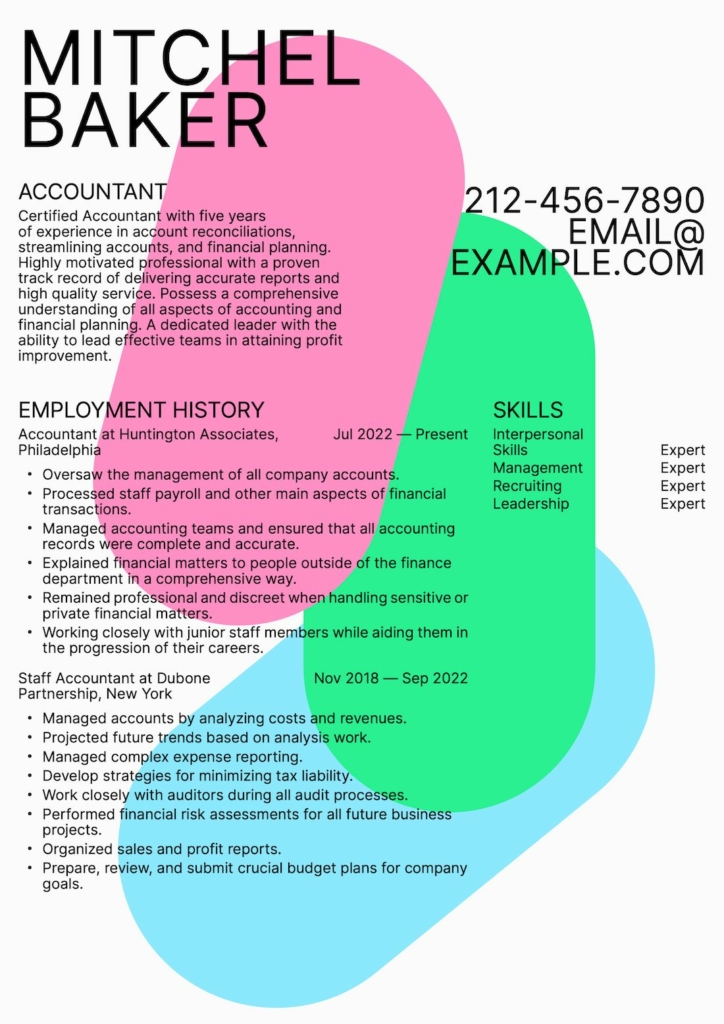

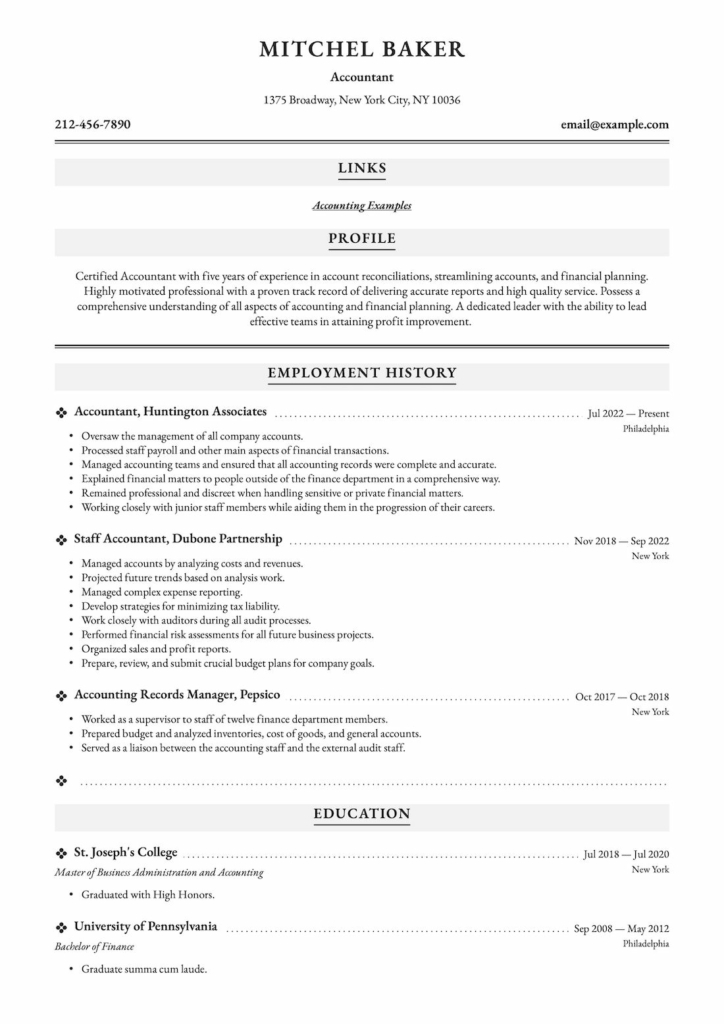

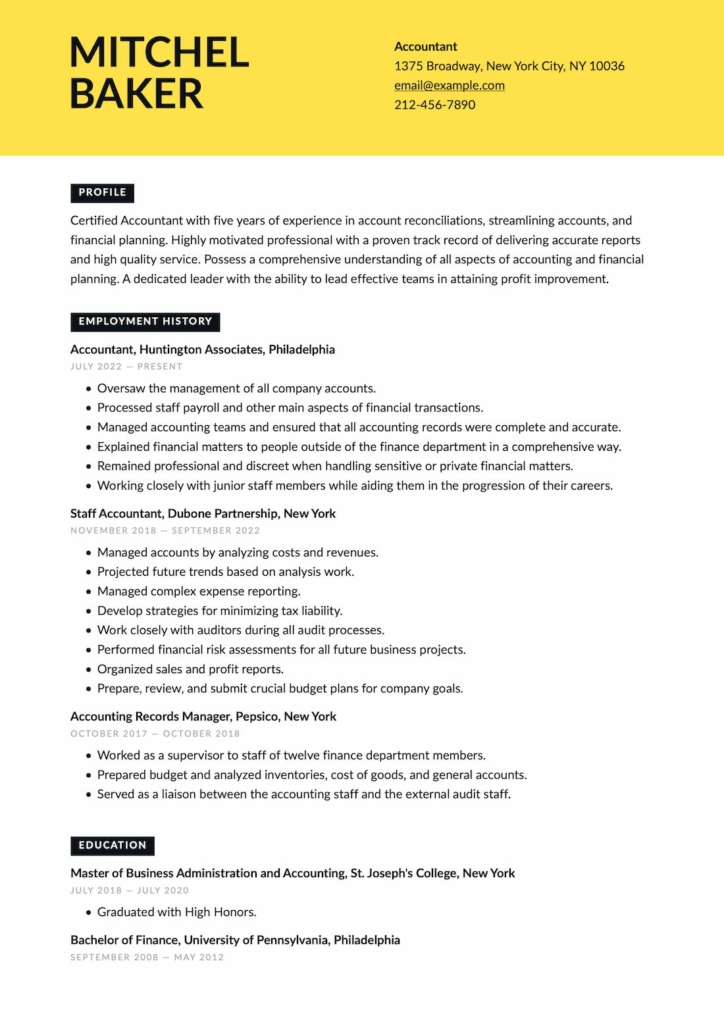

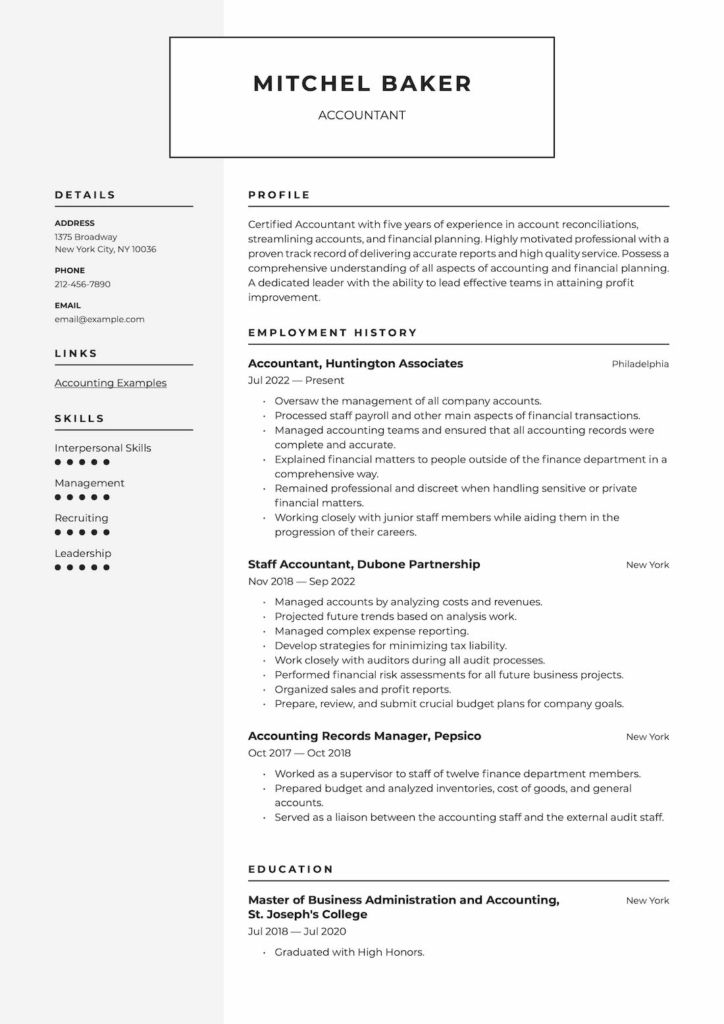

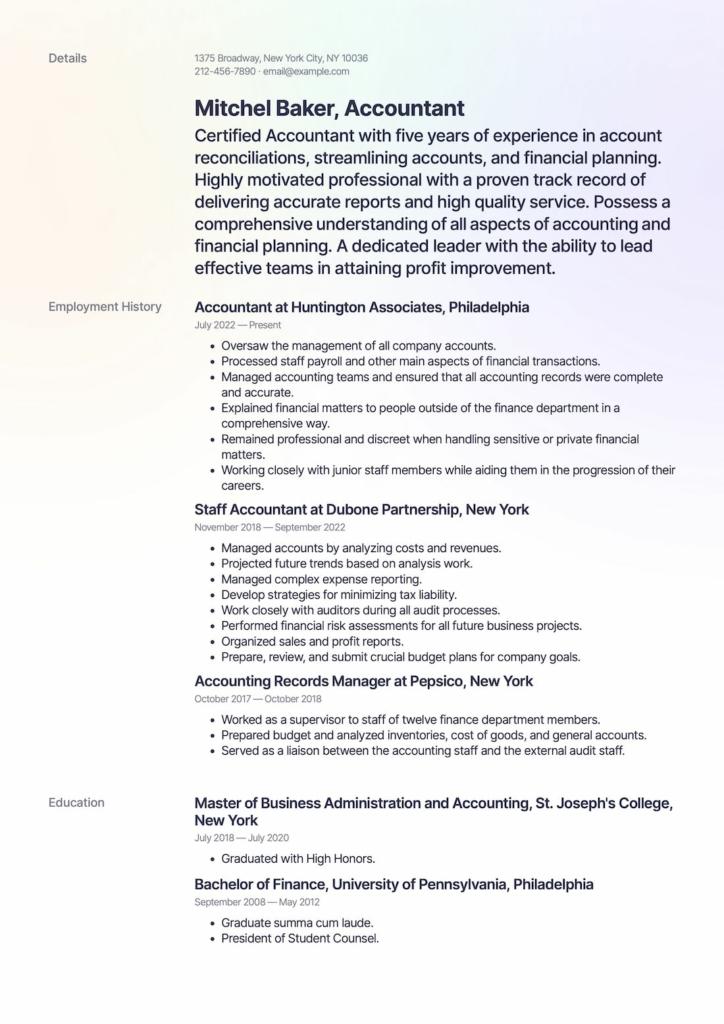

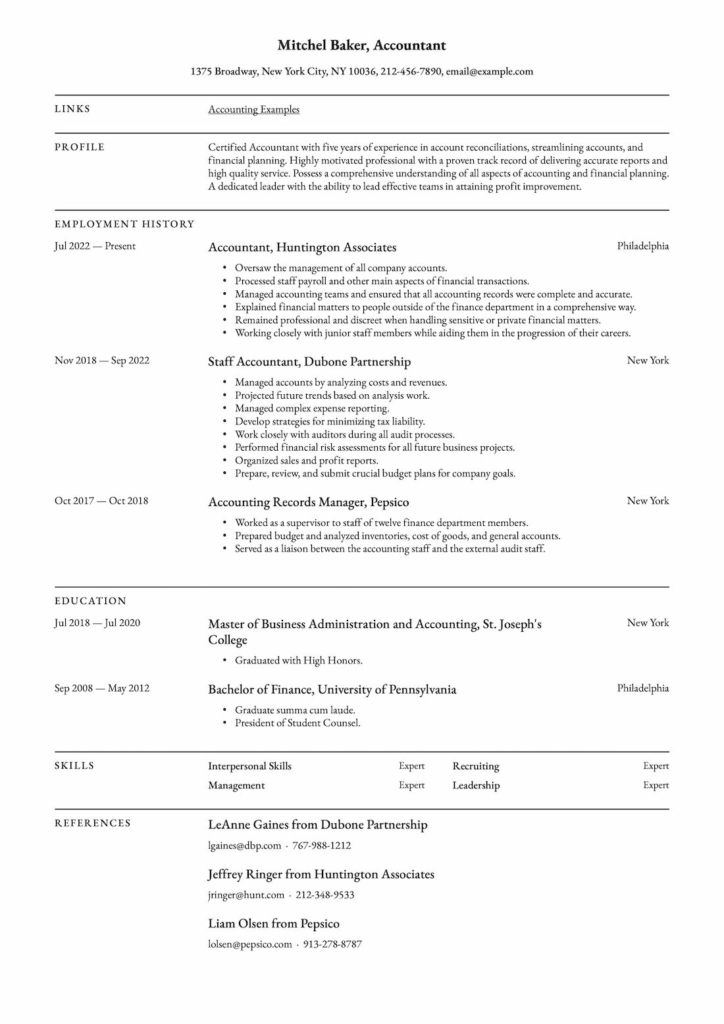

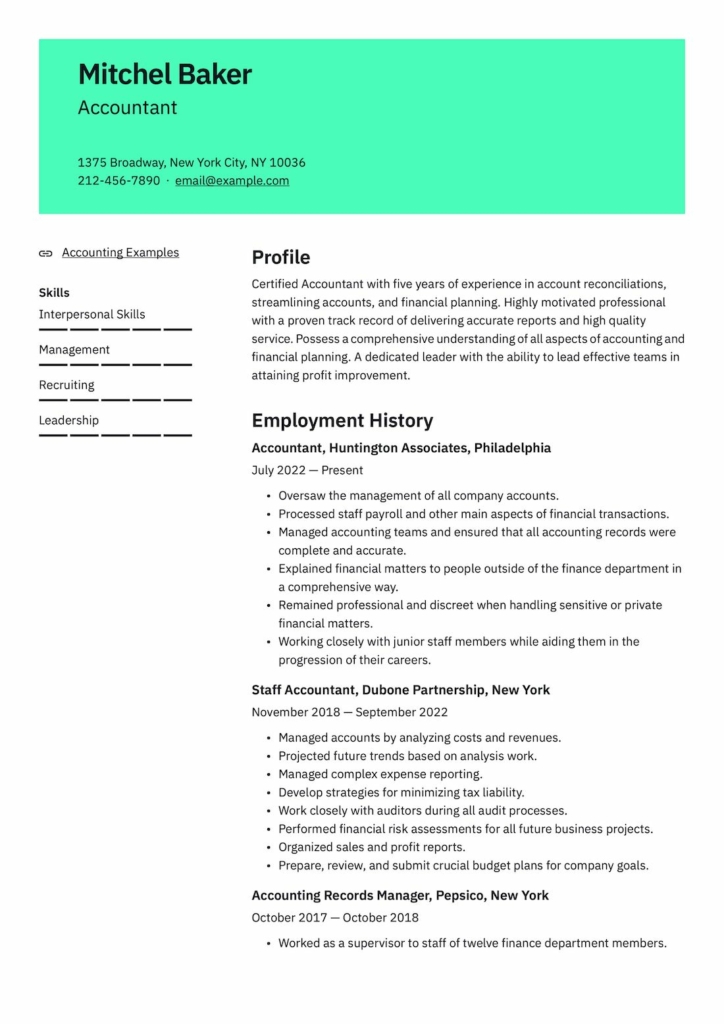

