When looking for a Financial Advisor position, it is vital to look through a few Financial Advisor resume samples.

The aim is to ensure that your resume stands out from the rest by being concise and informative. Do not include any irrelevant information that will make the reader uninterested.

Creating the perfect resume to ensure you have the best chance at landing an interview is a far easier process after looking at our: How to Make a Resume Guideline for Financial Advisor Roles?

What you can read in this article

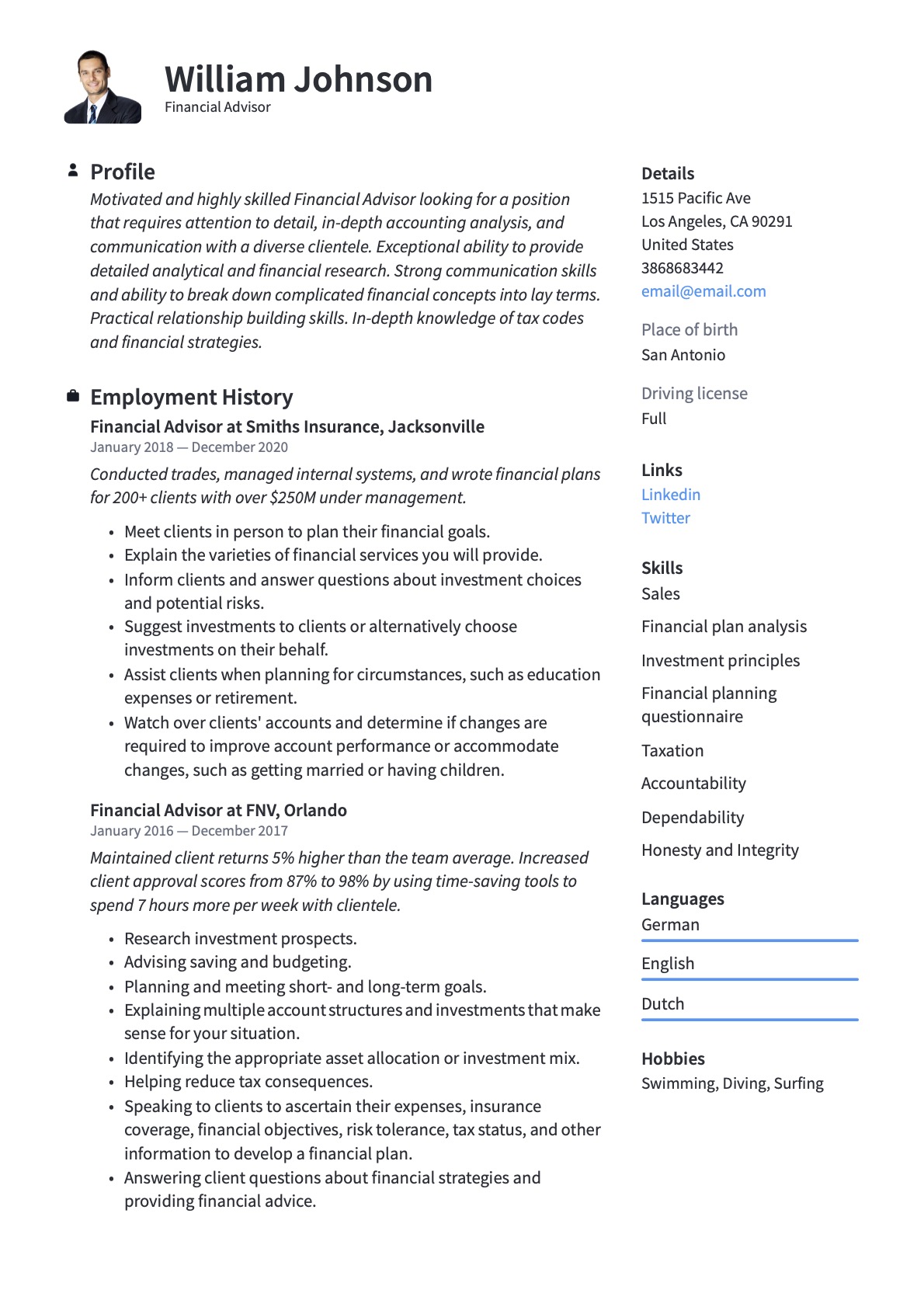

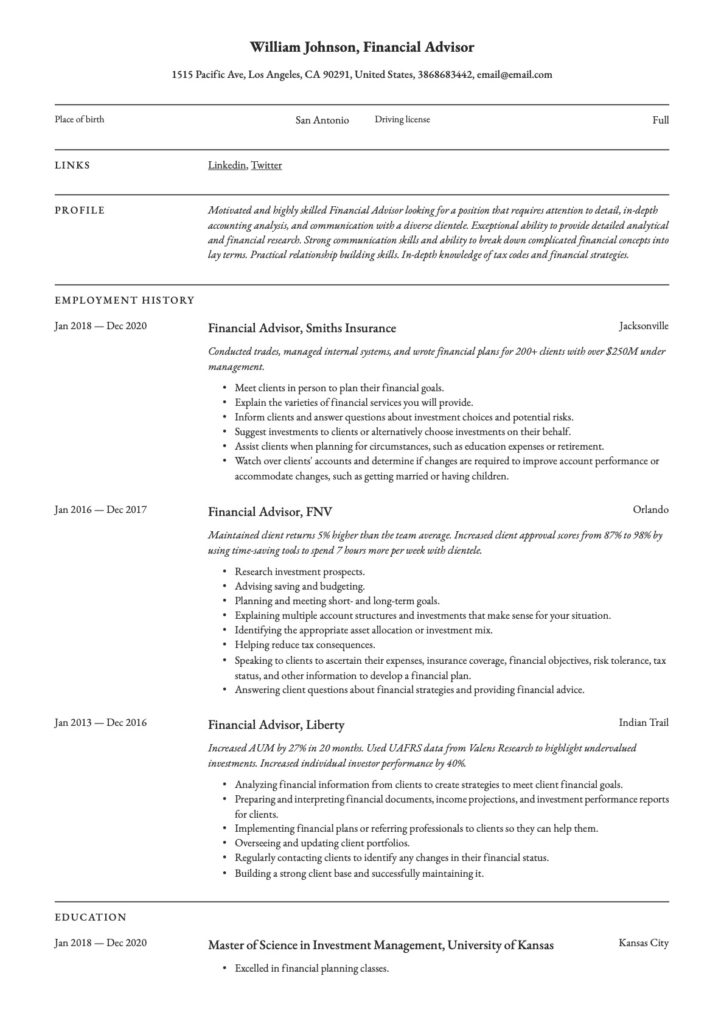

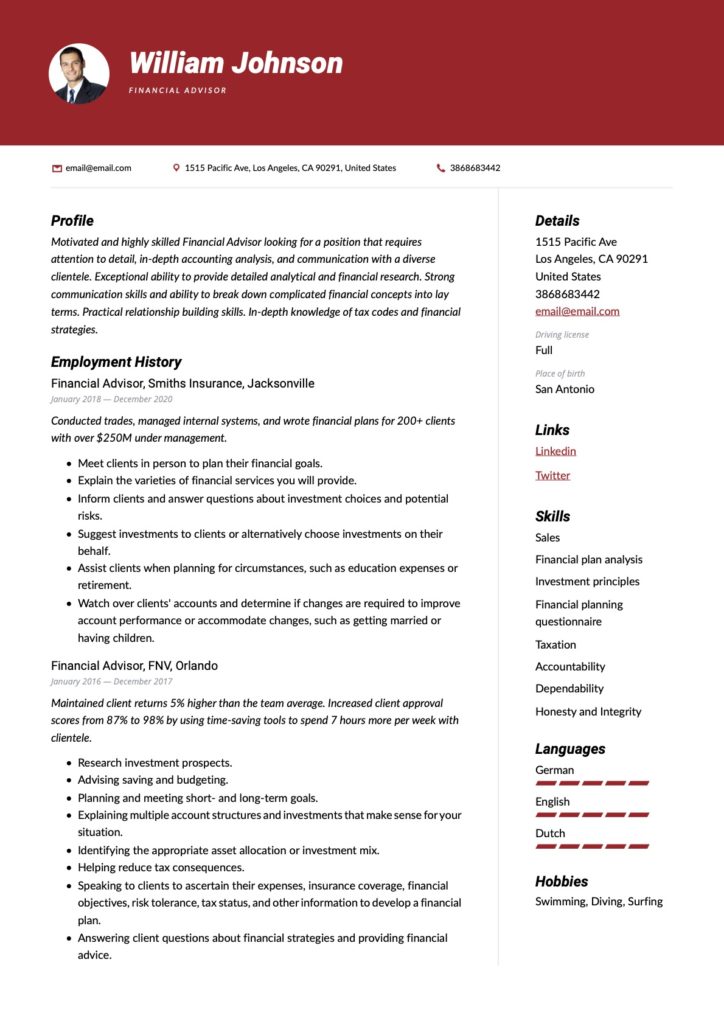

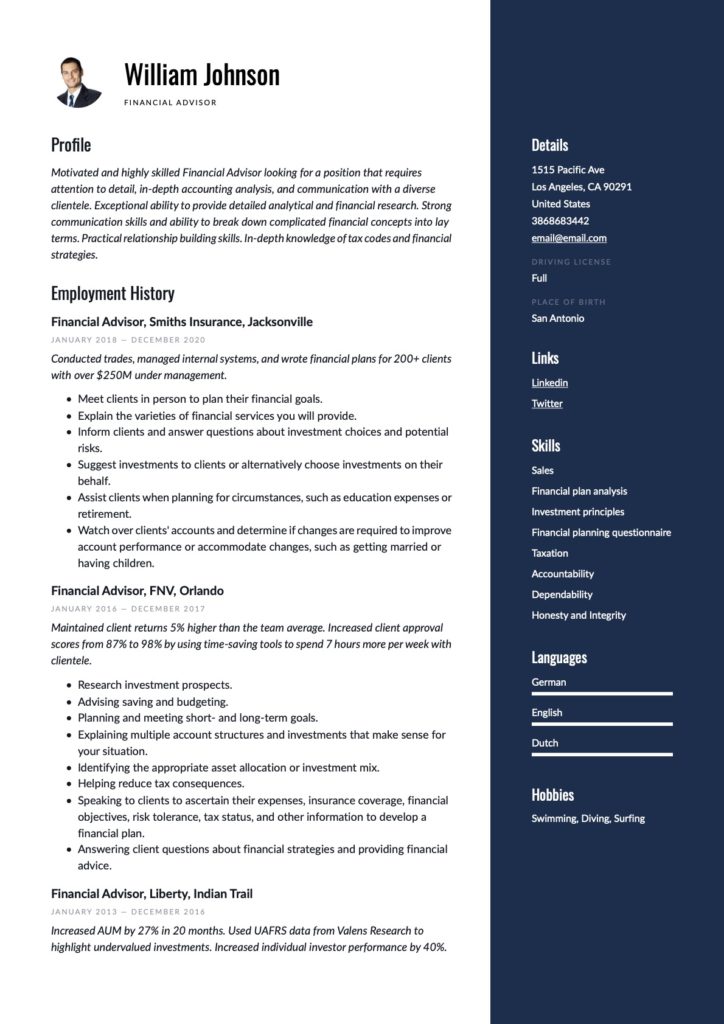

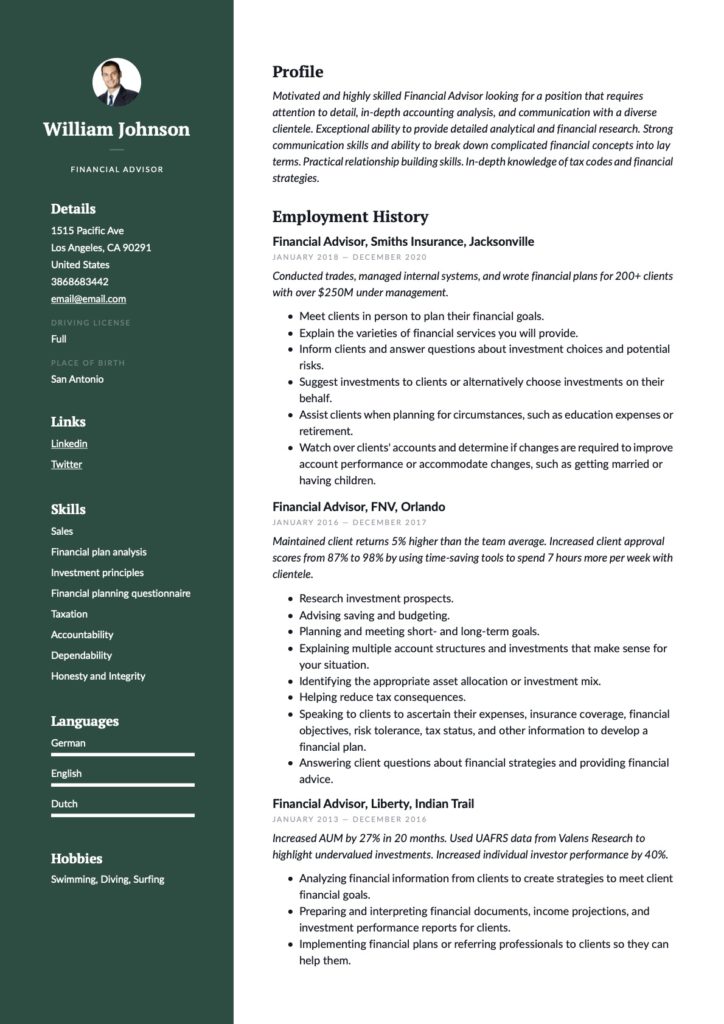

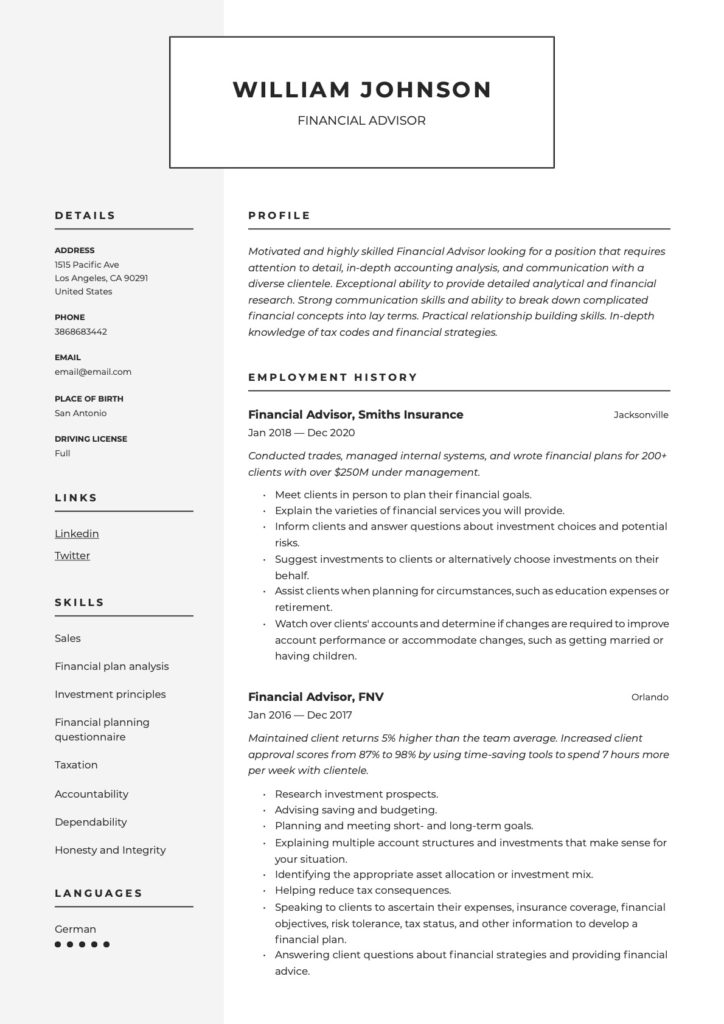

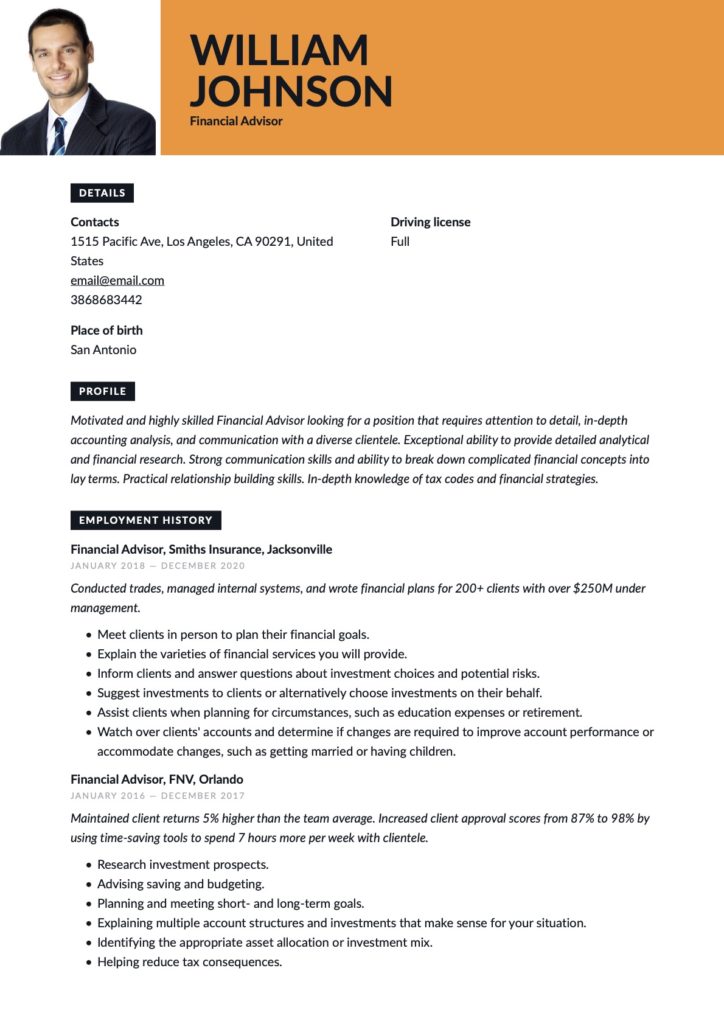

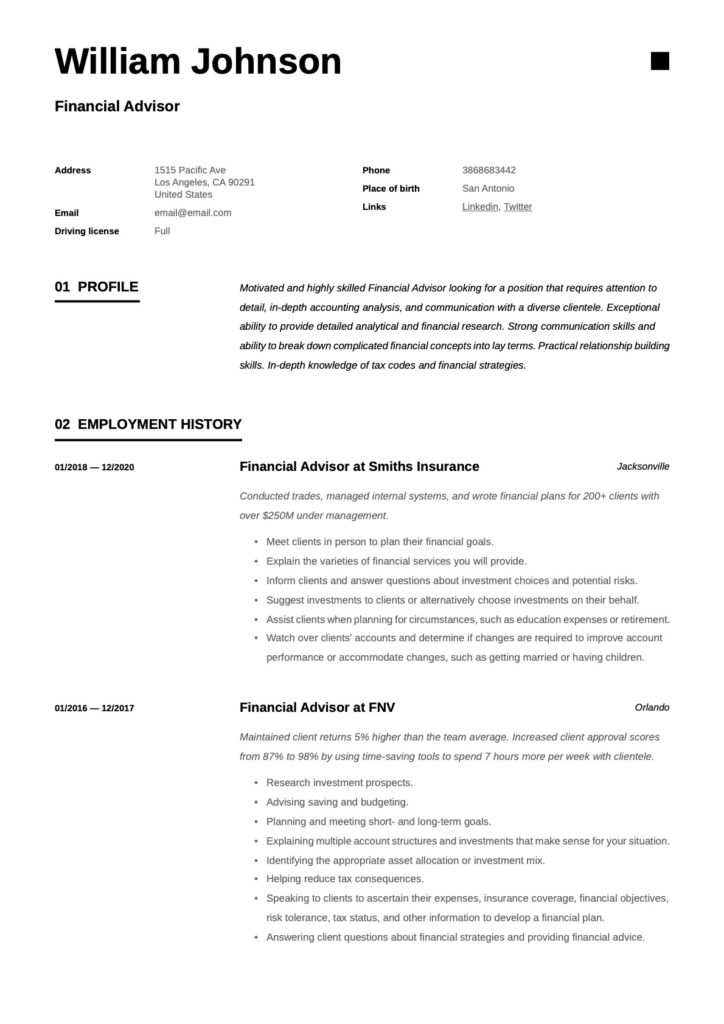

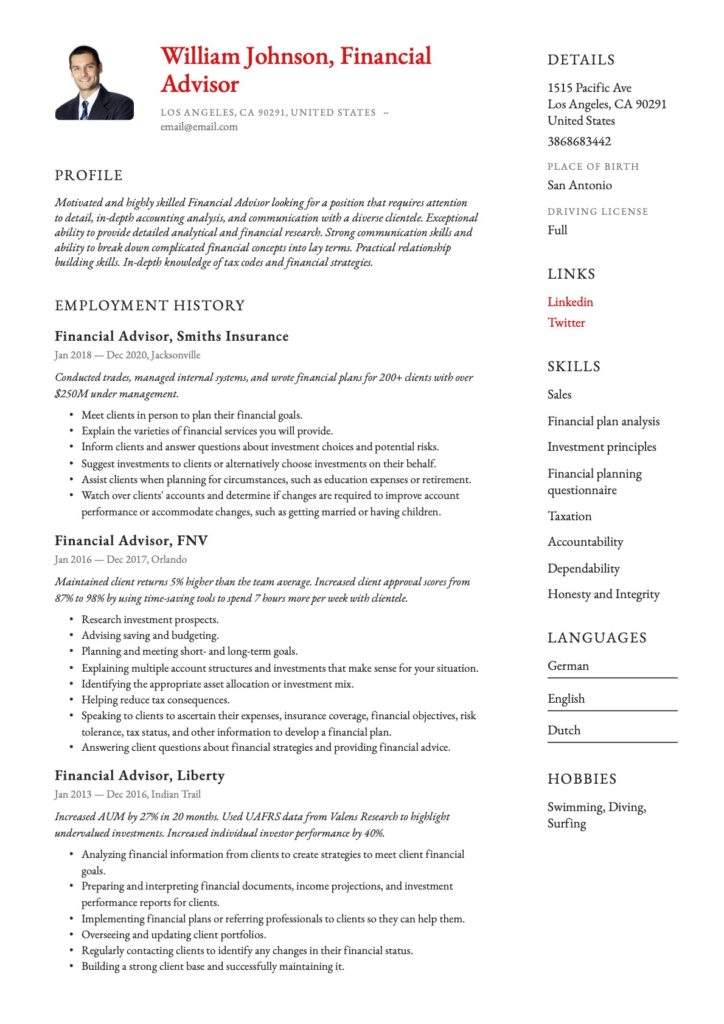

