On the lookout for a job as Bank Teller? You have come to the right place! Before writing your resume, please take a look through a few of our top-notch Bank Teller resume samples.

We will show you how to structure your information so that your resume is captivating, informative, and knocks the socks off any hiring manager.

What you can read in this article

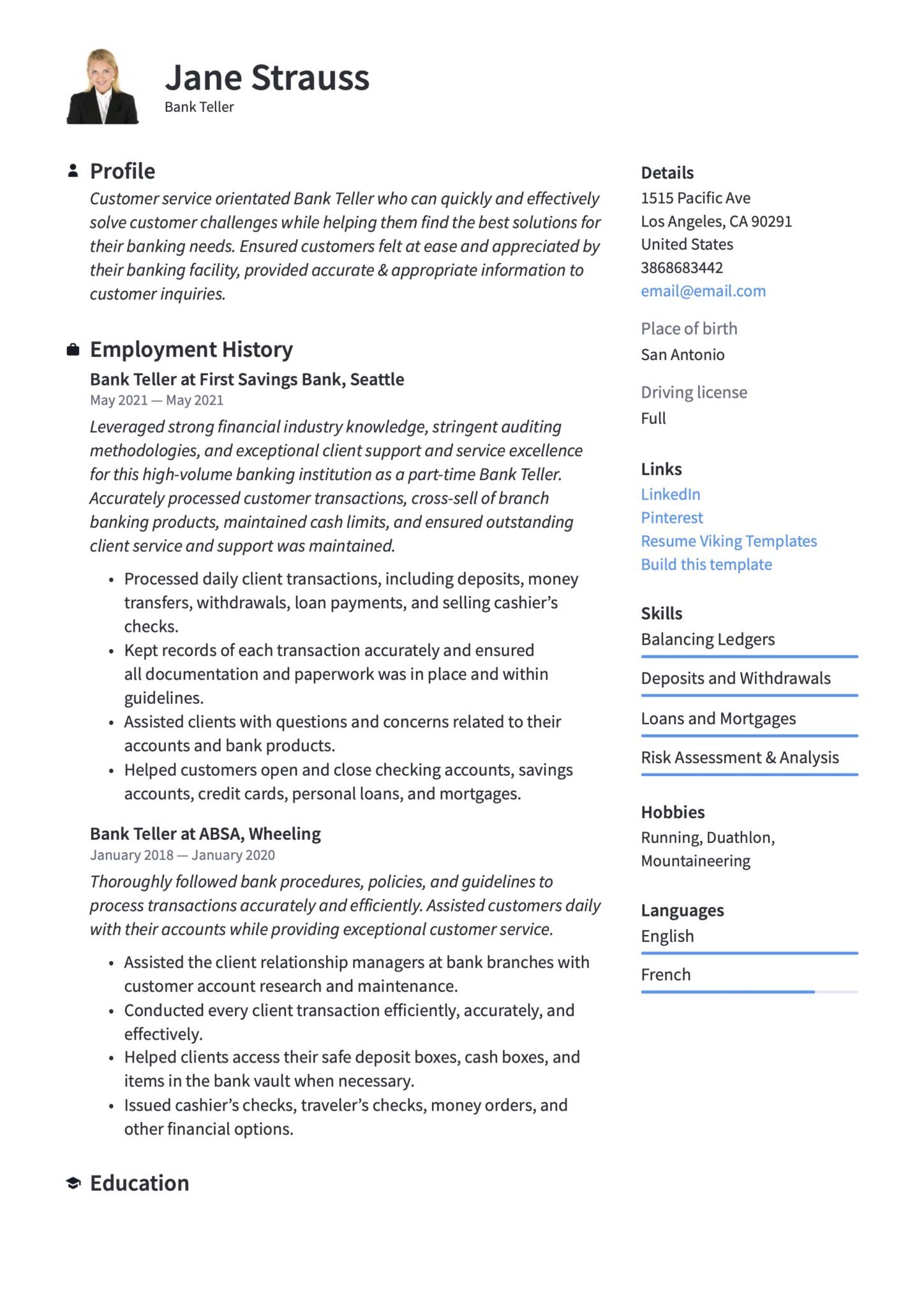

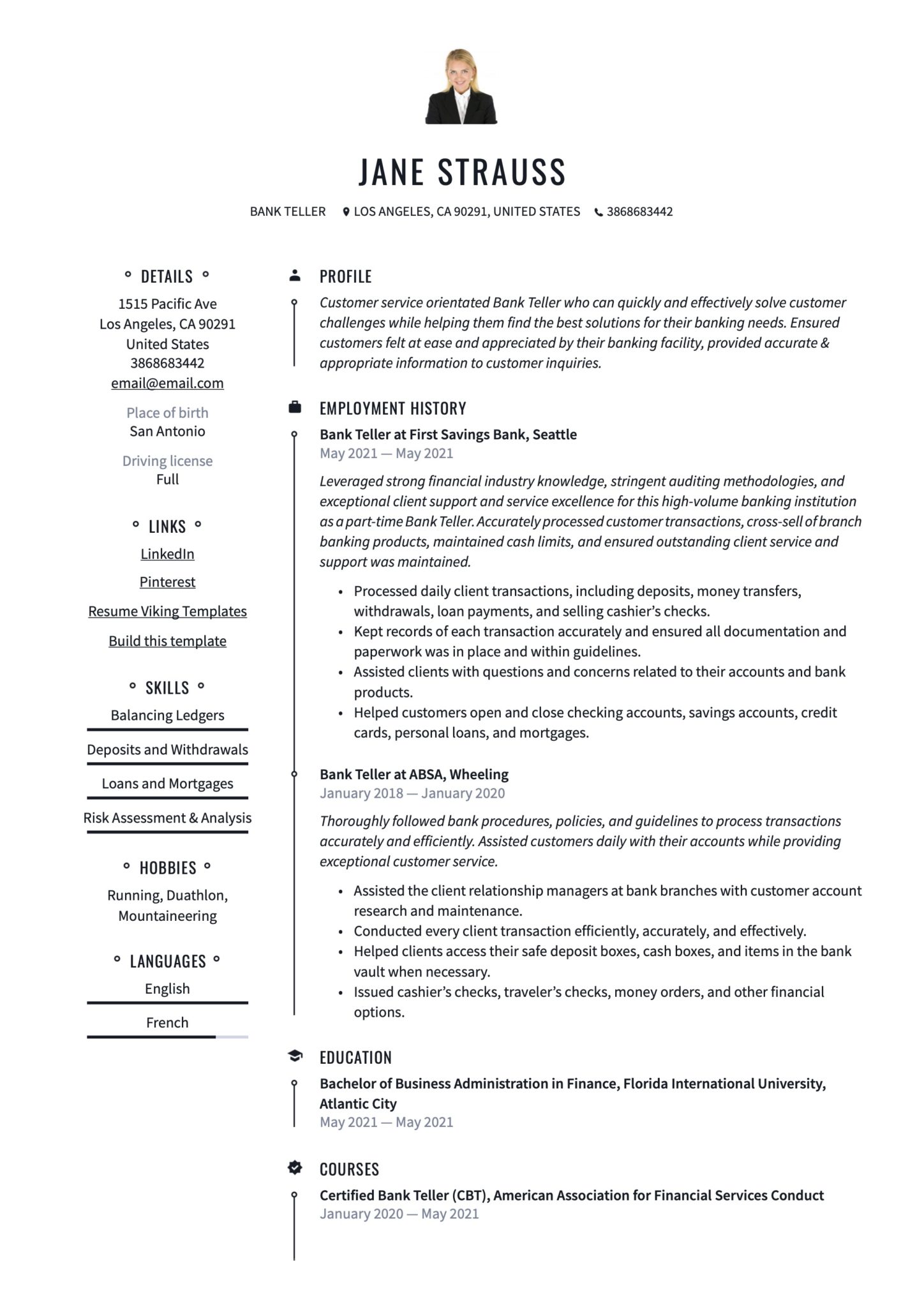

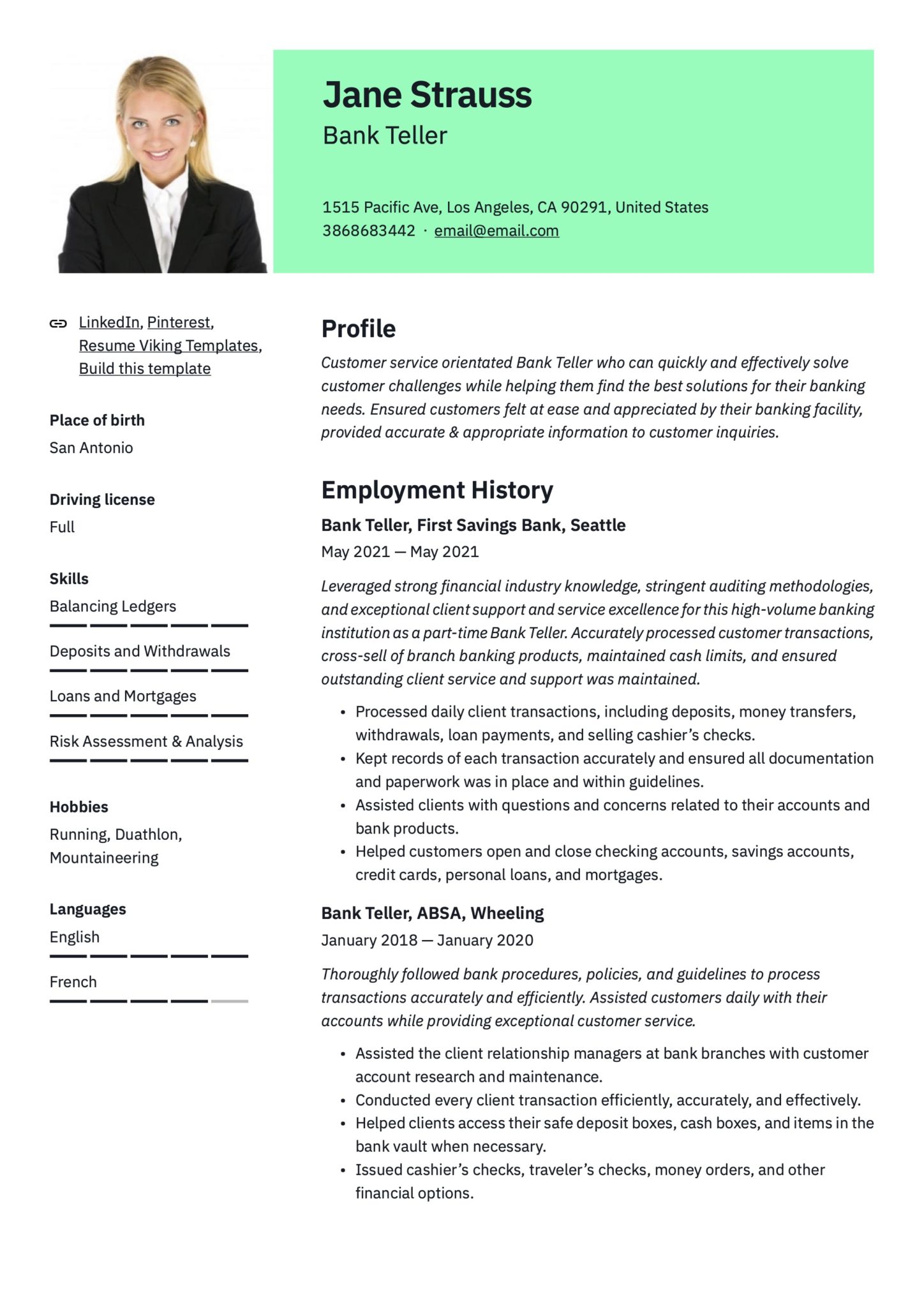

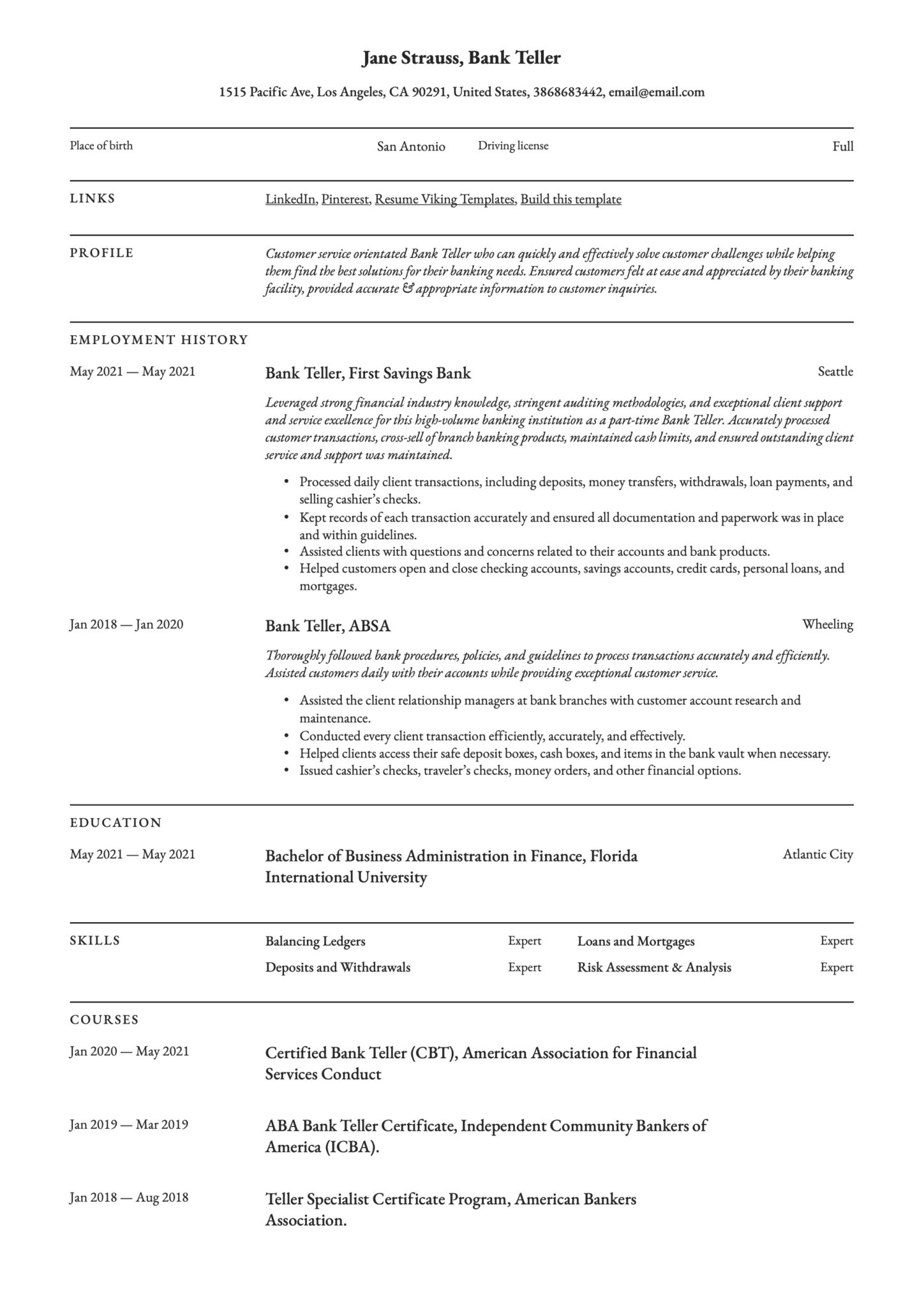

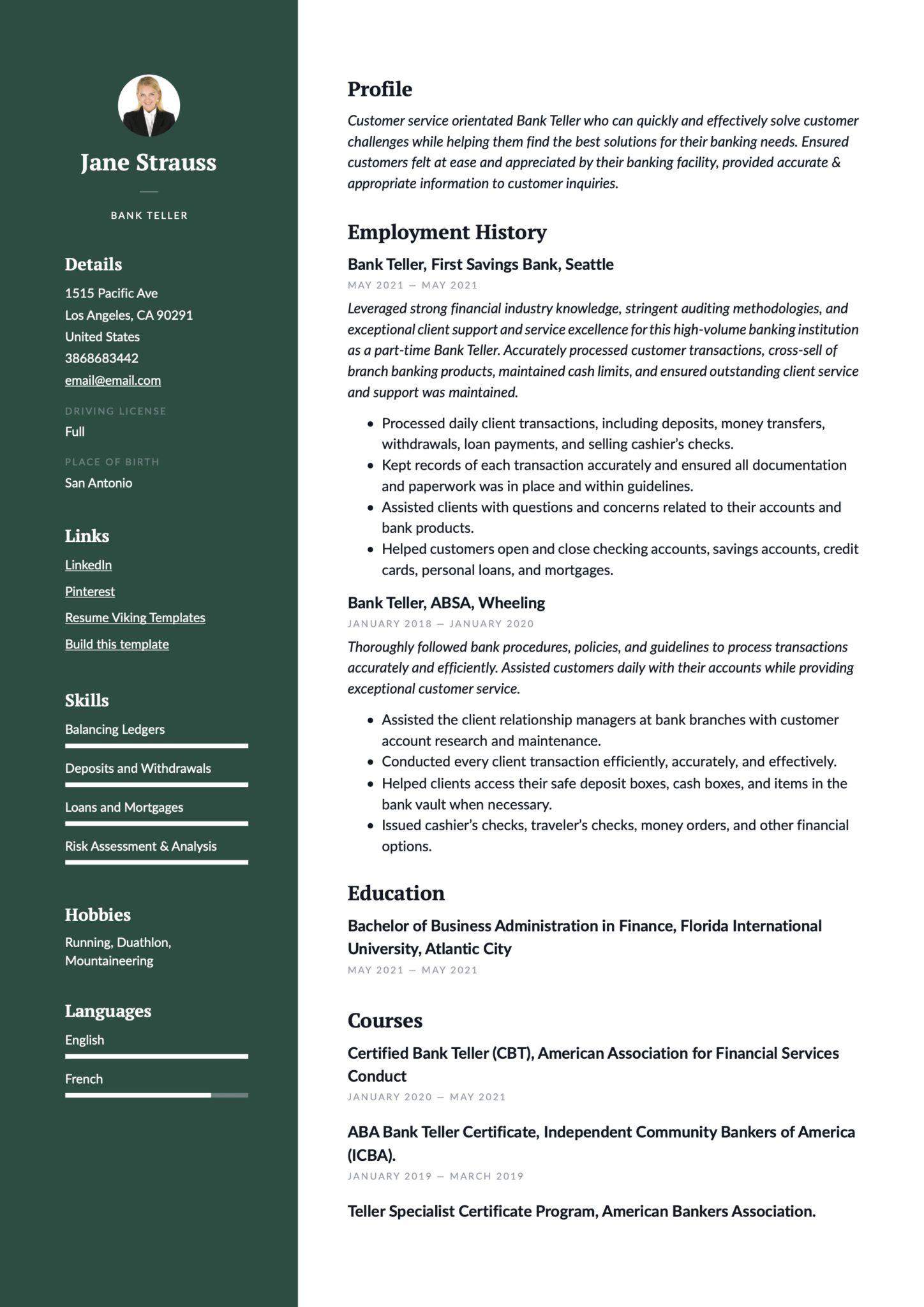

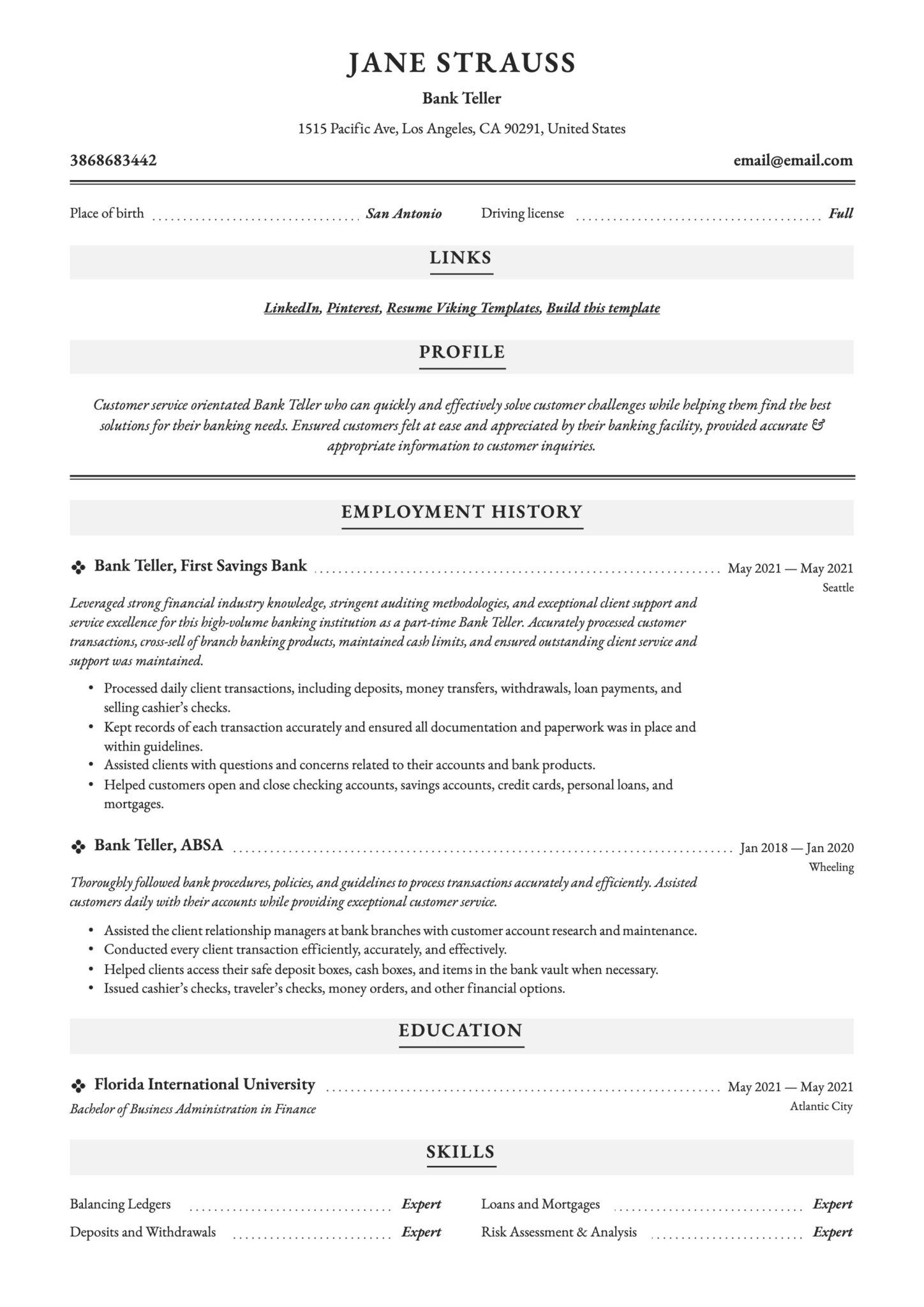