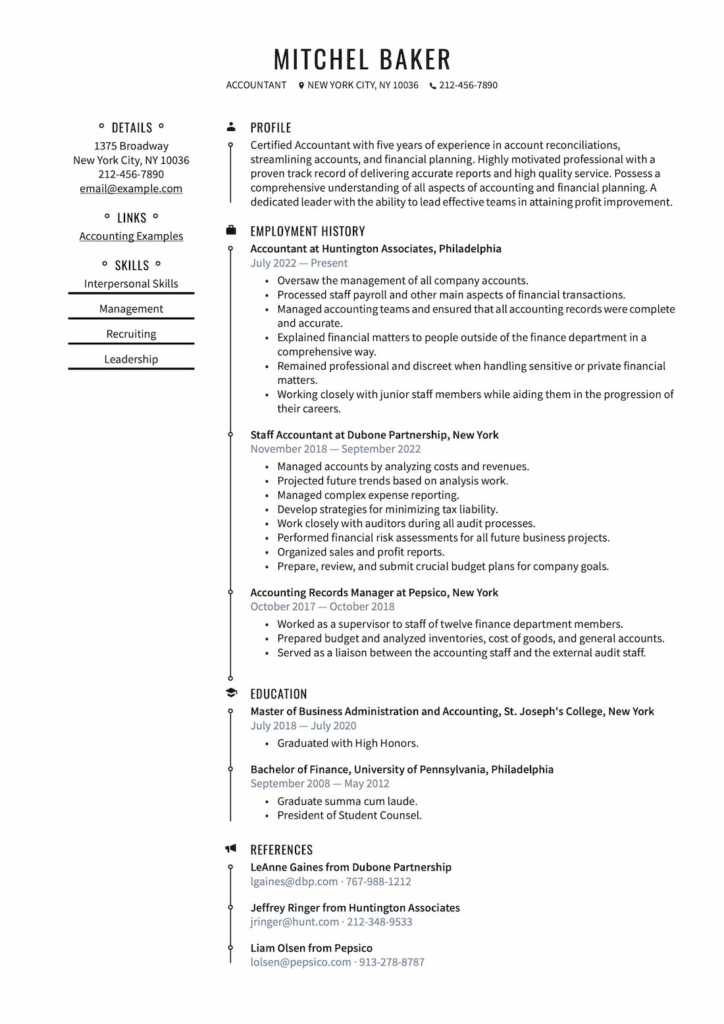

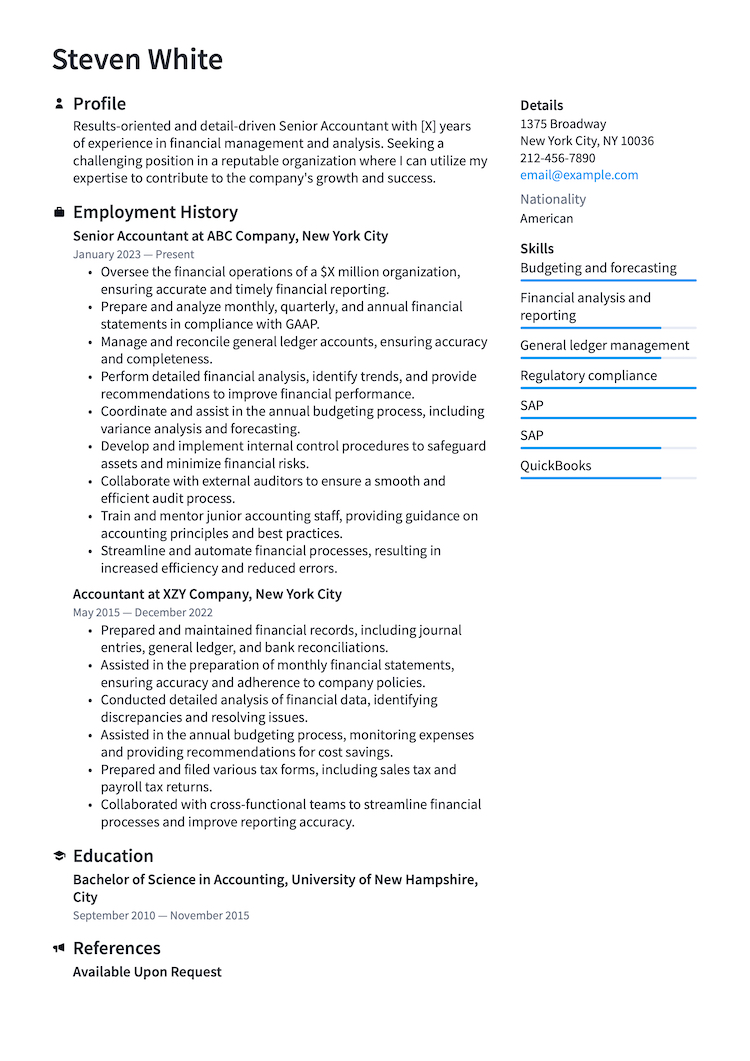

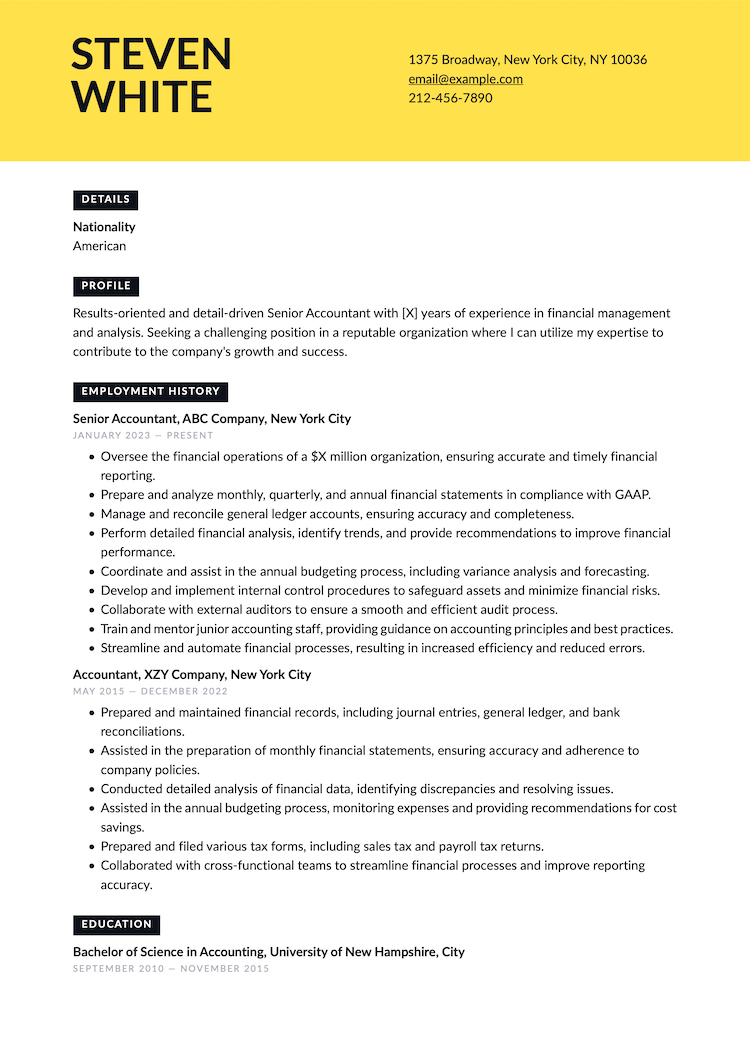

Accountant Resume Samples

Or download these examples in PDF at the bottom of this page for free. (You can also click the button to use the resume builder for $2,95)

