The insurance industry is vast, and there are many roles Insurance Agents can play in the insurance environment. In short, Insurance Agents help their clients choose insurance policies that are best suited for their needs.

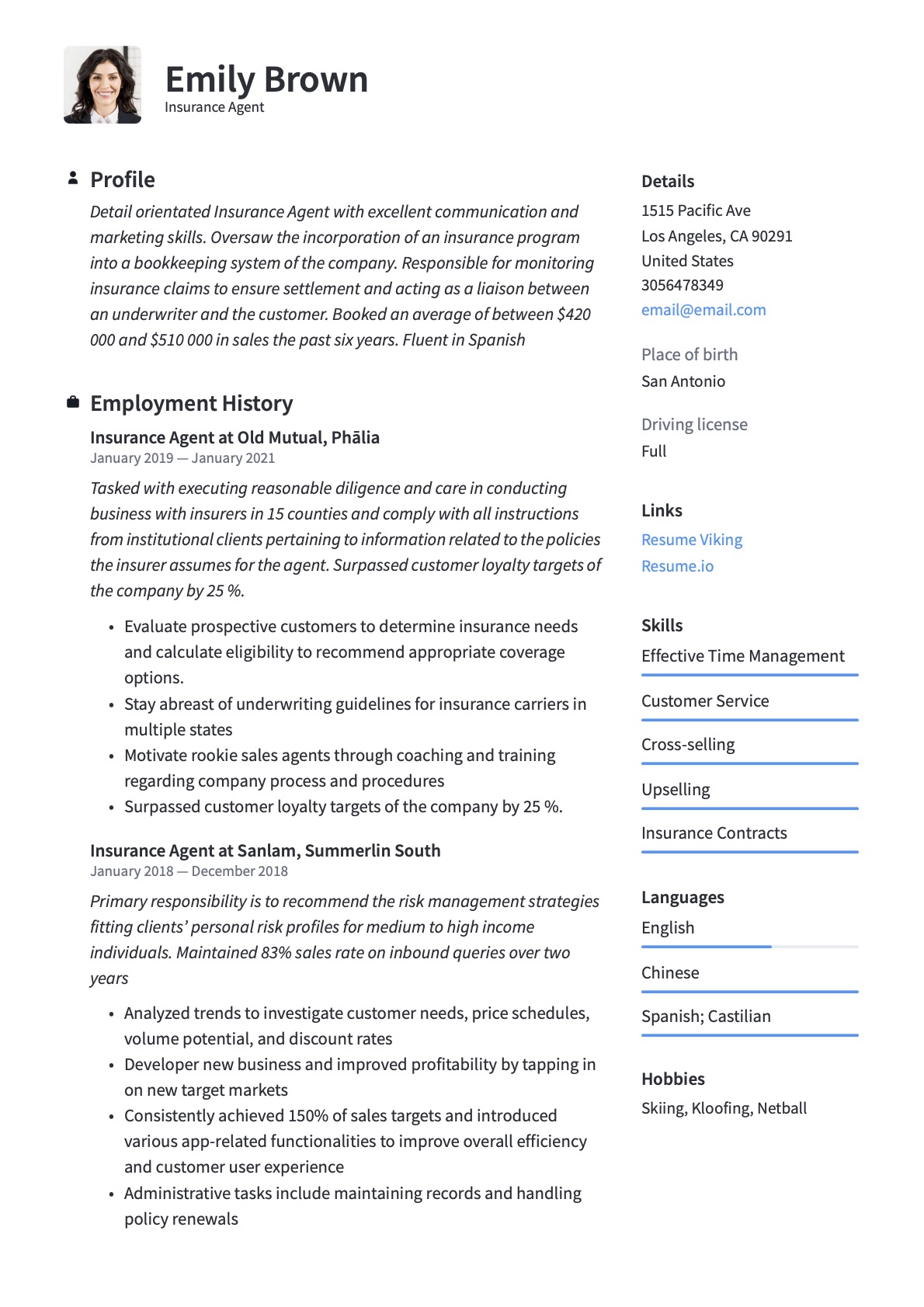

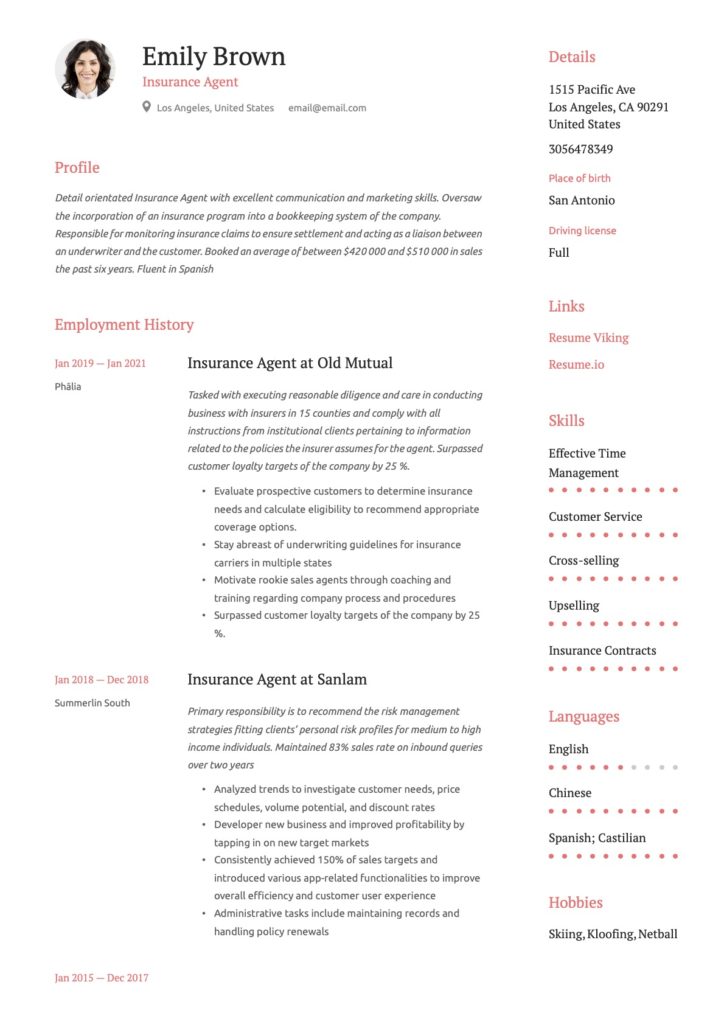

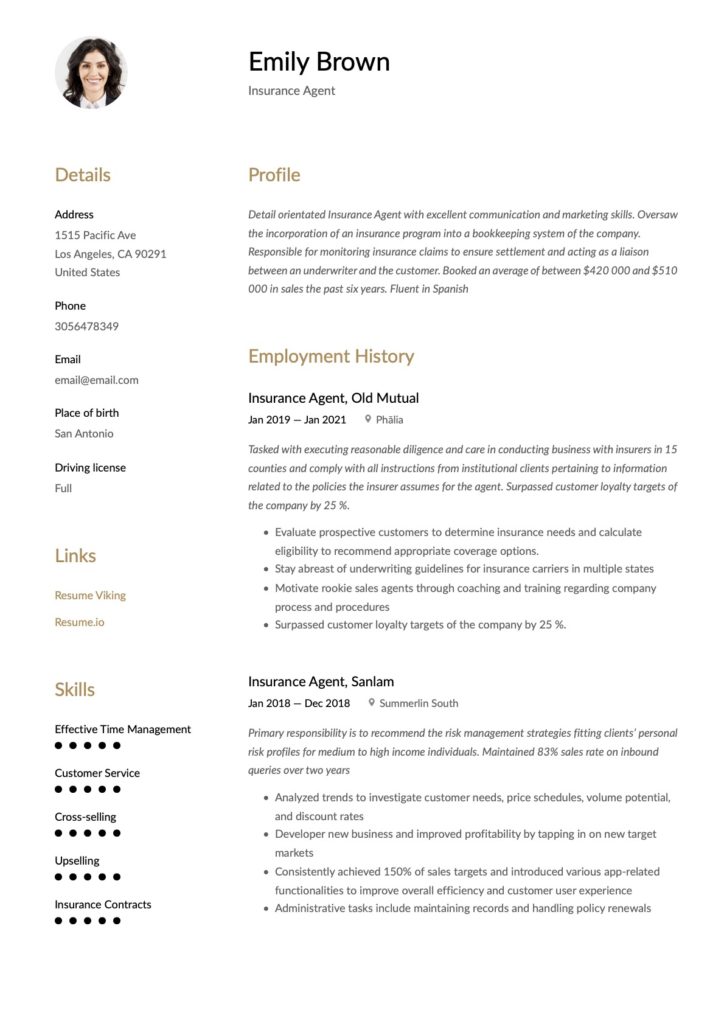