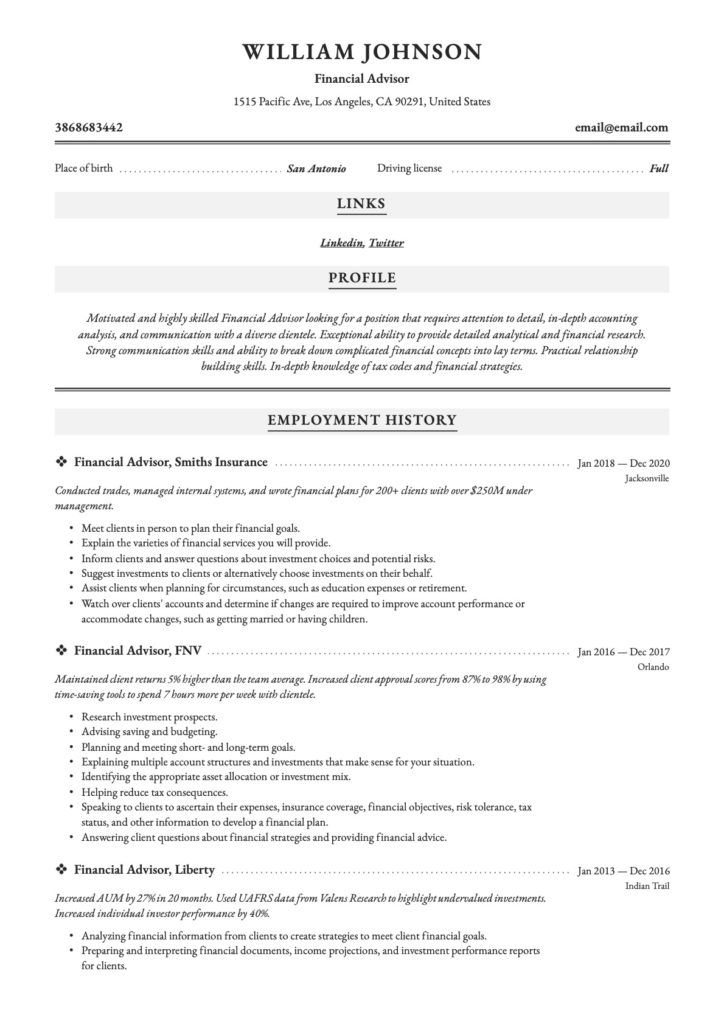

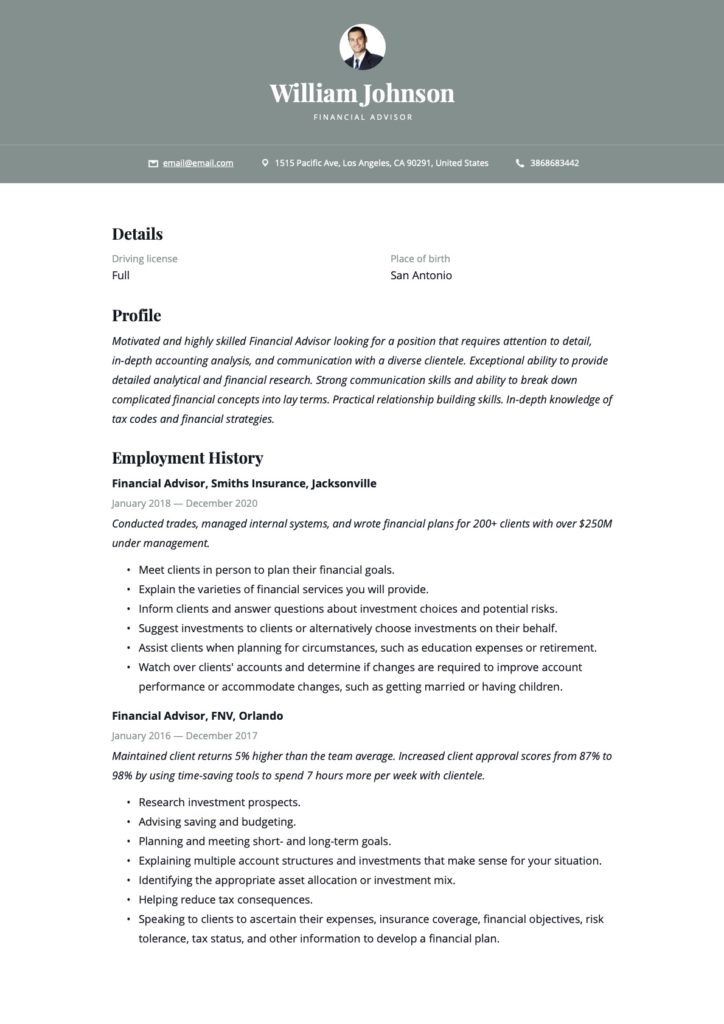

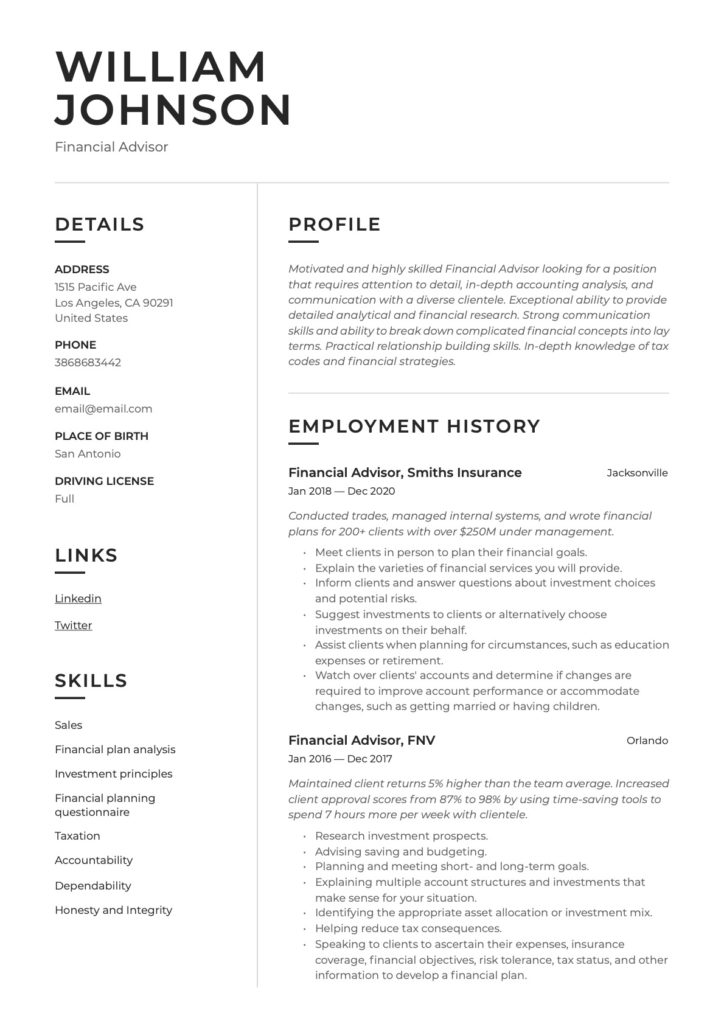

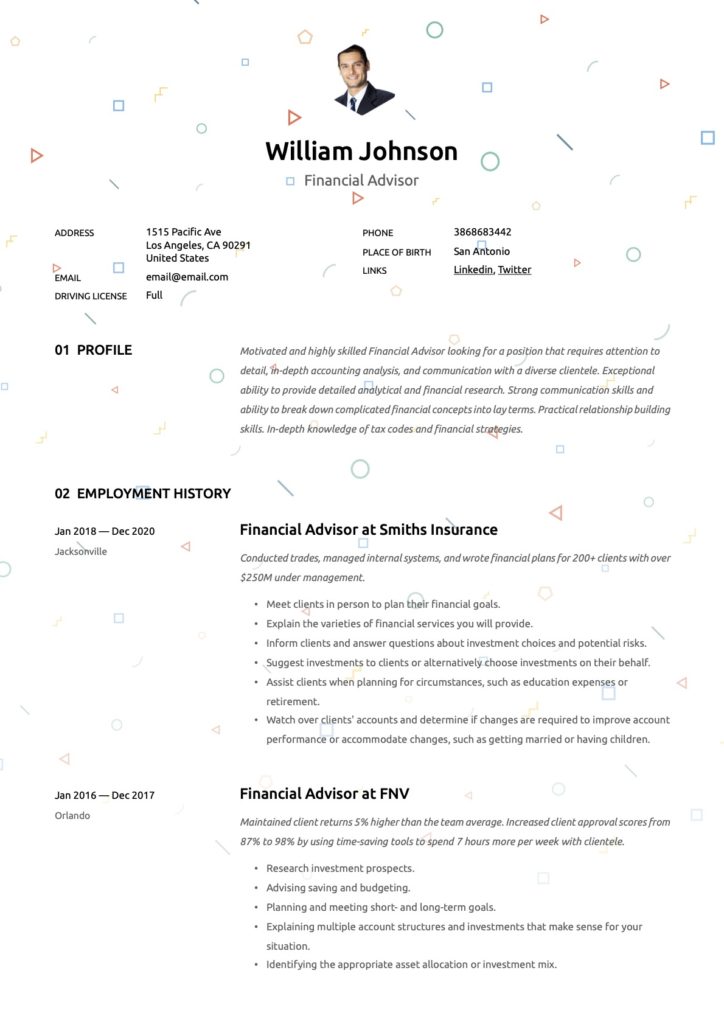

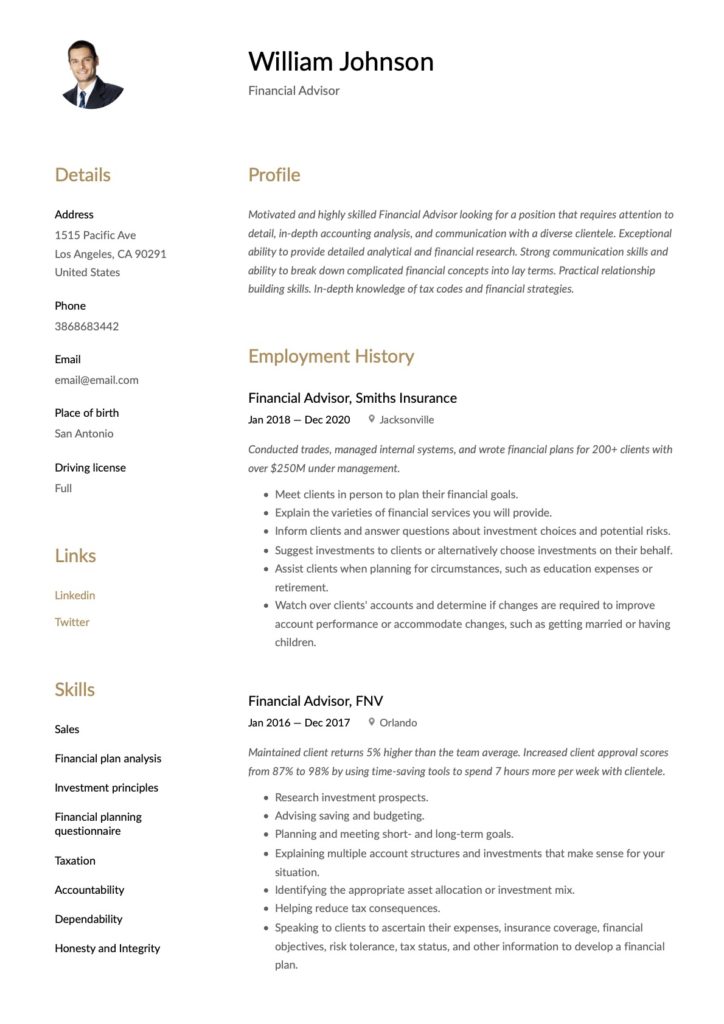

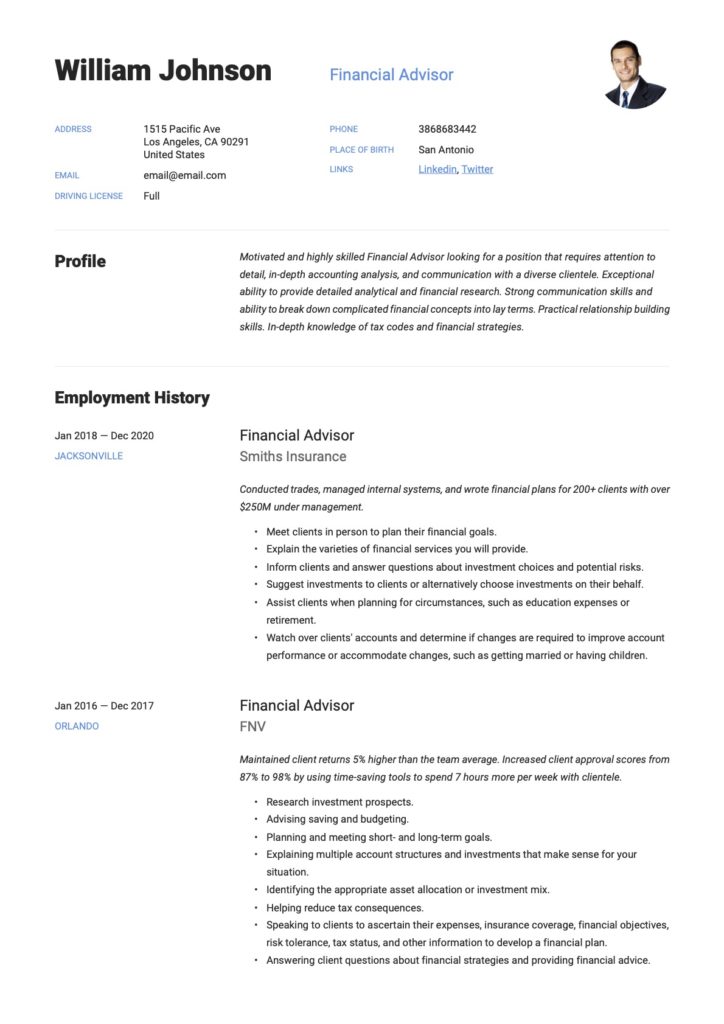

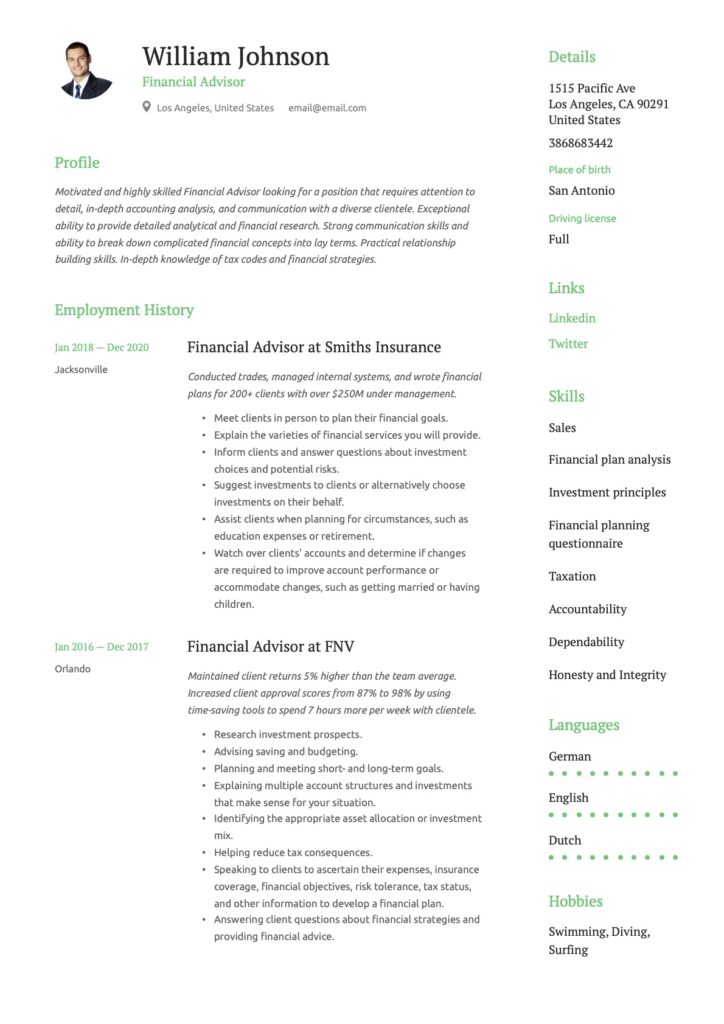

Financial Advisor Resume Examples

(Free sample downloads are at the bottom of this page)

Financial Advisor Resume Writing Guide

Resume Sections

1. Contact Information:

Include your full name, physical address, phone number, and email address. Ensure that you include alternative contact channels and any relevant social media handles such as your LinkedIn profile or Facebook URL details.

2. Profile Summary:

Helping clients to realize their dreams is your forte. That is, if someone employs you. Using a stellar Financial Advisor career summary can prove that you have got the skills that make you the perfect candidate. This section needs to make an impact. Including a broad overview of your background, industry experience, qualifications, and industry areas of interest will allow the employer to decide if you will be a good fit. Be specific and state which job you are applying for (1-3 sentences maximum).

3. Qualifications Summary:

Provide credible details about the certifications and qualifications you have obtained, including the institution's name, qualification name, and dates. Do not forget to mention the qualifications you are currently completing. Some Financial Advisor roles require a degree at Bachelor or Associate level. For others, no formal qualification, apart from a high school diploma, is needed. Still, the short courses, workshops, and in-house training you have received should be listed to provide credibility to your resume.