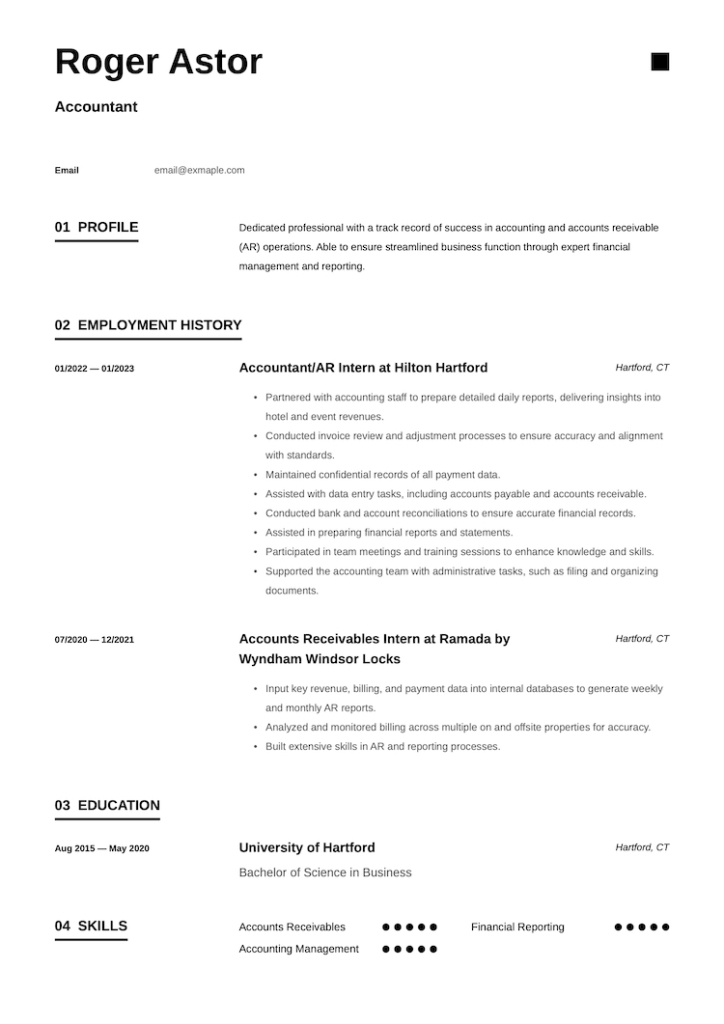

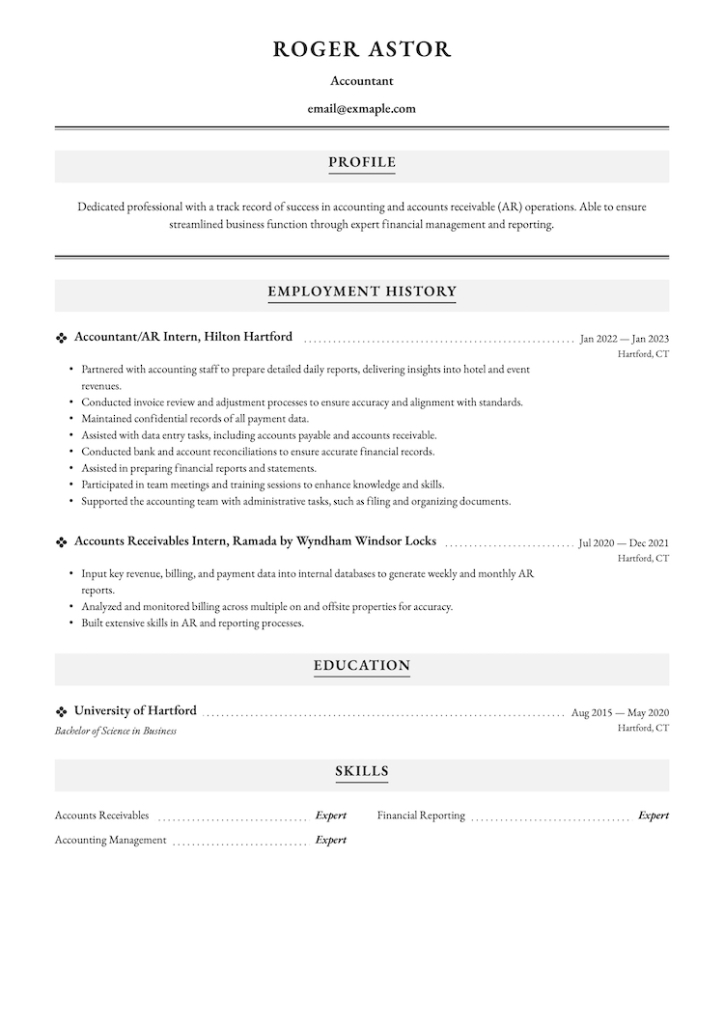

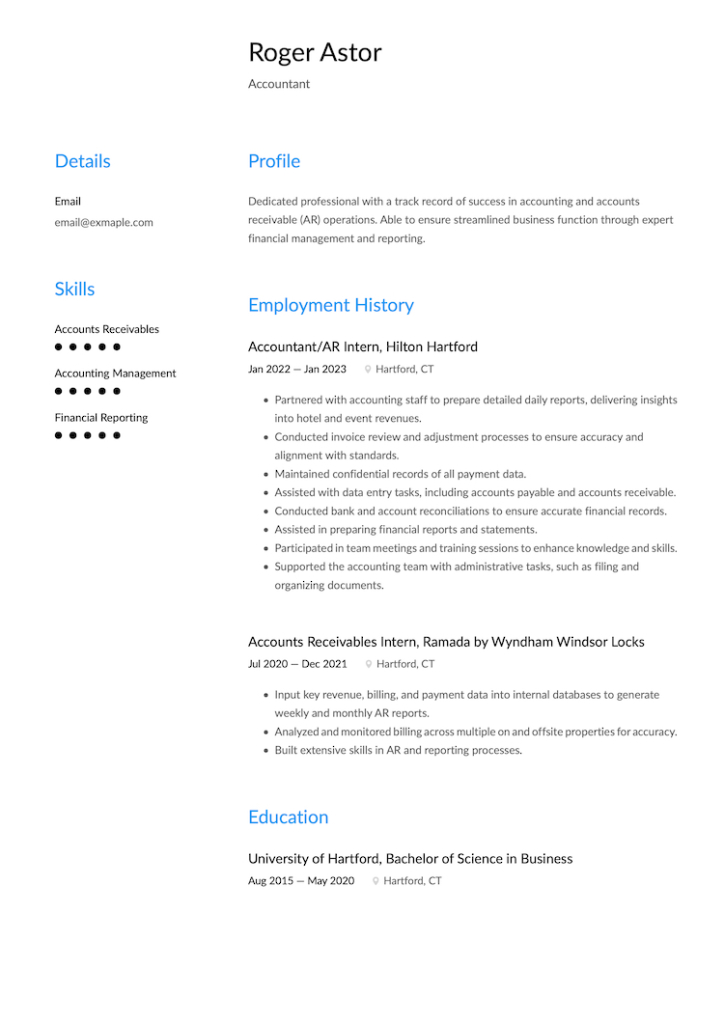

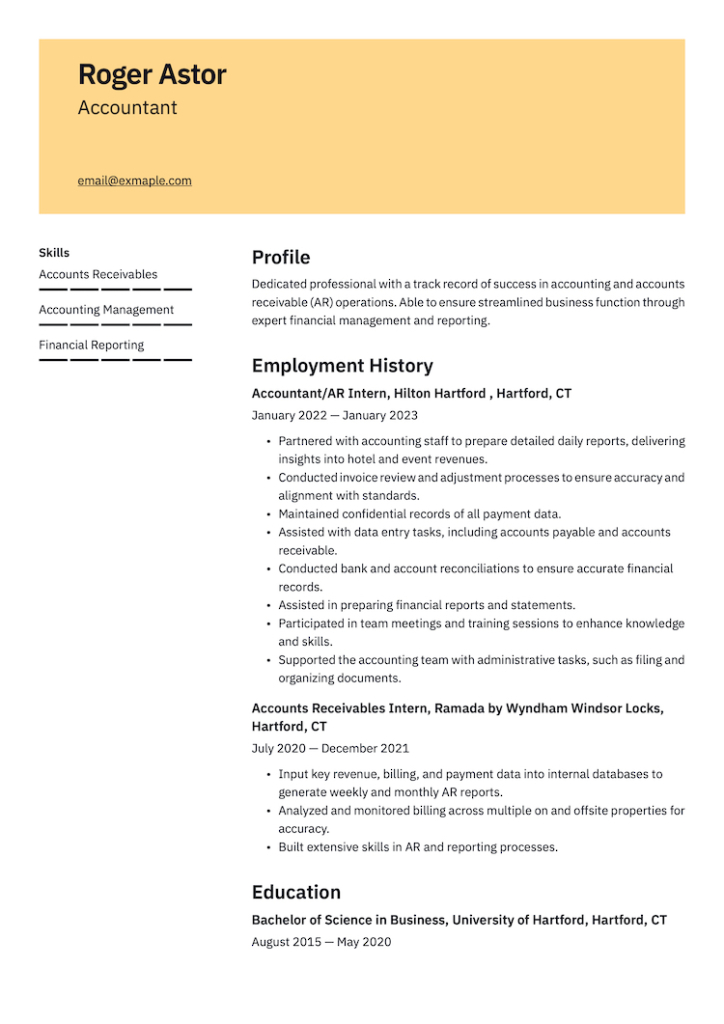

Accounting Intern

Accounting Intern

Entry Level

Supportive role providing assistance with various accounting tasks and gaining practical experience in a professional accounting environment.

- Assisted with data entry tasks, including accounts payable and accounts receivable.

- Conducted bank and account reconciliations to ensure accurate financial records.

- Assisted in preparing financial reports and statements.

- Participated in team meetings and training sessions to enhance knowledge and skills.

- Supported the accounting team with administrative tasks, such as filing and organizing documents.

Years in:

Job: 1 year (as an intern)