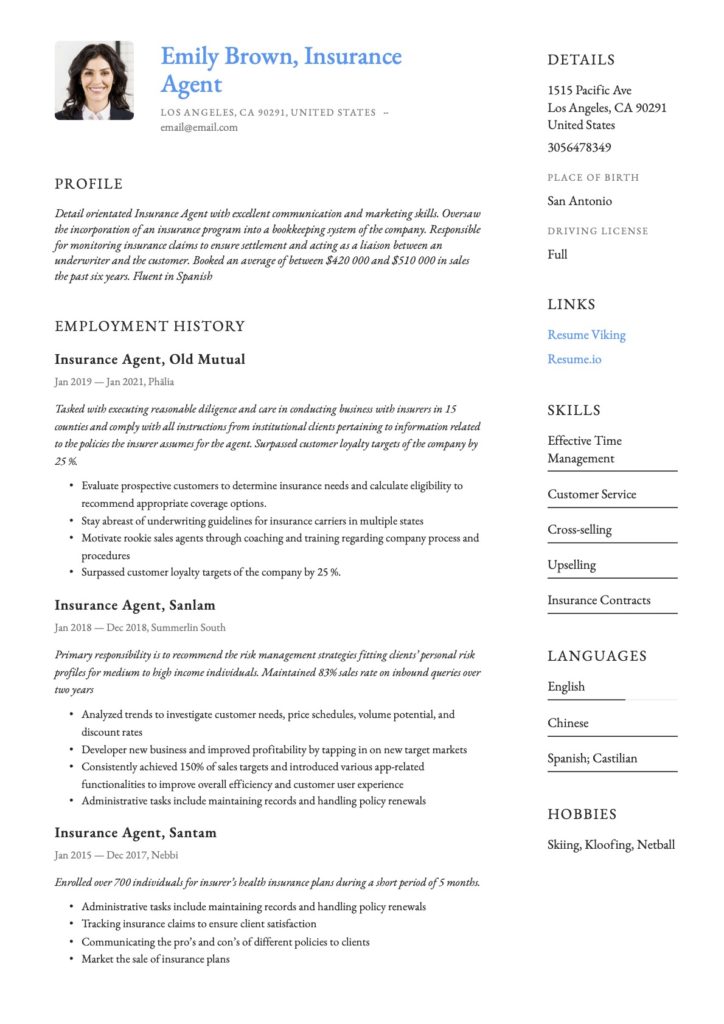

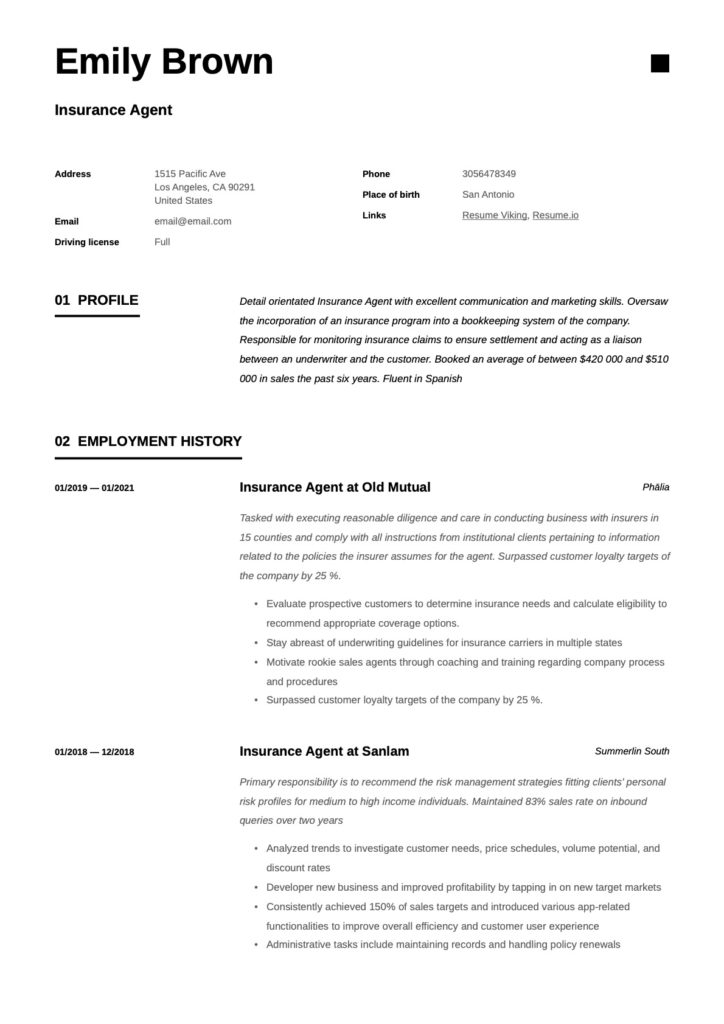