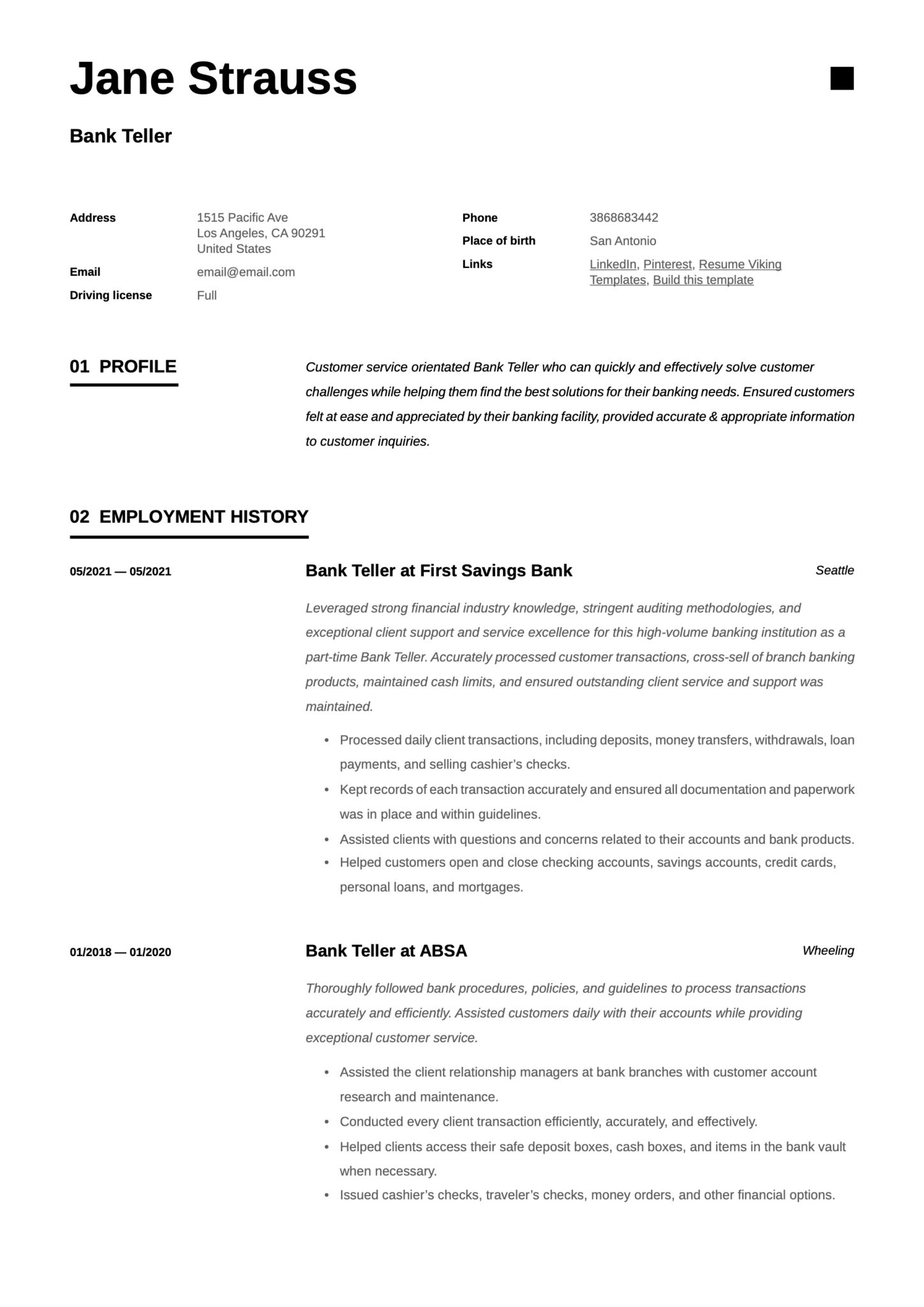

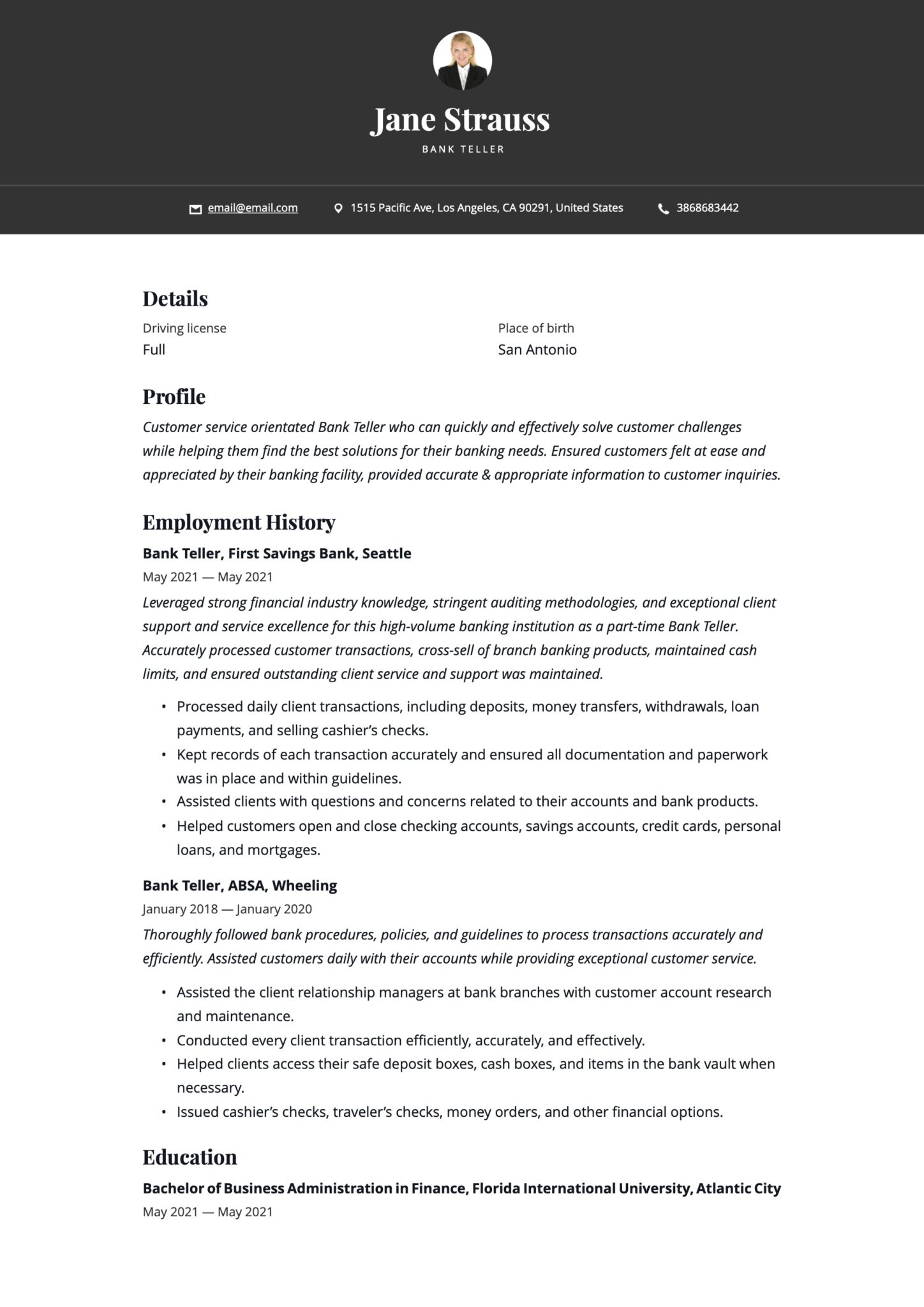

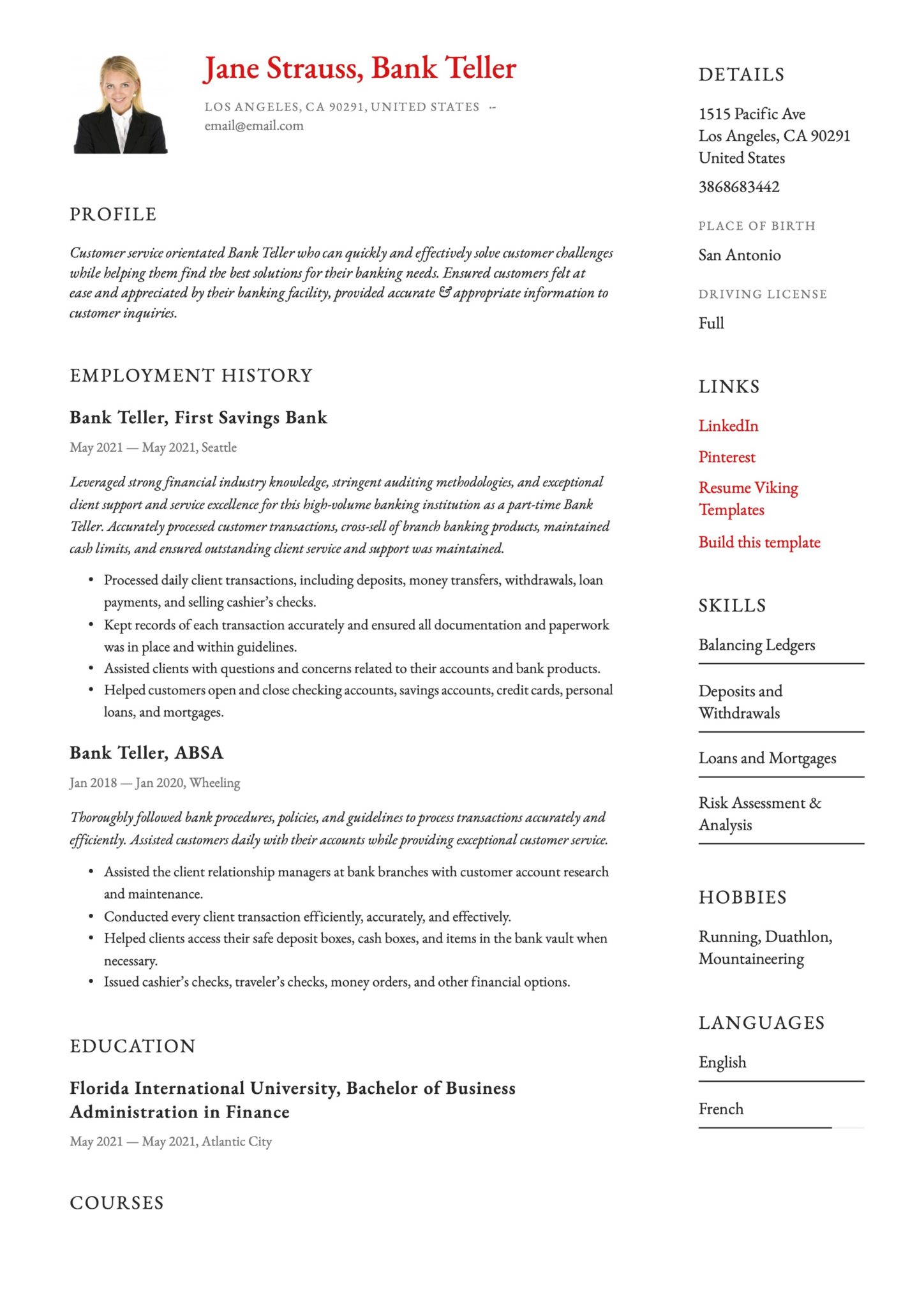

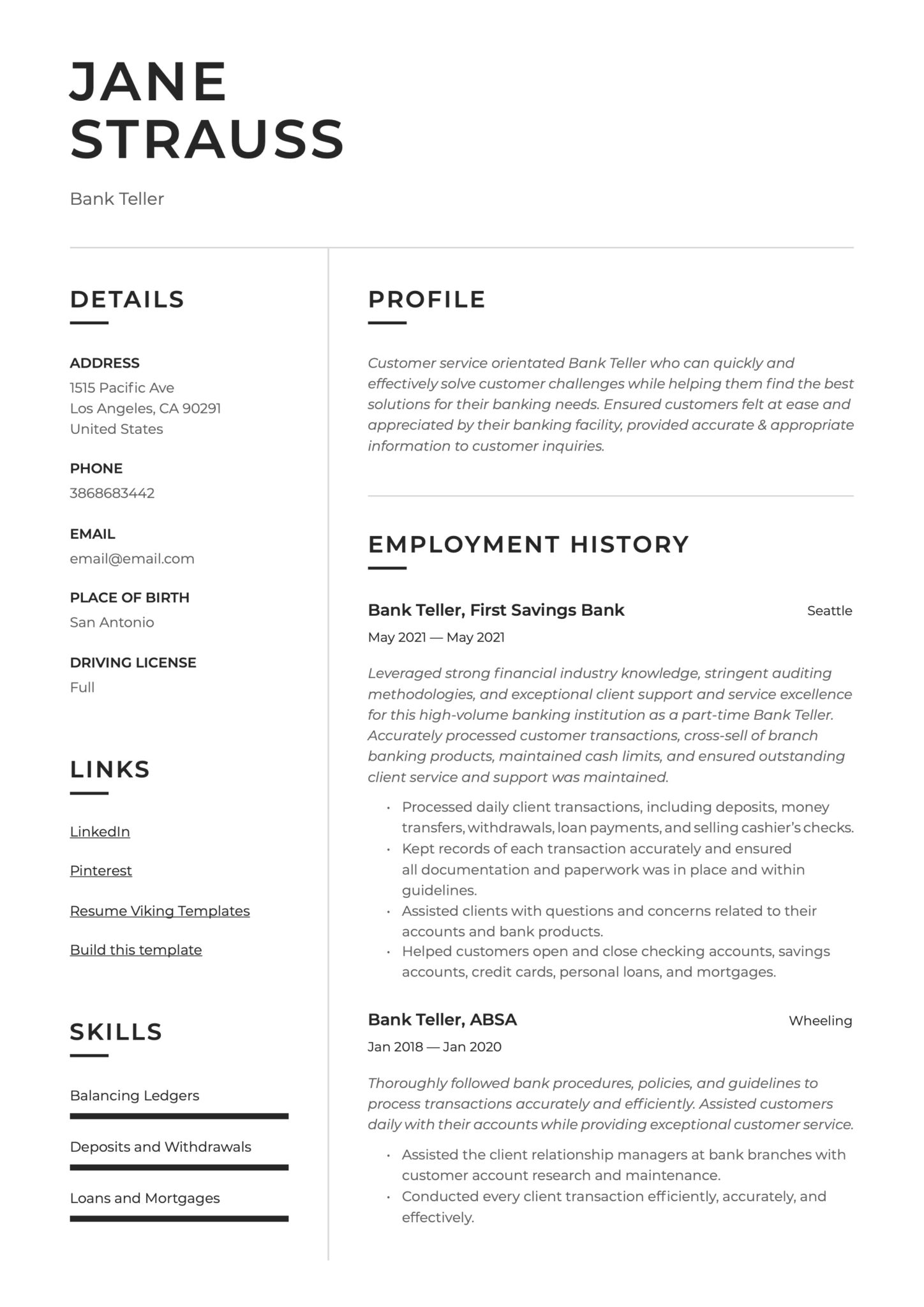

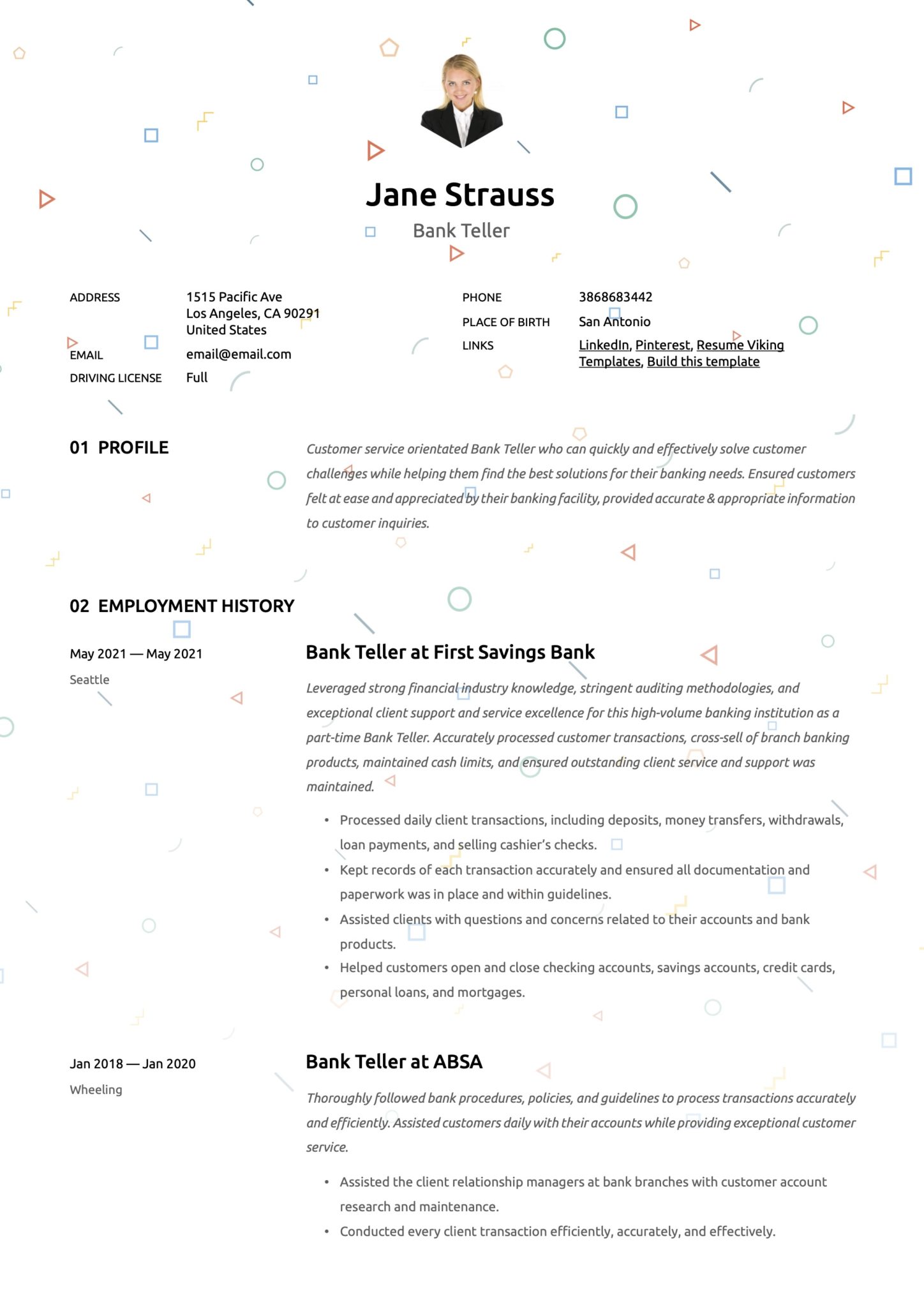

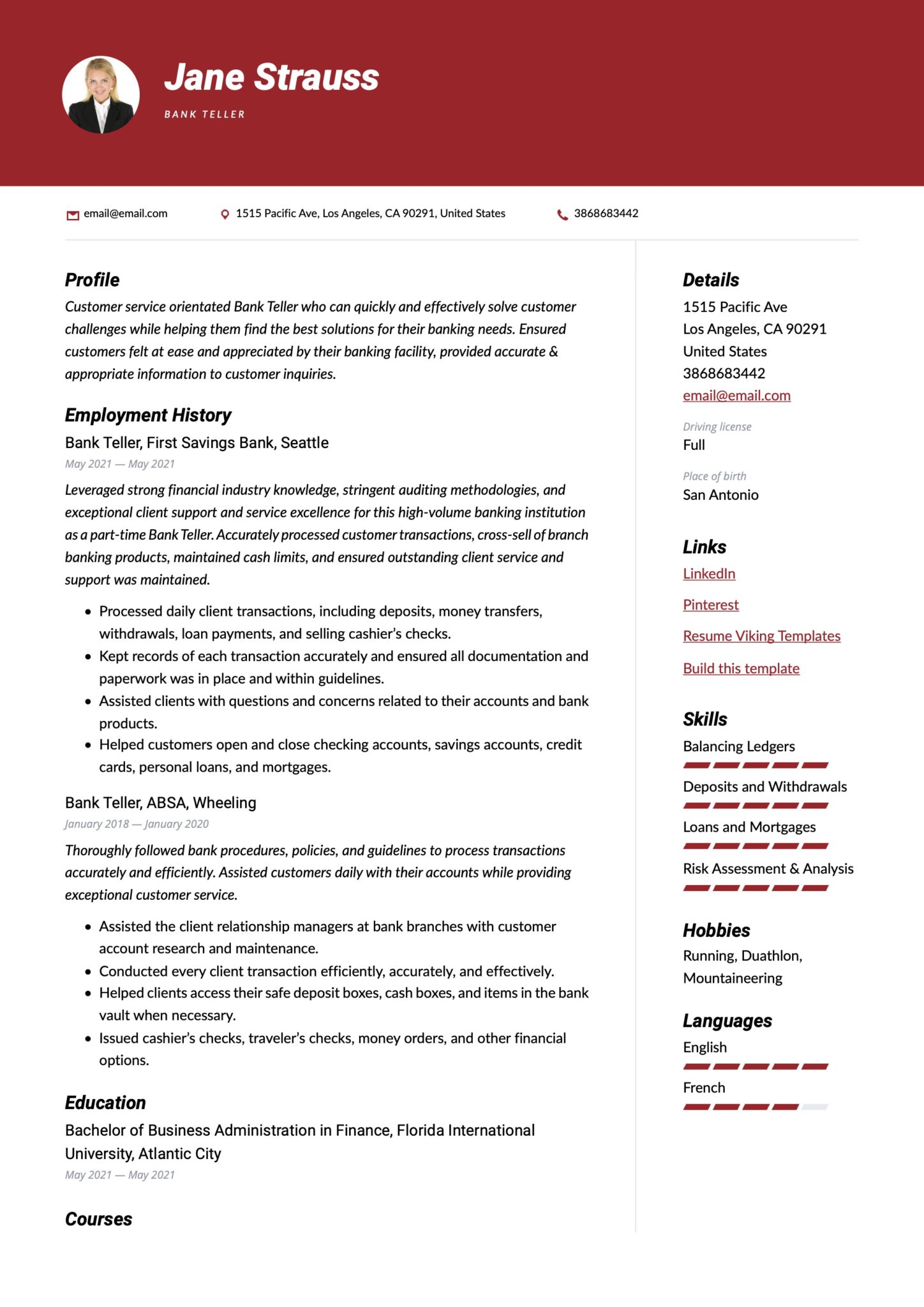

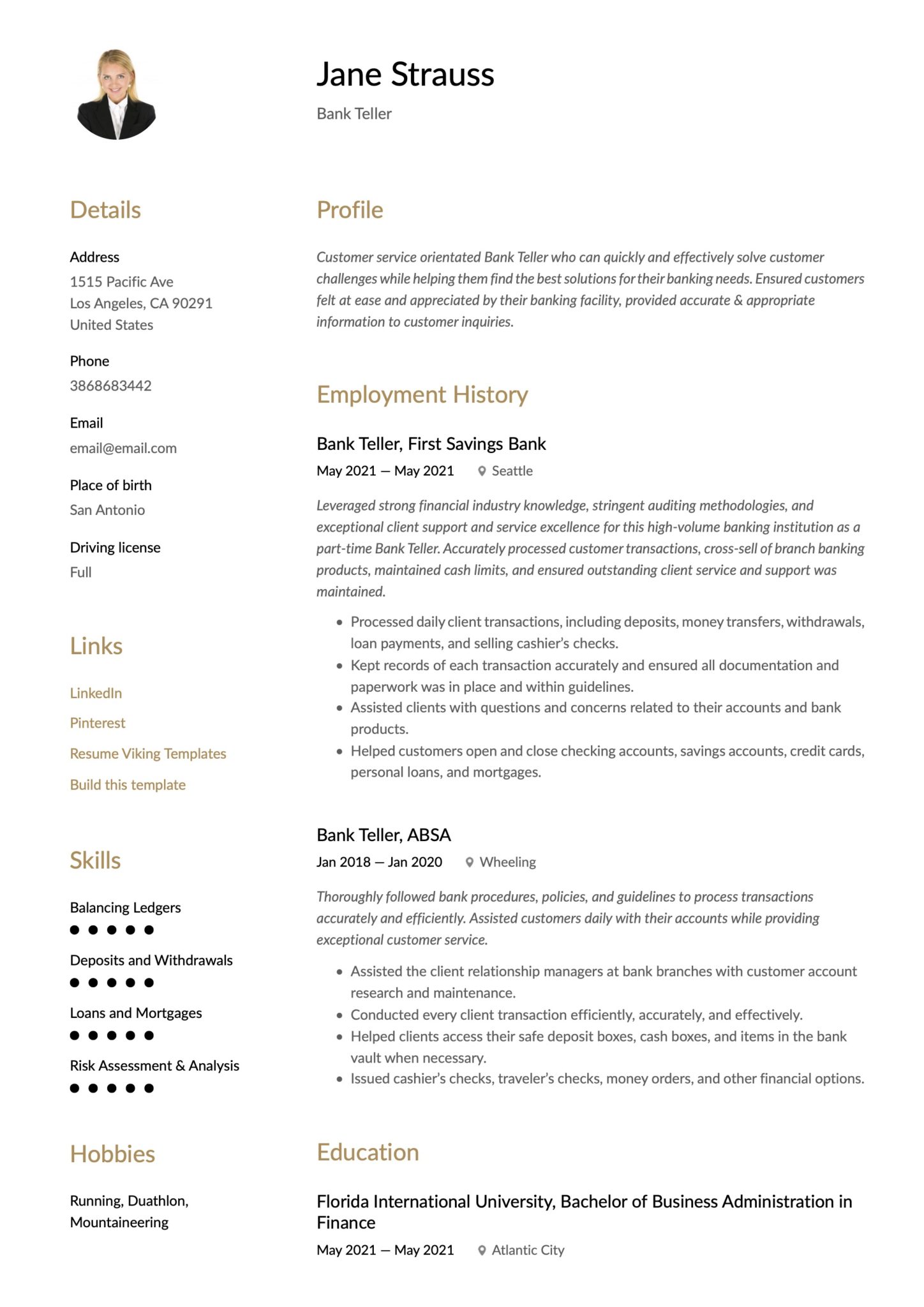

Bank Teller Resume Examples

Free downloads are found at the bottom of this page*

Bank Teller Resume Guide

Resume Sections:

- Contact information

- Profile Summary

- Work History

- Achievements

- Education

- Skill Section

- Certification & Licensing

- Extras: Languages/Awards/Publications/Volunteering/hobbies

What to Highlight in a Bank Teller Resume

Bank Tellers are essential workers who often have to deal with hundreds of customers, thousands of dollars, and countless problems daily. This is no easy task, and potential employers want to see that you can handle these responsibilities. This can be achieved by including the following information in your resume:

1. It would be best to make it clear that you have effective people skills and know-how to remain calm when put under pressure from demanding clients. Furthermore, it would help if you highlighted how you could use your people skills to keep customers happy and calm.