Field: 1 years

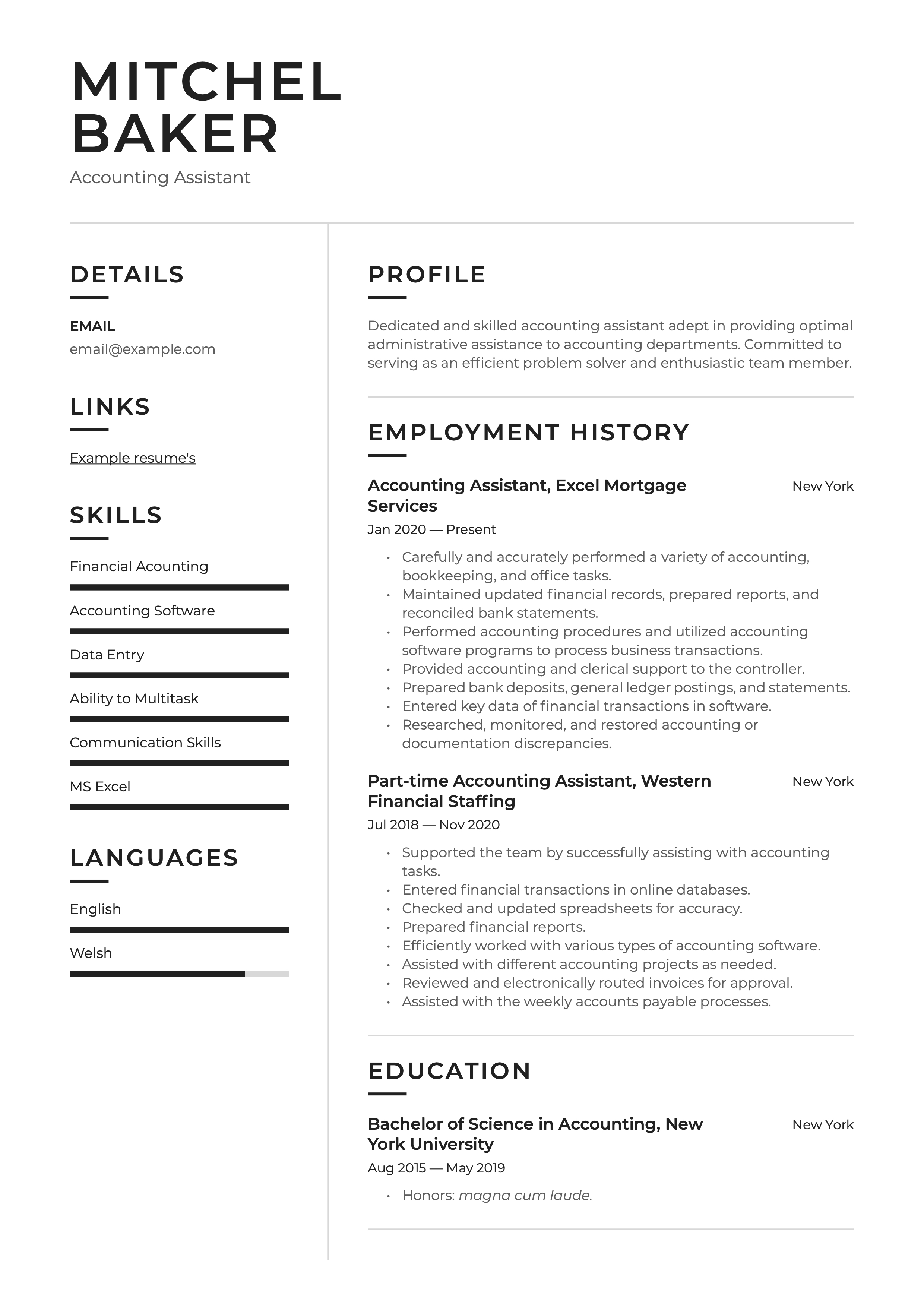

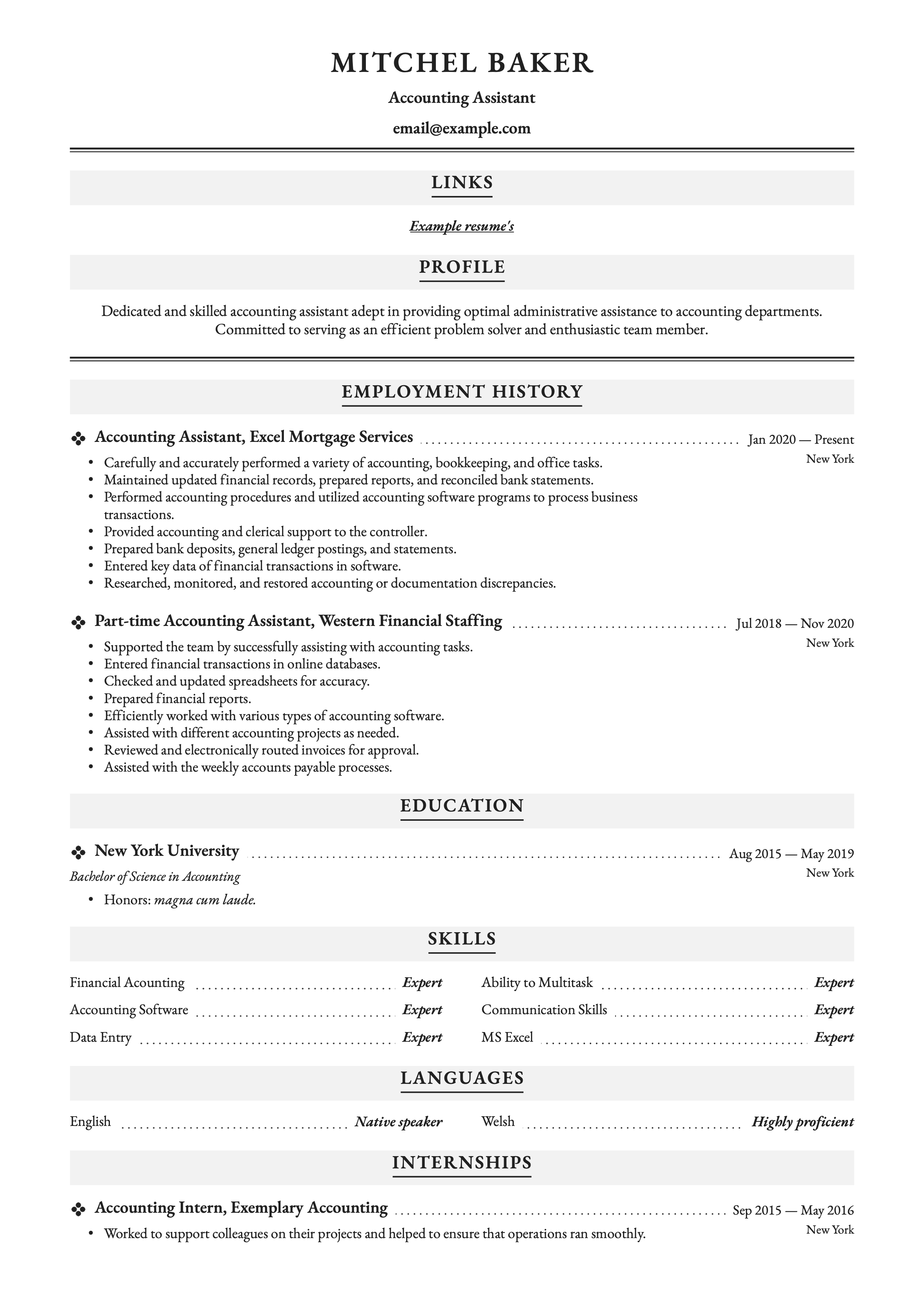

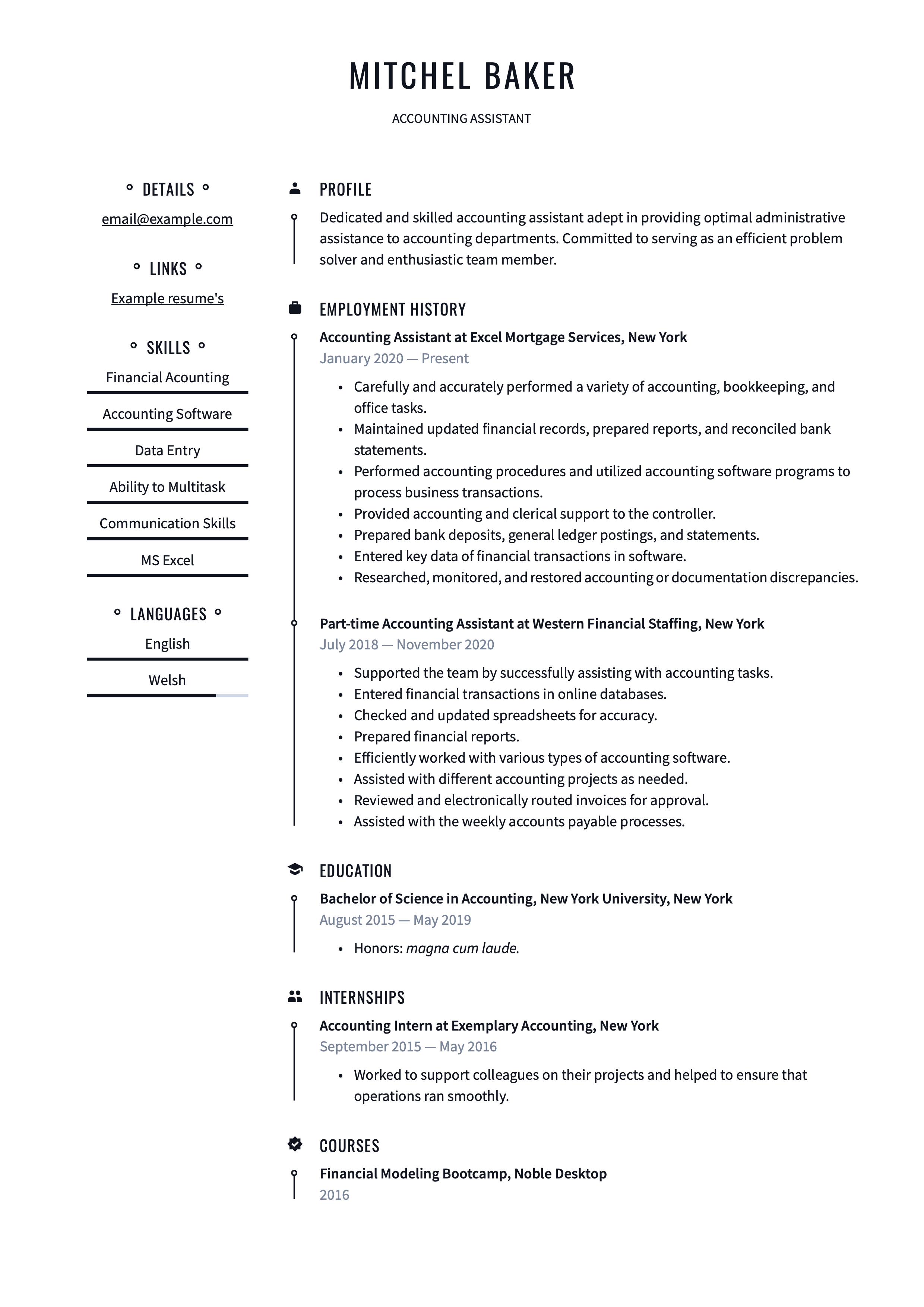

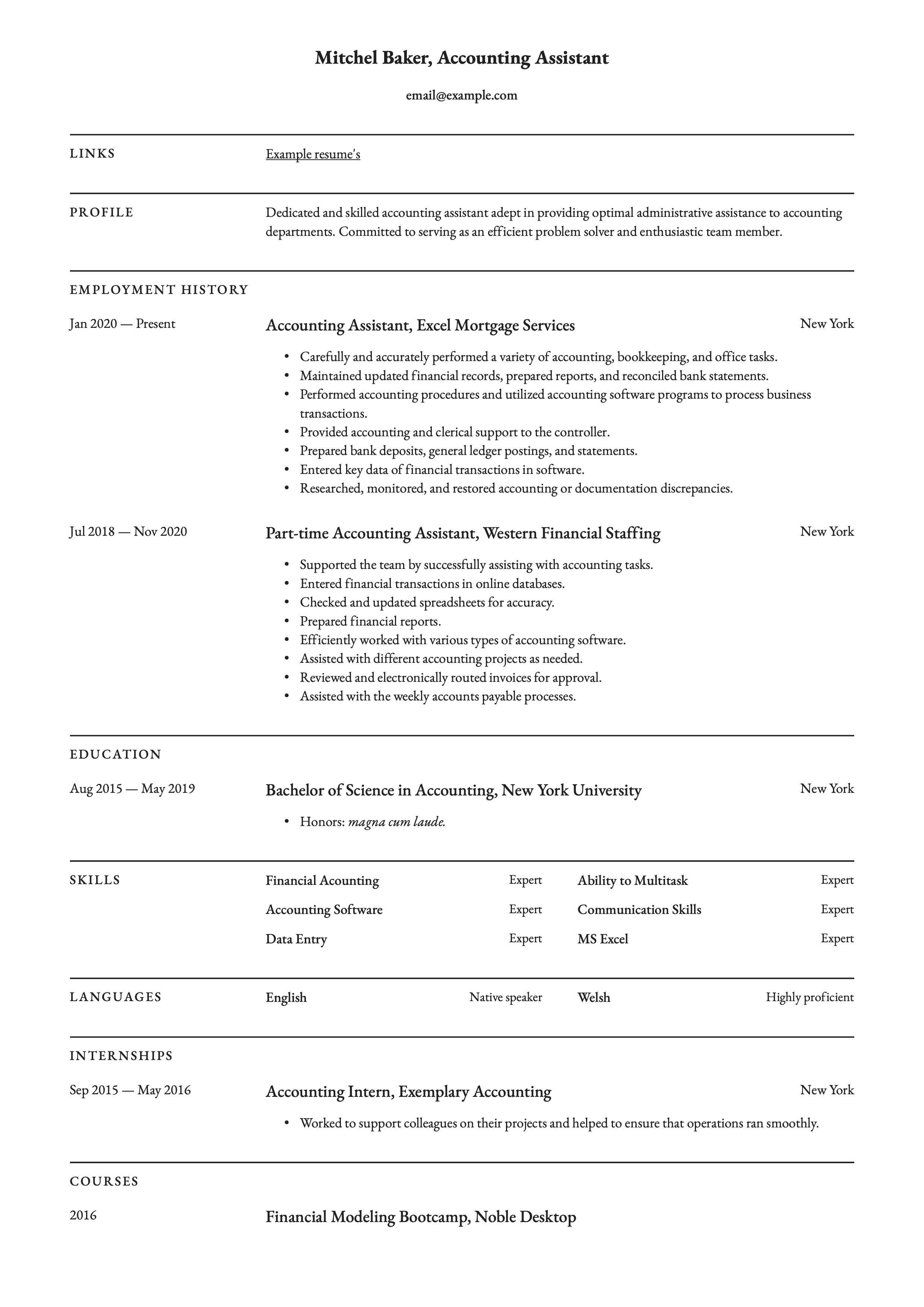

Accounting Assistant

Accounting Assistant

Junior Level

Supporting role responsible for performing accounting tasks and providing administrative support to the accounting department.

- Managed accounts payable and accounts receivable processes.

- Assisted in the preparation of financial statements and reports.

- Conducted bank reconciliations and resolved any discrepancies.

- Assisted with payroll processing and employee expense reimbursements.

- Provided general administrative support to the accounting team.