4. Relevant Financial Advising Experience:

It takes seven or more years to become a Certified Financial Planner (including four years getting a bachelor's degree). Major firms and high-end clients may require their Financial Advisors to obtain a master’s degree (typically another two years). Clearly write your relevant employment history, providing details from the last ten years of your experience up until your current position. Use informative sentences and bullet points that allow the employer to identify the most pertinent information. Financial Advisors jobs practically exist in every industry and for a multitude of products, services, and solutions. This means you need to be specific. Also, include the industry sector, for example, banking, insurance, and telecommunications.

5. Other Employment Experience:

This includes any permanent work history outside of direct Financial Advisory. It can be beneficial to list temporary and vocational jobs where you have actively dealt with customers. You should only mention this information if you have less than five years of customer experience. Otherwise, simply list the job title, company, and duration to ensure there are no gaps in your employment history. This section is very relevant if you are an entry-level or in the process of making a career change, for example, administration support into customer service. It can also be helpful to include your ‘’relationship management experience” to showcase your ability to work well with clients.

6. Skills Summary/Key Skills:

Include keywords from the job listing and your specific skill set. This adds essential credibility to your resume.

7. Education/Licenses/Certifications/Relevant Coursework/Training:

Financial Advisors may need various licenses or designations, such as Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC), Chartered Financial Analyst (CFA), or Certified Investment Management Analyst (CIMA). To obtain these licenses, Financial Planners will need to complete a different set of education, examination, and work history requirements. Include any professional development courses, programs, or workshops you have completed that better prepare you to work within this field. These can be problem-solving, follow up techniques, regulatory industry training, negotiation tactics, and licensing examinations.

What to Highlight in a Financial Advisor Resume

No matter what experience you have had as a Financial Advisor, there are specific details that potential employers need to know about and look for. Do not make these skills difficult to find.

Firstly, it is crucial that you clearly indicate what type of Financial Advisor you are. Below we have categorized them for you:

- Financial Planner:

A Financial Planner is the first type of Financial Advisor. They help companies and individuals create programs to meet long-term financial goals. Financial Planners may have specialties in investing, taxes, retirement, and estate planning. - Registered Investment Advisor (RIA):

A Registered Investment Advisor (RIA) is responsible for individual and institutional investors' assets. As a buy-side investment service, RIAs must be registered with the SEC and state regulatory agencies. RIAs can act in a fiduciary capacity and often hold to a higher standard of conduct than registered representatives. This fiduciary standard mandates that an RIA must always, unconditionally, put the client’s best interests ahead of his or her own, no matter the circumstances. - Hedge Fund Analysts:

A Hedge Fund Analyst is required to guide a portfolio manager on how best to structure the hedge funds investment portfolio. A Hedge Fund Analyst typically works for a hedge fund, as opposed to another buy-side institution. Within hedge funds, alternative asset derivatives, classes, and short or delta-neutral strategies may be implemented. Hedge Fund Analysts are responsible for finding investment opportunities based on research and due diligence, recommending them to portfolio managers, and monitoring risks and performances. - Private Bankers:

Private Bankers, or wealth managers, are personal Financial Advisors who are employed by very wealthy individuals to invest money. These clients are like institutional investors, commonly companies or organizations. Their approach to investing is different from the public. Private Bankers manage a portfolio collection, called a portfolio, for their clients by using the bank's resources, including teams of financial analysts, accountants, and other business professionals.

Secondly, include the primary tasks and services that you can offer. Some Financial Advisors provide a wide range of skills and services, while others specialize in one specific area. These skills and services include suggesting amounts of money to save, the kinds of insurance you should have (long-term care, term life, disability, etc.), the types of accounts you need, and estate and tax planning.

Financial Advisors typically have set working routines and responsibilities. Hiring managers look to see if you have been able to handle the workload and long hours required of a Financial Advisor. Include information about your past and current employment that shows your ability to work well in any conditions, travel often, and work long hours, sometimes even weekends. Furthermore, Financial Advisors are required to be educators to clientele. Include information that shows your ability to assist clients in becoming more financially savvy. This also shows your ability to work well with clients and form strong working relationships.

Lastly, show your knowledge with regards to asset allocation and risk profiling. These are tasks, other than then executing trades, that Financial Advisors are required to do. Advisors set up asset allocations that fit both the risk capacity and risk tolerance. Simply put, asset allocation is a rubric to ascertain what percentage of your total financial portfolio should be distributed across various asset classes. Someone who is more risk-averse will concentrate more on government bonds, certificates of deposit (CDs), and money market holdings. Alternatively, someone who is more comfortable with higher risks might decide to take on more stocks, corporate bonds, and even investment real estate.

Advisors need to show that they understand the importance of regularly touching base with their clients to maintain financial goals and make necessary changes. Once an investment plan has been implemented on a client’s behalf, the real work starts. Regular monitoring, maintenance, frequent correspondence, distributing periodic statements, and creating feedback activities to keep clients updated.

Financial Advisor Career Summary Examples

Potential employers and hiring managers receive hundreds of resumes to read through and limited time to read them in detail. Ensure that you keep your career summary short and concise, including only the most essential and relevant information first. Your goal is to capture the reader’s attention, and you can do this by including specific information that they are looking for.

Begin your career summary by including your years of experience within this industry and explicitly mentioning your responsibilities and duties. Your best friend's job description is to read it carefully to ascertain which qualities potential employers are looking for. Include phrases from your resume's job description to really stand out and show that you are the perfect candidate.

The next step is to include a sentence that highlights an outstanding quality that shows you will add real value to the company. Recommended skills have “creative engagement abilities, strong people skills, outstanding negotiating skills, and dedicated and timeous.” Note that you need to prove these qualities by backing them up with experience.

Finally, your summary should end with your educational qualifications and achievements and any certified courses or professional memberships. Below are a few examples to help advise you:

Three Examples of different career summaries:

Summary example 1:

'Hard-working Financial Advisor with 5+ years of experience. Impressive skill set in client education and financial planning. Looking for a position at (Insert Company Name). At (Insert Company Name), increased client satisfaction from 83% to 96% through automation frees up more time for clients face-to-face. Sustained client returns 5% higher than the team average.'

Summary example 2:

'Client-focused Financial Advisor with 5+ years of experience increasing wealth for clients. Looking to provide experienced guidance at current (insert company name) Improved performance of individual client accounts by 35% at previous employer through UAFRS accounting analysis.'

Summary example 3:

'Motivated and highly skilled Financial Advisor looking for a position that requires attention to detail, in-depth accounting analysis, and communication with a diverse clientele. Exceptional ability to provide detailed analytical and financial research. Strong communication skills and ability to break down complicated financial concepts into lay terms. Practical relationship-building skills. In-depth knowledge of tax codes and financial strategies.'

Financial Advisor Job Descriptions, Responsibilities, and Duty Examples

Employers look for specific foundational skills and duties when reading an applicant’s resume, depending on their career stage and education level.