2. Create an excellent first impression by breaking your job description down into the main responsibility areas:

- Where you can work and how long you are willing to work for. Often, Bank Teller positions require employees to transfer to different banks in different states. Further, some banks may expect their employees to work on weekends, holidays, and for extended hours in the early evening.

- Highlight the banking systems you are competent with.

3. The way you layout your information can make a serious impact on the reader’s satisfaction. Below we have outlined several areas that affect the layout of your resume:

- Use the reverse chronological order to list your information.

- Choose a smart font and change the font sizes for the headings and the paragraphs to make your resume look professional.

- Keep a one-inch margin around all sides of the page.

- Save your resume as a PDF as it is a more universal document that can be opened on almost every device.

4. Remember to add extra details such as your availability to work extended hours, fill in when a staff member is absent, transition between branches at different locations and whether you are able to come into the bank at short notice or handle queries from your manager after hours.

Career Summary & Objectives

As we have already mentioned, you want to do everything in your power to ensure that your resume grabs the attention of the reader. A career summary or objective statement is the perfect way to do this.

A career summary is a short paragraph between 5-6 lines in length that should be situated at the very top of your resume. Your career summary serves as an introduction to your resume and allows the reader to form a clear idea about the type of resume they are about to read. For this reason, you need to keep your career summary short and concise, and you should refrain from including any irrelevant information.

If you are wondering whether you should choose a career summary or a career objective, let us help you.

- Suppose you have an extensive amount of Bank Teller experience. In that case, a career summary is a perfect choice for you as it allows you to sum up your impressive experience as well as highlight your most impressive skills, qualities, and qualifications.

- On the other hand, if your Bank Teller experience is on the thinner side, rather opt for a career objective. Instead of highlighting your experience, a career objective outlines your career goals while still showing off your most impressive skills and qualities.

Start your career summary with your years of experience in the industry, followed by the primary duties you were responsible for. Next, add a line that highlights your most attractive skills and qualities and state how they make you a better employee. Lastly, finish off with your highest qualifications and certifications.

Examples of Bank Teller Career summaries:

Bank Teller Summary 1

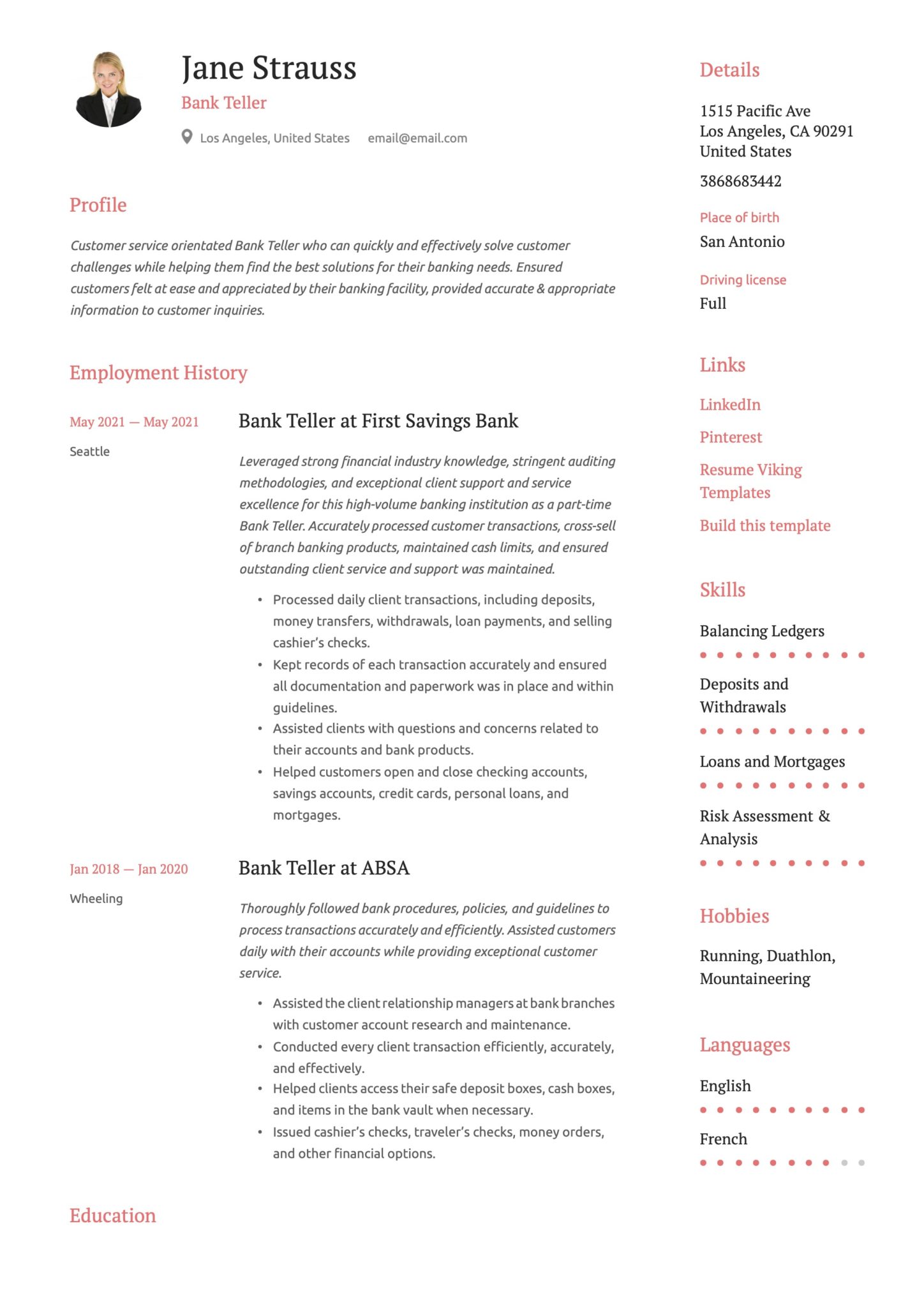

“Customer service orientated Bank Teller who can quickly and effectively solve customer challenges while helping them find the best solutions for their banking needs. Ensured customers felt at ease and appreciated by their banking facility, provided accurate & appropriate information to customer inquiries.“

Bank Teller Summary 2

“Personable Bank Teller at a high-volume bank with six years of expertise in financial customer service. 99.85% client happiness rating over a 6-year period of employment. Seeking to leverage the knowledge of advanced banking activities and banking product experience to become the next senior Bank Teller at PLS Savings Bank.“

Bank Teller Summary 3

“Current college student majoring in finance with two years of experience at a retail store with heavy traffic. Excellent customer service, communication, and interpersonal skills. 99% score on Bank Teller Certification Exam. Seeking to use client services skills and banking retail experience to become a junior bank teller at OTP Investment Bank.“

Bank Teller Summary 4

“Friendly and accurate bank teller with over four years of experience helping customers in downtown Wheeling. Voted “Teller of the Year” in 2017 for exceptional customer service. Excited to utilize extensive aptitude of consumer banking, withdrawals, processing deposits, and transfers and addressing financial questions to become the next bank teller at SELI Bank.“

Employment History

Between 2019 and 2029, Bank Teller jobs are expected to drop by 12%, resulting in 57,850 fewer jobs. This is scary news, and it means that your Bank Teller resume needs to be of the highest standard more than ever.

When listing your employment history, follow the following steps:

- Oder your experience in reverse-chronological ordering.

- Include a job title, the company's name, where the company is located, and the dates you worked at the company.

- Include between 5-6 bullet points with details about the responsibilities you held in your previous positions.

- Begin each statement with an action verb.

- Add one or two quantifiable achievements to verify your banking skills.

Examples:

Bank Teller at First Savings Bank

(Jan 2018 – Nov 2020)

Leveraged strong financial industry knowledge, stringent auditing methodologies, and exceptional client support and service excellence for this high-volume banking institution as a part-time Bank Teller. Accurately processed customer transactions, cross-sell of branch banking products, maintained cash limits, and ensured outstanding client service and support was maintained.

- Processed daily client transactions, including deposits, money transfers, withdrawals, loan payments, and selling cashier’s checks.

- Kept records of each transaction accurately and ensured all documentation and paperwork was in place and within guidelines.

- Assisted clients with questions and concerns related to their accounts and bank products.