Years in:

Job: 2 year

Field: 3 years

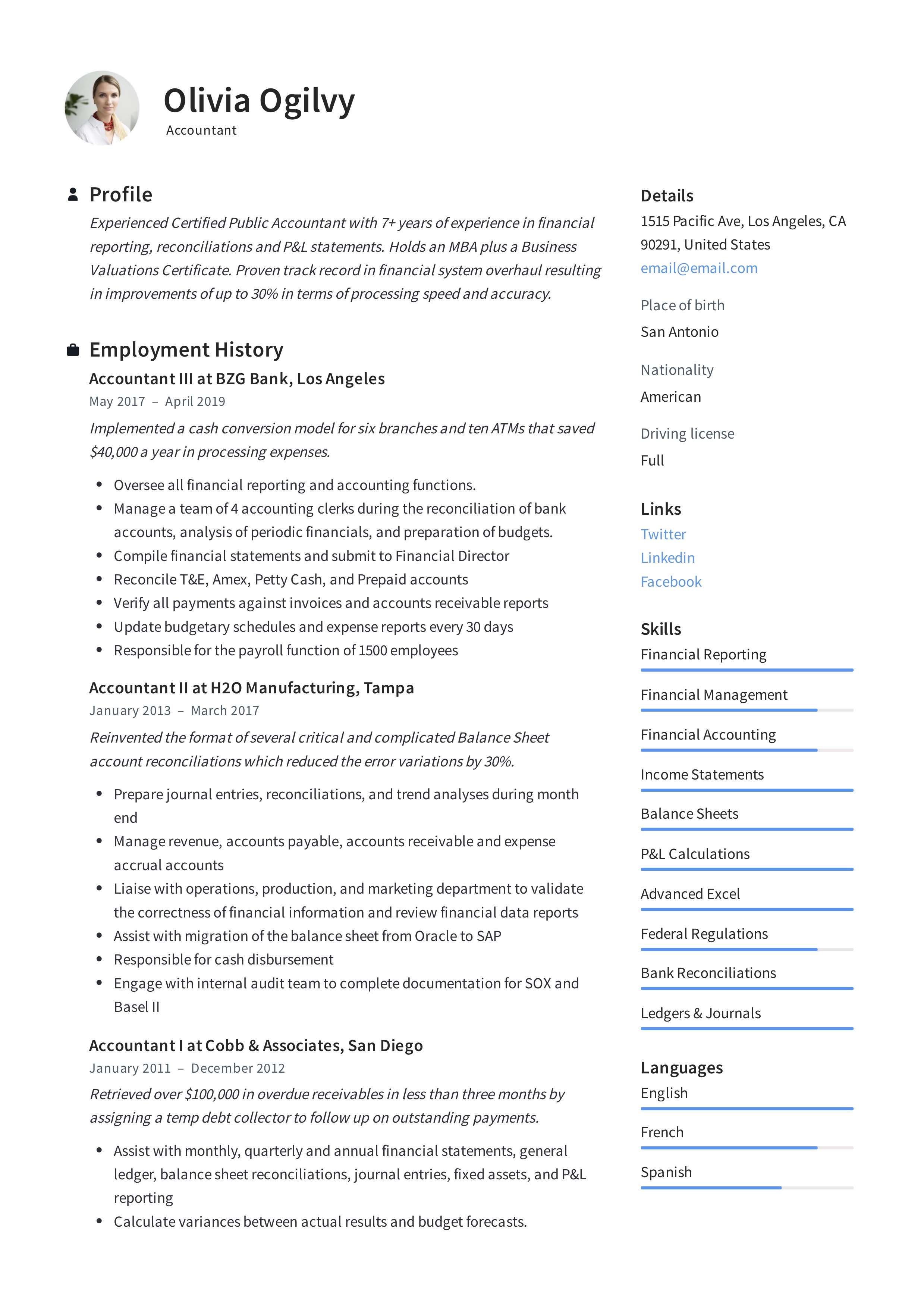

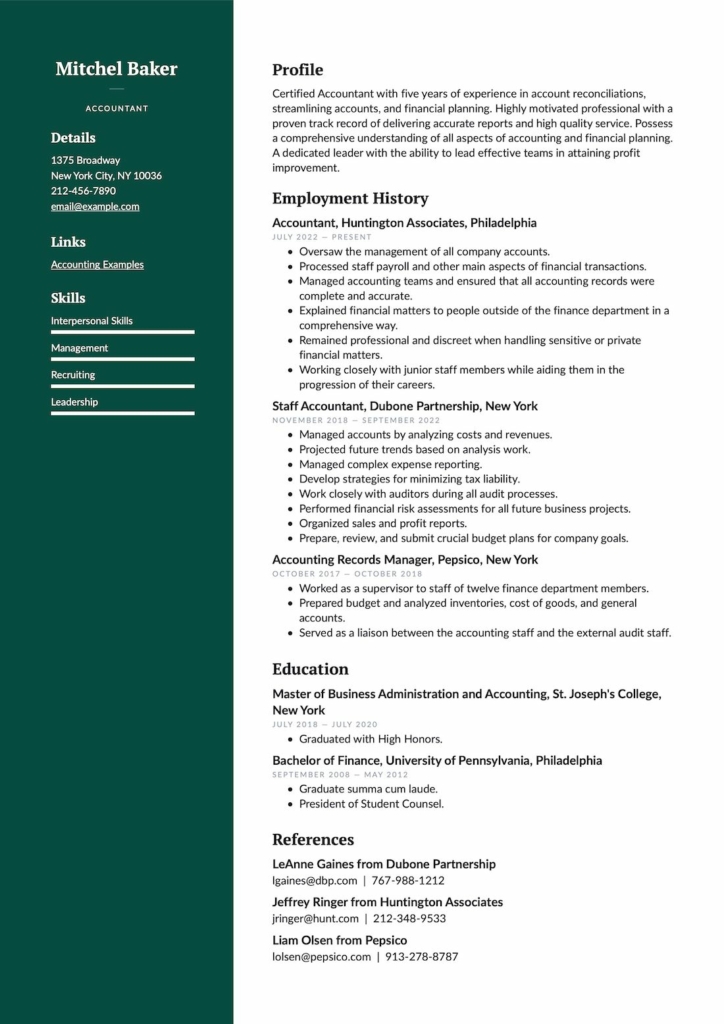

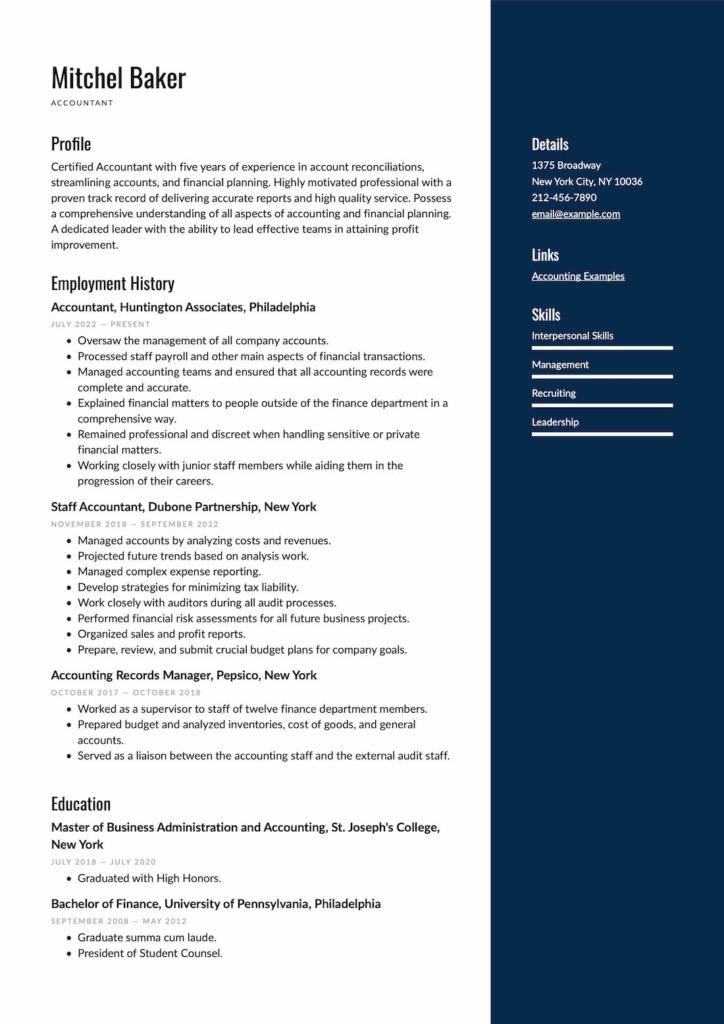

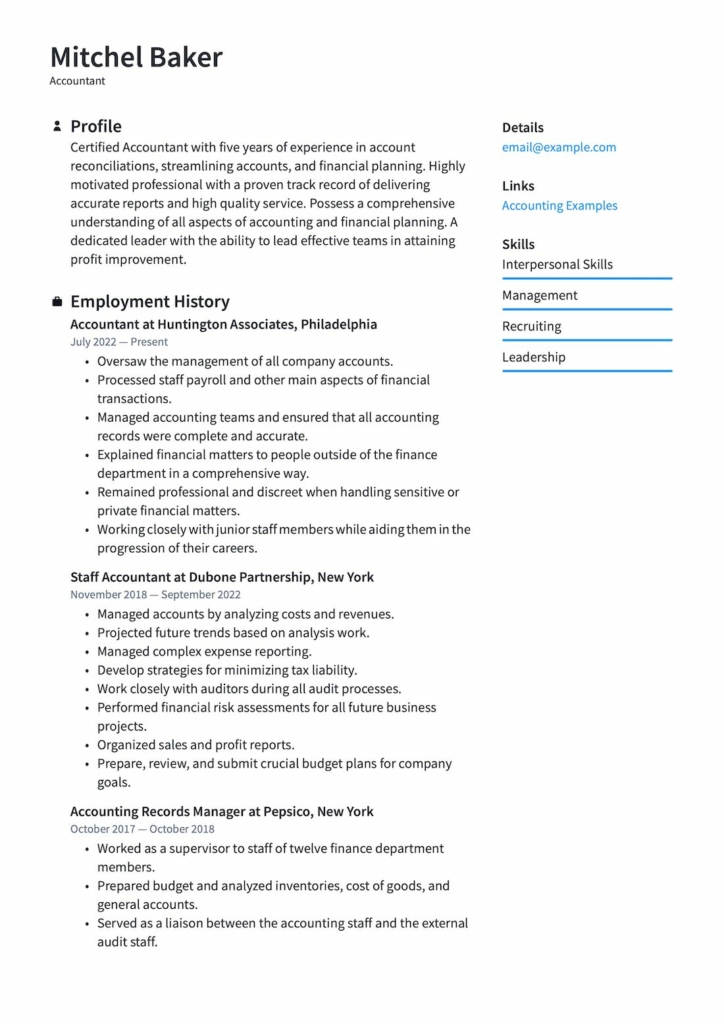

Accountant

Accountant

Experienced

Experienced accountant with a strong track record in financial operations, analysis, and compliance. Skilled in preparing financial statements, conducting reconciliations, and providing valuable insights. Collaborative team player with a keen eye for detail and a focus on delivering accurate results to support business decision-making.

- Prepared accurate journal entries, performed account reconciliations, and ensured data integrity.

- Assisted in financial statement preparation, maintaining compliance with accounting standards.

- Conducted detailed financial analysis, including variance analysis and trend identification.

- Collaborated with cross-functional teams to streamline processes and improve efficiency.

Years in:

Job: 4 year

Field: 6 years

Staff Accountant

Medior Level

Responsible for various accounting duties, including financial analysis, reconciliations, and supporting month-end close processes.