Below are a few tips to aid you:

- Reference your most recent jobs first. Use a professional job title (Financial Advisor).

- Include the firm’s name and the dates you began and finished.

- Include 3-6 bullet points.

- Within those bullets, include a range of duties and achievements. Remember to have numbers to quantify your accomplishments.

- Ensure that your resume’s accomplishments are relevant to the FP&A job that you are applying too.

- Use numbers, dollars, hours, percentages, and numbers of clients or trainees to add credibility.

- Use power and action words to capture the reader’s attention.

Below you will find a list of jobs you are likely to be tasked with.

Sample duties and responsibilities:

- Meet clients in person to plan their financial goals.

- Explain the varieties of financial services you will provide.

- Inform clients and answer questions about investment choices and potential risks.

- Suggest investments to clients or alternatively choose investments on their behalf.

- Watch over clients' accounts and determine if changes are required to improve account performance or accommodate changes, such as getting married or having children.

- Research investment prospects.

- Advising saving and budgeting.

- Planning and meeting short- and long-term goals.

- Explaining multiple account structures and investments that make sense for your situation.

- Helping reduce tax consequences.

- Answering client questions about financial strategies and providing financial advice.

- Recommending strategies for client insurance coverage, cash management, investment planning, and other areas.

- Regularly reviewing client accounts and plans to see if economic changes, situational concerns, or financial performance require their plan changes.

- Analyzing financial information from clients to create strategies to meet client financial goals.

- Preparing and interpreting financial documents, income projections, and investment performance reports for clients.

- Overseeing and updating client portfolios.

- Regularly contacting clients to identify any changes in their financial status.

- Building a strong client base and successfully maintaining it.

Highlight Your Accomplishments

If you feel tempted to copy and paste your list of duties performed from your accomplishment section, let me stop you right there. Doing this will indicate to the employer that you are unoriginal and not stand out from the crowd. You need to be thinking about all the accomplishments that set you apart from other applicants, specifically the achievements that show the employer that you are the perfect person for the job.

If you ask yourself what you could include to prove you are the perfect person for the job, think about the following questions. What is a Financial Advisor? What do Financial Advisors do? A Financial Advisor is someone who advises, creates financial plans, and provides financial support services to clients. Equipped with this knowledge, show that you can do these tasks and have done them well in the past. Instead of saying, “I did XYZ,” rather say, “I raised X metric by Y%.”

Metrics can easily prove your work's impact, and this is an excellent way to take your resume from good to great. Include that number. For instance:

Examples of Accomplishment Statements

- Conducted trades, managed internal systems, and wrote financial plans for 200+ clients with over $250M under management.

- Maintained client returns 5% higher than the team average.

- Increased client approval scores from 87% to 98% by using time-saving tools to spend 7 hours more per week with clientele.

- Increased AUM by 27% in 20 months.

- Used UAFRS data from Valens Research to highlight undervalued investments. Increased individual investor performance by 40%.

- An average of 27 – 35 customers receives assistance monthly to refinance their mortgages, due to personal financial problems such as layoffs or unforeseen health problems.

Financial Advisor Education Section

Your education section is an integral section of your resume. You should focus mainly on the What, When, and Where when discussing your qualifications, industry licenses, and certifications. The qualifications name, the institution name, and the date you obtained the qualification is sufficient. If you are in the process of completing a qualification, that is relevant to this field, be sure to include it as well.

Completed Secondary and Tertiary Education needs to be listed as follows:

Begin with commencement and completion dates for diplomas, bachelor’s degrees, and associate degrees. Next, write the full name of the qualification, followed by the full institution's name, and lastly, the City or abbreviated State name. High school diploma details are written similarly but should only be included if you have less than five years of working experience. For courses, simply list the completion date.

Examples of a Financial Advisor education section:

2014-2017 – Master of Science in Investment Management University of Kansas, Kansas City, KA

Excelled in financial planning classes. Vice President, Student Valuation Club. Grew membership 70%

2012-2013 – Certified Financial Planner, CFP Board, Online. Subjects Completed: General finance principles, Professional conduct, Risk management, Investment planning, Tax planning

2009-2011 – Bachelor of Science in Finance, State University of New York, New York, NY.

Graduated with a GPA of 3.5 on a 4.0 scale. Courses Included: Economics, Communications, Investing Tactics, Financial Accounting, Business Management, Retirement Planning

2007-2008 – CPA – Certified Public Accountant, American Institute of CPAs (AICPA), Orlando, FL. 150 hours of coursework completed plus 50 hours practical internship

What to Write in a Financial Advisor Resume Skills Section

The customer relations field requires certain technical skills; however, employers also look for soft skills. These are your personal qualities and skills that indicate whether you are fit to work as a Financial Advisor who will add value by being timeous, having adequate knowledge, and can work well with customers. Incorporating these terms and phrases into your summary or profile can be helpful.

Hard Skills:

| Restructuring | Risk Analysis |

| Risk Management | Quantitative Analysis |

| Ranking | Client education |

| Generating financial reports | Sales |

| Equity analysis | Financial planning |

| Financial plan analysis | Investing |

| Research | Preparing and giving presentations |

| Risk assessment | Financial planning questionnaire |

| Investment principles | Life insurance |

| Taxation | Fund management |

| Unit Trusts | Money markets |

| Short term insurance | Pension funds |

| Annuities | Economics |

Soft Skills:

| People skills | Accountability | Confidence |

| Dependability | Honesty | Listening |

| Communication (verbal & written) | Detail oriented | Time planning |

| Organization | Negotiation | Detail Orientated |

| Integrity | Initiative | Empathy. |

| Self-Control | Networking | Persuasion |

| Persistence | Social Perceptiveness | Service Orientation |

| Strategic Thinking | Creative | Dedicated |

| Realistic | Conscientious | Time Management |

Qualifications/Certifications associated with Financial Advisors

| CPA – Certified Public Accountant | CFP – Certified Financial Planner | ChFC – Chartered Financial Consultant |

| CFA – Chartered Financial Analyst | CIC – Chartered Investment Counselor | FRM – Financial Risk Manager |

| CLU – Chartered Life Underwriter | CMFC – Chartered Mutual Fund Counselor | CMA – Certified Management Accountant |

Professional Information of Financial Advisors

Sectors: Banking, Investment Management, Financial Services, Long Term Insurance, Short Term Insurance, Fund Management, Financial Consulting

Career Type: Services, Professional Consulting, Advisory, Fund Analysis, Client Service, Client Relations, Strategic Forecasting

Person type: Negotiator, Planner, Consultant, Engager, Advisor, Fixer, Implementer, Problem Solver, Facilitator, Predictor, Problem Solver

Education levels: Post School Diploma to Masters’ Degree

Salary indication: Annual salary $70 593 (Indeed)

Labor market: Estimated 4% growth between 2019 – 2029 (BLS)

Organizations: Unlimited