- Helped customers open and close checking accounts, savings accounts, credit cards, personal loans, and mortgages.

Bank Teller at US National Bank, Wheeling, IL

(June 2015 – December 2017)

Thoroughly followed bank procedures, policies, and guidelines to process transactions accurately and efficiently. Assisted customers daily with their accounts while providing exceptional customer service.

- Assisted the client relationship managers at bank branches with customer account research and maintenance.

- Conducted every client transaction efficiently and effectively.

- Assisted clients access their safety deposit boxes, cash holding boxes, and items in the bank’s vault when necessary.

- Issued cashier’s checks, traveler’s checks, money orders, and other financial options.

Job Descriptions Samples

When potential employers read through an applicant’s resume, they expect to see proven foundational skills and duties that indicate whether an applicant is competent or not. Below we have outlined several examples of skills and qualities that a hiring manager and a potential employer would hope to see in a Bank Teller’s resume:

Samples:

A Bank Teller may:

- Oversee the ATM custodian initiatives, and acts as Policy and Procedure Champion for the entire branch, ensuring that all policies and procedures are maintained.

- Demonstrate a genuine client-centric service culture that ensures customer satisfaction levels are elevated and maintained.

- Keep up to date on banking policies and procedures, including the storage of various business items.

- Host weekly meetings to ensure audit details were understood and adhered to.

- Oversee ATM balances, refill cash as needed, and ensure the system is working well.

- Assist in lobby management initiatives, engage with customers in conversation regarding service offerings, locate of personnel, and ensure customer satisfaction is maintained.

- Ensure that the cash drawer is balanced, and all supporting documentation is in line with cash receipts and client transactions.

- Provide reports analyzing preferred customers' financial status in support of sales of new products and opportunities.

- Conduct due diligence and thorough verification of all relevant documents, which effectively prevent possible losses by identifying forged and counterfeit documents.

- Review proof works for any erroneous and omitted information before entering the image data storage system.

- Respond to client inquiries while identifying critical transactional issues or discrepancies to provide viable solutions to maximize customer satisfaction and valuable feedback.

- Master new bank systems and databases post-merger. And lead team members and colleagues in utilizing different features.

- Provide one-on-one support and training to newly hired employees, including in-person and over-the-phone customer service delivery, navigating bank-specific systems, and balancing cash.

- Maintain appropriate cash limits, cash checks, and establish deposits.

- Promote the Bank's products and services. Analyze customer accounts to find possible accounts they may be interested in and refer them to the Personal Banker or Platform

- Greet customers as they enter the Bank and refer them to the right area for service.

Accomplishments

I know how tempting it can be to simply copy and paste the list of duties and responsibilities you performed straight into your accomplishments section but let me stop you right there.

This is the last thing that you want to do as it will only result in you coming across as lazy and unoriginal, qualities you do not want potential employers to think about you.

Rather, take the time to read through the job description to ascertain the specific pieces of information the employer is looking for and tailor your accomplishments around this.

Your goal is to think about what sets you apart, the things you are most proud of, and what you have achieved in your previous roles. Now communicate these through quantified and action-packed statements.

Quantifying Your Resume

Quantification is one of the most important things that you need to include throughout your resume whenever you make a statement about performance or achievements. Without Quantification, the reader has nothing to measure you against, and your statements become meaningless. Think about whether your statements can answer the following questions: “How much?” or “How many?” If they can, include Quantification.

- How many transactions do you conduct in a week?

- How many recurring stop or debit orders do you have in a month?

- How many cross-sales do you make in a month?

Samples of accomplishment statements without Quantification:

- Handle customer transactions every week.

- Achieved sales goals by identifying customer needs and referring financial products and services.

- Managed my personal goals aside from the companies.

- Voted “Teller of the Year” for exceptional customer service.

Now, samples WITH Quantification:

- Handle on average 120 customer transactions per week.

- Achieved sales goals of 8% or more quarterly by identifying customer needs and referring financial products and services.

- For example, I managed my personal goals aside from the companies and received a 100% satisfaction rating from customer service surveys.

- Voted “Teller of the Year” in 2020 for exceptional customer service.

Education

Whether you have loads of impressive educational qualifications under your belt or just leaving high school, your education section is equally important. It should be given the attention it deserves as it is a section that employers pay close attention to. Here you can include every qualification, certification, or industry license you have obtained.

The complicated part, however, is knowing how to list your information correctly. Fear not. We will show you exactly what to do.

Begin by stating your commencement and completion dates for diplomas, associate degrees, and bachelor’s degrees. (For courses, you simply have to include the date of completion.)

Next, state the full name of your qualification, as well as the full name of the institution and the City or abbreviated State name where the institution is located.

List your high school diploma details similarly, but only include this if you have less than five years of working experience.

Experienced Bank Teller Resume Education Sample:

2019 – Certified Bank Teller (CBT), American Association for Financial Services Conduct

2018 – ABA Bank Teller Certificate, Independent Community Bankers of America (ICBA).

2017 – Teller Specialist Certificate Program, American Bankers Association.

2014 – 2016 – Bachelor of Business Administration in Finance, Florida International University, Miami, FL.

Entry-Level Bank Teller Resume Education Sample:

2016 – 2018 – Bachelor of Science in Finance and Accounting Management, Northeastern University, Boston, MA.

Relevant Coursework: Applications for Managerial Finance, Advanced Financial Recordkeeping & Accounting Practices, Financial Management.

Minor: English Studies

Skills

When you have to deal with a large amount of money every day and are required to keep detailed records, it requires Bank Tellers to have specific technical skills; however, soft skills are equally important as they allow you to successfully deal with clients every day and maintain customer satisfaction levels.

Employers are very interested to know about the technical and soft skills you can bring to the table as it allows them to gauge whether you are a good fit for their company or not.

When listing your skills and qualities, we recommend that you remember the following:

- Use the job description to identify the exact skills and qualities the employer is looking for. If they are relevant to you, include them. Do not forget to include your own unique skills and qualities that make you who you are.

- Instead of using bullet points, list your skills and qualities in a skills matrix table. This will allow you to save space, and it allows your resume to look more professional and allows the reader to find your information quickly.

20+ Bank Teller Skills for a Resume

| Balancing Ledgers | Vault |

| Deposits and Withdrawals | Privacy & Confidentiality |

| Loans and Mortgages | Foreign Currency & Currency Exchange |

| Investments | Teamwork Skills |

| Financial Account Maintenance | Technical Skills |

| Risk Assessment & Analysis | Organizational Skills |

| Cash Drawer & Cash Handling | Time Management Skills |

| Basic Math Skills | Decision-Making Skills |

| Financial Transactions | Verbal Communication Skills |

| Problem-Solving Skills | Computer Skills |

| Safety Deposit Boxes | Critical-Thinking Skills |

Qualifications/Certifications associated with Bank Tellers

| Bachelor of Science in Finance and Accounting Management | Bachelor of Business Administration in Finance | Teller Specialist Certificate Program |

| Certified Bank Teller (CBT) | ABA Bank Teller Certificate | Customer Care Workshop |

Action Verbs for your Bank Teller Resume

| Closing | Introducing | Servicing |

| Listening | Helping | Interacting |

| Influencing | Involving | Negotiating |

| Selling | Cleaning | Making |

| Resolving | Engaging | Communicating |

Extra Sections for Bank Teller Resumes

You often reach the end of your resume, but you feel that you still have more to offer. If this is how you feel, the optional extras section is exactly what you have been looking for. Here you can include information about your abilities that you may not have included in previous sections.

Bank Teller Resume Additional Sections to consider:

- Certifications on a Resume – Certificates prove to the reader that you have meaningful skills when your college and past work experience might say otherwise.

- Volunteering Experience – If you had a volunteer job in your past, it can be a great way to show the reader that you are hardworking and will show that you care about self-development.

- Language Proficiency – Daily, you never know whom you might have to communicate with. If you can speak a second language proficiently, it will really impress potential employers.

- Interests on a Resume – Hobbies and interests can look great but ensure that they are relevant to this field of work.

Download Bank Teller Templates in PDF

Professional Information for Bank Tellers

Sectors: Banking, Financial Services,

Career Type: Sales, Transactional, Customer Service, Client, Solutions, Client Relations

Person type: Client Handler, Administrator, Transactor, Supporter, Processor

Education levels: High School Diploma to Bachelor’s Degree

Salary indication: An average of $ 21 191 per annum (Glassdoor)

Labor market: Estimated 15% decline between 2019 – 2029 (BLS)

Organizations: Banks and Financial Services Enterprises