- Prepared journal entries and performed account reconciliations.

- Assisted in the preparation of financial statements and reports.

- Conducted variance analysis and provided insights on financial performance.

- Assisted with budgeting and forecasting processes.

- Collaborated with cross-functional teams to gather financial data and support decision-making.

Years in:

Job: 4 year

Field: 6 years

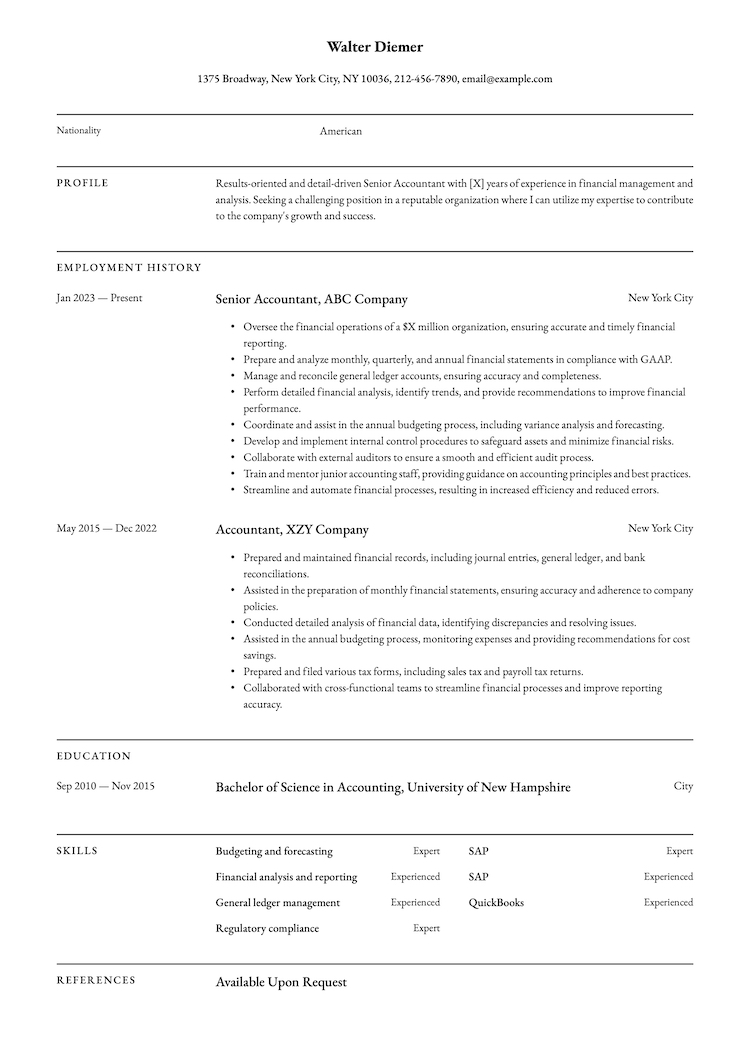

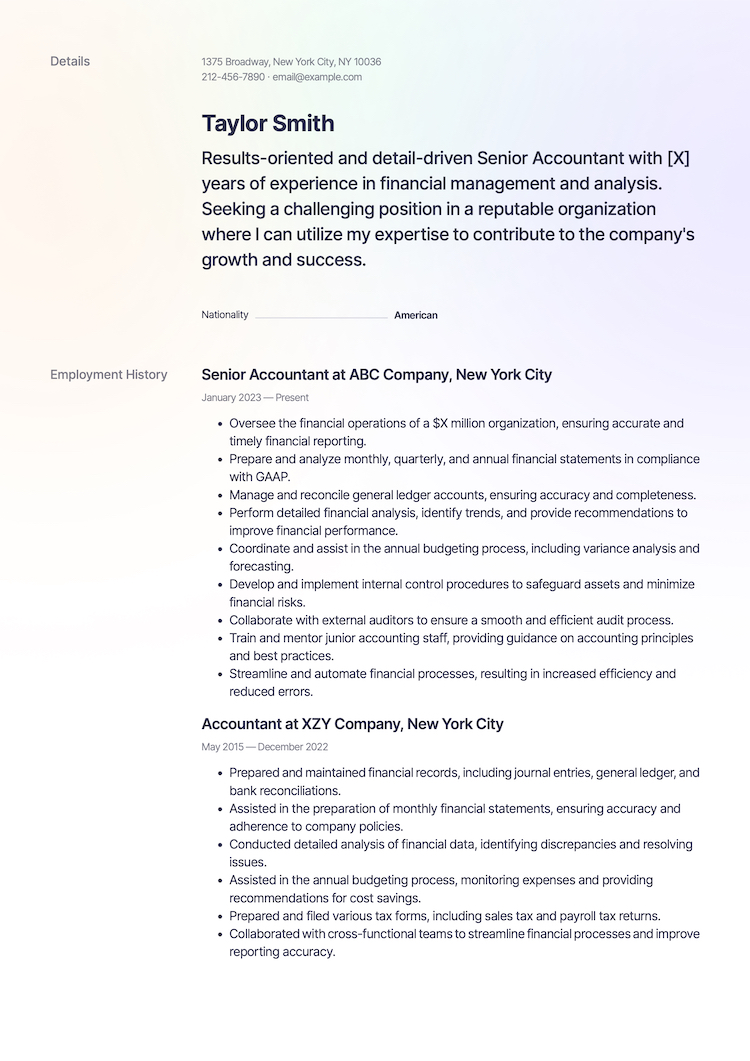

Senior Accountant

Download this resume in PDF

Senior Accountant

Experienced

Responsible for overseeing accounting processes, managing financial operations, and providing guidance to junior accounting staff.

- Managed month-end and year-end closing processes.

- Prepared complex financial statements and reports.

- Conducted financial analysis and provided insights for decision-making.

- Assisted in budgeting and forecasting processes.

- Reviewed and approved journal entries and account reconciliations.

- Provided mentorship and guidance to junior accounting team members.

Years in:

Job: 6 year

Field: 10 years

Accounting Manager

Senior Level

Leadership role overseeing the accounting department, ensuring accurate financial reporting, and providing strategic guidance.

- Managed all accounting operations, including financial reporting and budgeting.

- Developed and implemented accounting policies and procedures.

- Oversaw month-end and year-end closing processes.

- Conducted financial analysis and provided recommendations to improve financial performance.

- Collaborated with executive management on strategic financial decisions.

- Led and supervised a team of accountants and finance professionals.

Years in:

Job: 8 year

Field: 15 years

Forensic Accountant

Advanced

Specialized role involving the investigation and analysis of financial data for legal purposes, such as fraud investigations, litigation support, and dispute resolution.

- Conducted forensic audits to detect and investigate financial irregularities and fraudulent activities. (8 years in this job)

- Analyzed financial documents, including bank statements, invoices, and contracts, to uncover evidence of financial misconduct.

- Prepared detailed reports and documentation of findings to support legal proceedings.

- Provided expert testimony and collaborated with legal teams during litigation or arbitration processes.

- Assisted in the development of fraud prevention and detection measures for organizations.

Years in:

Job: 8 year

Field: 10 years

Financial Controller

Senior Level

Leadership role responsible for overseeing all aspects of financial management, including financial reporting, budgeting, and financial analysis.

- Managed the financial reporting process, ensuring accurate and timely preparation of financial statements. (6 years in this job)

- Developed and monitored key financial metrics and KPIs to assess the company's financial performance.

- Led the budgeting and forecasting processes, collaborating with department heads to align financial goals.

- Implemented internal controls and procedures to ensure compliance with accounting standards and regulations.

- Provided financial insights and recommendations to the executive team to support strategic decision-making.

Years in:

Job: 6 year

Field: 12 years

Tax Accountant

Intermediate

Specialized role focused on tax compliance, planning, and advisory services for individuals and businesses.

- Prepared and filed tax returns for individuals, partnerships, corporations, and trusts, ensuring compliance with tax laws and regulations. (3 years in this job)

- Conducted tax research to stay updated on changes in tax legislation and identify tax-saving opportunities.

- Assisted clients in tax planning strategies to minimize tax liabilities and maximize deductions.

- Represented clients during tax audits and communicated with tax authorities to resolve any issues.

- Provided guidance and advice on tax-related matters, including estate planning and international taxation.

Years in:

Job: 3 year

Field: 5 years

Audit Manager

Advanced

Leadership role overseeing the audit process and ensuring compliance with accounting standards and regulations.

- ffective and efficient audits. (7 years in this job)

- Developed audit plans and procedures to assess the effectiveness of internal controls and identify areas of risk.

- Conducted complex financial audits, including reviewing financial statements and supporting documentation.

- Provided recommendations to improve internal controls and operational efficiency based on audit findings.

- Interacted with clients' management and executives to communicate audit results and provide insights for improvement.

Years in:

Job: 7 year

Field: 15 years

The Accountant Resume Guide

Key Highlights for Accountants

As an accountant, it's crucial to emphasize certain aspects of your experience and skills to effectively showcase your suitability for prospective employers and recruiters. Here are the key highlights to include in your resume:

- Scope of Accounting Role: Highlight the scope of your accounting role, demonstrating your understanding of the organizational and management structure of businesses. If you've worked in a small business, emphasize your ability to handle complete financial jurisdiction, reporting directly to the business owner. Conversely, if you have experience in a Fortune 500 company, showcase your ability to work within a larger financial team responsible for specific divisions' financial record keeping.

- Technological Proficiency: Today's accountants need to be technologically adept, capable of utilizing various software tools and accounting packages. Include specific examples of software proficiency, such as MS Excel, Sage, SAP, QuickBooks, AccPac, and FreshBooks. Additionally, highlight your familiarity with customer relationship management (CRM) systems like Oracle, inventory management applications such as InventPro, warehousing and distribution tools like OrderHive, and even sales applications like Salesforce.

- Taxation Expertise (For Certified Public Accountants): If you are a Certified Public Accountant (CPA), emphasize your proficiency in tax calculations, reporting, and federal tax return submissions. Discuss your experience in handling these functions either within the company or in collaboration with CPA firms, where you provided financial services to clients, including corporations, governments, and individuals.

- Risk Management and Financial Analysis: Illustrate your ability to contribute to risk management efforts by analyzing current costs, revenues, and financial commitments to predict future obligations and protect cash flow reserves. Highlight your experience in approving budgets and expenses, showcasing your capability to handle varying scales of financial responsibilities, ranging from thousands to hundreds of millions per month, based on the size and turnover of the organizations you've worked with.

By highlighting these key aspects of your experience and skills, you can effectively demonstrate your value as an accountant and increase your chances of securing desired opportunities in the competitive job market.

Resume Structure and Format

Choosing the Right Resume Format:

The first step in creating an effective accountant resume is choosing the appropriate resume format. There are three common formats to consider: chronological, functional, and combination.

- Chronological Format: This format emphasizes your work history and lists your experiences in reverse chronological order, starting with your most recent position. It is ideal for candidates with a solid work history and consistent career progression.

- Functional Format: The functional format focuses on your skills and abilities rather than your work history. It is suitable for individuals who are transitioning careers, have gaps in employment, or have diverse skill sets.

- Combination Format: As the name suggests, the combination format combines elements of both chronological and functional formats. It allows you to highlight both your work experience and relevant skills, making it suitable for accountants with a well-rounded background.

When choosing the right format, consider your unique circumstances, career goals, and the requirements of the job you are applying for.

The Career Summary

Hiring managers have large numbers of hundreds of resumes to screen and limited time to read them all in detail. Keep your career summary concise and to the point. Put the most relevant information first to capture their attention while they’re quickly scanning your resume.

Start your career summary with your years of experience in the industry and the main duties you performed. When deciding what duties to add, use the job description as your guide. For instance, if the job you are applying to highlights experience in intercompany reconciliations or investment analysis use those same words and phrases. The more your resume resonates with the job description of keywords, the better fit you will seem.

Next, add a line that showcases any outstanding qualities that will add value to the company. A hiring manager would be interested to know if you have “strong mathematical skills, meticulous financial recording capabilities, and excellent troubleshooting abilities.” It’s important to note that these qualities should be proven with examples in the professional experience section to re-enforce your message.

Finally, end your objective with your educational degrees/diplomas and any certified courses or professional memberships you may have that are pertinent to the job.

Accountant Summary Example 1

“Experienced Certified Public Accountant with 7+ years of experience in financial reporting, reconciliations and P&L statements. Holds an MBA plus a Business Valuations Certificate. Proven track record in financial system overhaul resulting in improvements of up to 30% in terms of processing speed and accuracy.“

Accountant Summary Example 2

“Dependable and meticulous accounting with experience in corporate and intercompany accounting functions. Strong competencies in strategic revenue planning and budgetary targets for all company facilities and affiliates. Holds a Bachelor’s Degree in Accounting Sciences and a GRP (Global Risk Professional) qualification.“

Work Experience

The work experience section is a crucial component of your accountant resume. It provides evidence of your skills, knowledge, and achievements in previous roles. When listing your work experience, include the following details for each position:

- Job title: Clearly state your job title, highlighting your level of responsibility and expertise.

- Company name: Provide the name of the company or organization you worked for.

- Dates of employment: Include the start and end dates of your employment.

- Location: Specify the location of the company.

- Job responsibilities: Detail your key responsibilities and duties in bullet point format. Focus on your accomplishments and quantify them with specific examples, such as cost savings, revenue growth, or process improvements.

Use action verbs to make your statements more impactful.

Example:

Senior Accountant, XYZ Company | City, State

(January 2018 – Present)

- Managed financial operations for a portfolio of clients, overseeing month-end close processes, financial statement preparation, and general ledger reconciliations.

- Implemented cost-saving measures resulting in a 20% reduction in annual expenses.

- Developed and implemented standardized accounting procedures, resulting in improved accuracy and efficiency.

- Led a team of three junior accountants, providing guidance and training on financial reporting and analysis.

- Collaborated with cross-functional teams to streamline budgeting and forecasting processes, resulting in more accurate projections.

Job Descriptions & Responsibilities

An employer would expect to see the following proven foundational duties and skill sets within an applicant’s resume, depending on educational level and career stage.

An Accountant I at an entry-career stage (3-5 years experience) may:

- Assist with monthly, quarterly, and annual financial statements, general ledger, balance sheet reconciliations, journal entries, fixed assets, and P&L reporting

- Calculate variances between actual results and budget forecasts.

- Reconciliations of main bank account and international subsidiary accounts

- Prepare documents for annual tax returns

- Work with external auditors during the audit review and compile all the necessary documentation required during the investigation

- Responsible for accounts payable and accounts receivable statements

An Accountant II at the mid-career stage (5-8 years experience) may

- Prepare journal entries, reconciliations, and trend analyzes during month end

- Manage revenue, accounts payable, accounts receivable and expense accrual accounts

- Liaise with operations, production, and marketing department to validate the correctness of financial information and review financial data reports

- Assist with migration of the balance sheet from Oracle to SAP

- Responsible for cash disbursement

- Engage with the internal audit team to complete documentation for SOX and Basel II

An Accountant III at an experienced/advanced stage (8-15 years experience) may:

- Oversee all financial reporting and accounting functions.

- Manage a team of 4 accounting clerks during the reconciliation of bank accounts, analysis of periodic financials, and preparation of budgets.

- Compile financial statements and submit to Financial Director

- Reconcile T&E, Amex, Petty Cash, and Prepaid accounts

- Verify all payments against invoices and accounts receivable reports

- Update budgetary schedules and expense reports every 30 days

- Responsible for the payroll function of 1500 employees

Education and Certifications:

In this section, include your educational background and any relevant certifications you have obtained. Include the following information:

- Degree: Specify the degree(s) you have earned, such as Bachelor of Science in Accounting.

- Institution: Mention the name of the university or educational institution where you completed your studies.

- Graduation Date: Include the month and year of your graduation.

If you have earned any certifications, such as Certified Public Accountant (CPA), Chartered Professional Accountant (CPA), Certified Management Accountant (CMA), or Association of Chartered Certified Accountants (ACCA), list them along with the issuing authority and the year of certification.

Examples:

Bachelor of Science in Accounting XYZ University Graduated: May 2017

Certified Public Accountant (CPA) State Board of Accountancy Certification Date: July 2018

Examples for more than five years’ experience:

2016 – Chartered Financial Analyst (CFA), Association for Investment Management & Research (AIMR), Tampa, FL

2015 – Masters in Business Administration, Boston University, Boston, MA

If you have less than five years’ experience, you may also add your majors, minors, GPA scores and accolades, and honors awards:

2019 – Current Certified Chartered Accountant, Association of Chartered Certified Accountants (ACCA), Online

2016 – 2018 Associate’s Degree in Applied Accounting Science, University of Detroit, MA

GPA: 3.8

Majors: Financial Management, Accounting

Minors: Information Science, Accounting, Economics

Accolades: Deans Honors List

2013 – Certificate in Accounting Fundamentals, Merrick Business School, Baltimore, MD

Skills Section

Accountants require a diverse set of skills to excel in their roles. In the skills section of your resume, highlight the technical and soft skills that are relevant to the accounting profession. Some essential skills to include are:

- Financial analysis and reporting

- Budgeting and forecasting

- Auditing and compliance

- Tax preparation and planning

- Proficiency in accounting software (e.g., QuickBooks, SAP, Excel)

- Attention to detail and accuracy

- Analytical and problem-solving abilities

- Communication and interpersonal skills

- Time management and organizational skills

Use bullet points to list your skills, making it easy for recruiters to scan and identify your key strengths.

Soft Skill Examples

| Leadership | Strategic Thinking | Process Driven |

| Attention to Detail | Creative | Task Orientated |

| Integrity | Dedicated | Time Management |

| Empathy | Realistic | Analytical |

| Self-Control | Conflict Handling | Accurate |

| Collaboration | Problem-Solving | Detailed |

| Persuasion | Prioritization | Focused |

| Persistence | Deadline Driven | |

| Social Perceptiveness | Meticulous | |

| Service Orientation | Numerical |

Qualifications & Certifications associated with Accountants

| Bachelor of Accounting Sciences | Masters in Business Administration | Chartered Financial Analyst (CFA) |

| Personal Financial Specialist (PFS) | Chartered Global Management Accountant (CGMA) | Certificate in Project Management (CIPM) |

| Accredited in Business Valuation (ABV) | Certified in Financial Forensics (CFF) | Certified Information Technology Professional (CITP) |

| Certified in Entity and Intangible Valuations (CEIV) | Certified in the Valuation of Financial Instruments (CVFI) | Certified Public Accountant (CPA) |

| Master Excel User | Certified Key Accounts Manager (CKAM) | Associates Degree in Accounting Management |

Action Verbs for your Accountant Resume

| Auditing | Surveying | Monitoring |

| Developing | Problem-Solving | Improving |

| Researching | Analyzing | Processing |

| Modeling | Reducing | Optimizing |

| Compiling | Communicating | Presenting |

| Calculating | Listening | Reconciling |

Tailoring Your Resume

Analyzing Job Descriptions:

To make your resume stand out, carefully analyze job descriptions and identify the key skills and qualifications employers are seeking. Tailor your resume to match these requirements, highlighting the skills and experiences that align with the job posting.

Customizing for Each Application:

While it may be tempting to use a generic resume for multiple job applications, customizing your resume for each position is essential. Adjust your professional summary, skills section, and work experience to align with the specific job requirements, using keywords and phrases from the job description. This customization shows employers that you have taken the time to understand their needs and increases your chances of getting noticed.

Formatting and Design

Readability and Organization

A well-structured and organized resume is essential for readability. Use clear headings, bullet points, and subheadings to create sections that are easy to navigate. Maintain consistent formatting throughout your resume to ensure a professional and polished appearance.

Font and Font Size

Choose a clean and professional font that is easy to read, such as Arial, Calibri, or Times New Roman. Keep the font size between 10 and 12 points for the body text, ensuring readability while conserving space.

Length and Page Margins

Ideally, keep your accountant resume to one or two pages in length. Be concise and focus on the most relevant information. Use appropriate margins (typically 1 inch) to maintain a balanced layout and maximize the use of space.

Proofreading and Finalizing

Grammar and Spelling

Before submitting your resume, thoroughly proofread it for grammar and spelling errors. Use spell-check tools, but also carefully review your content to ensure accuracy. Grammatical mistakes can create a negative impression, so take the time to edit and refine your resume.