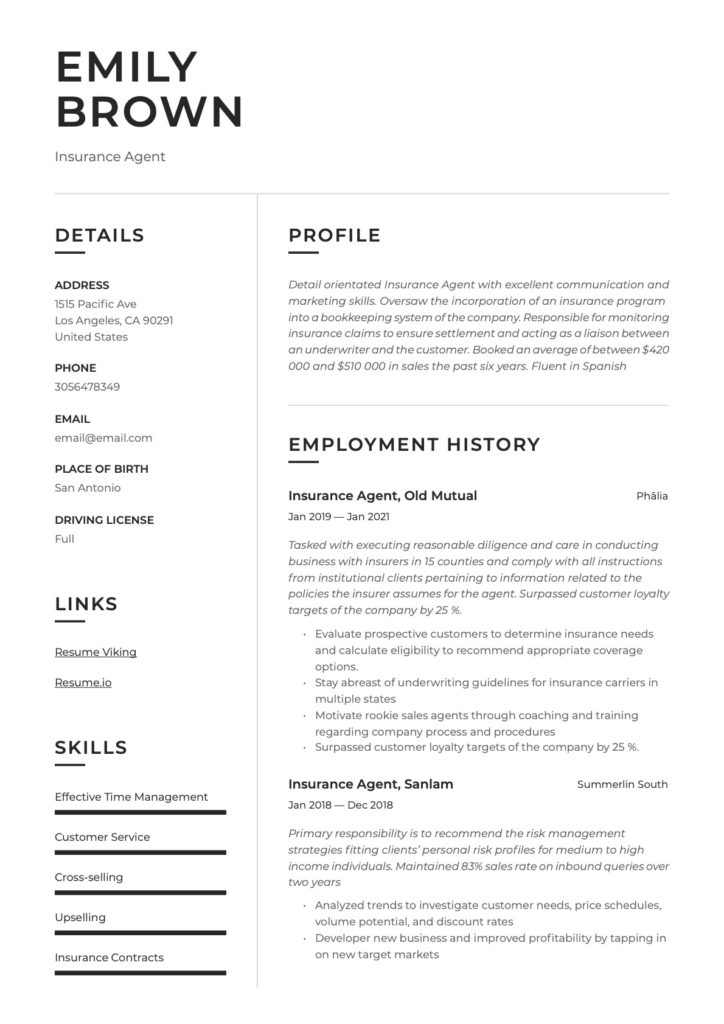

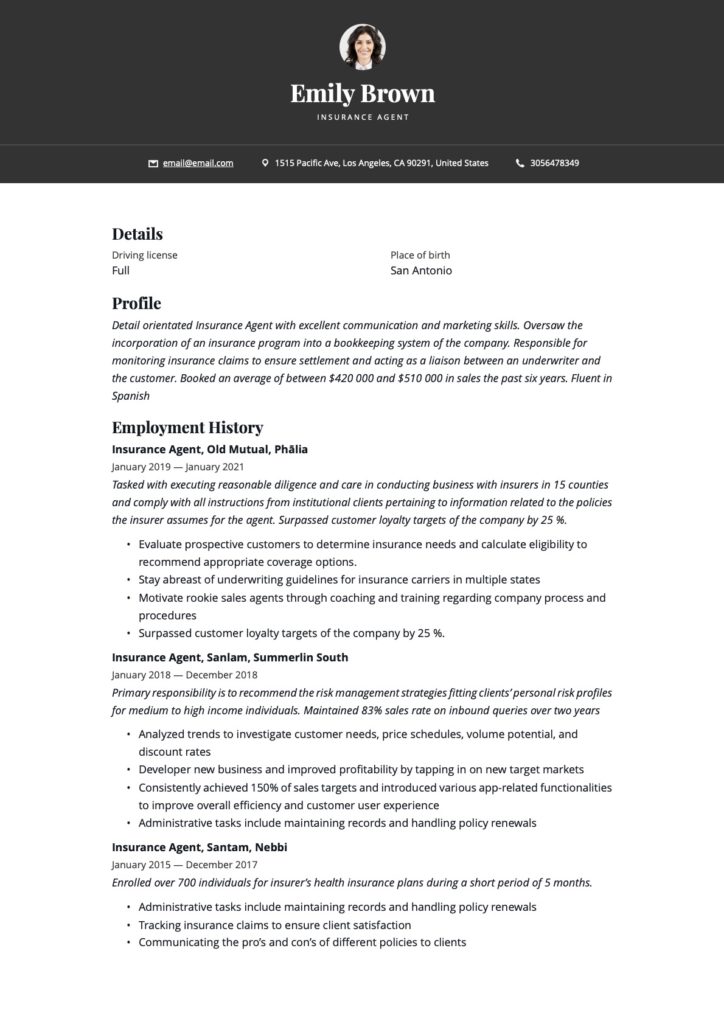

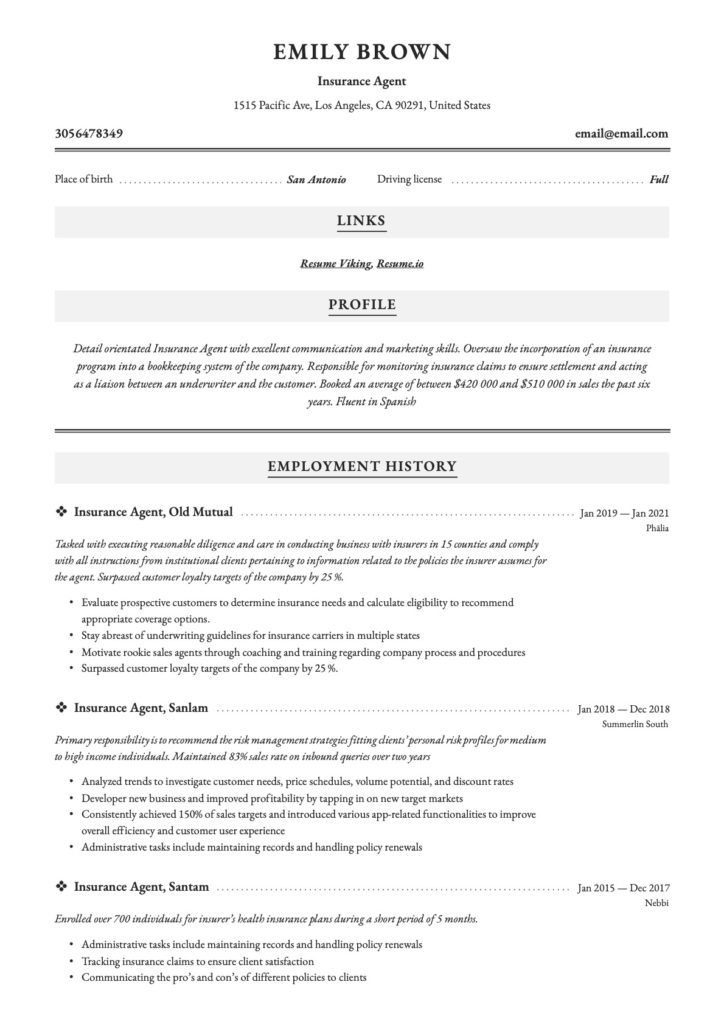

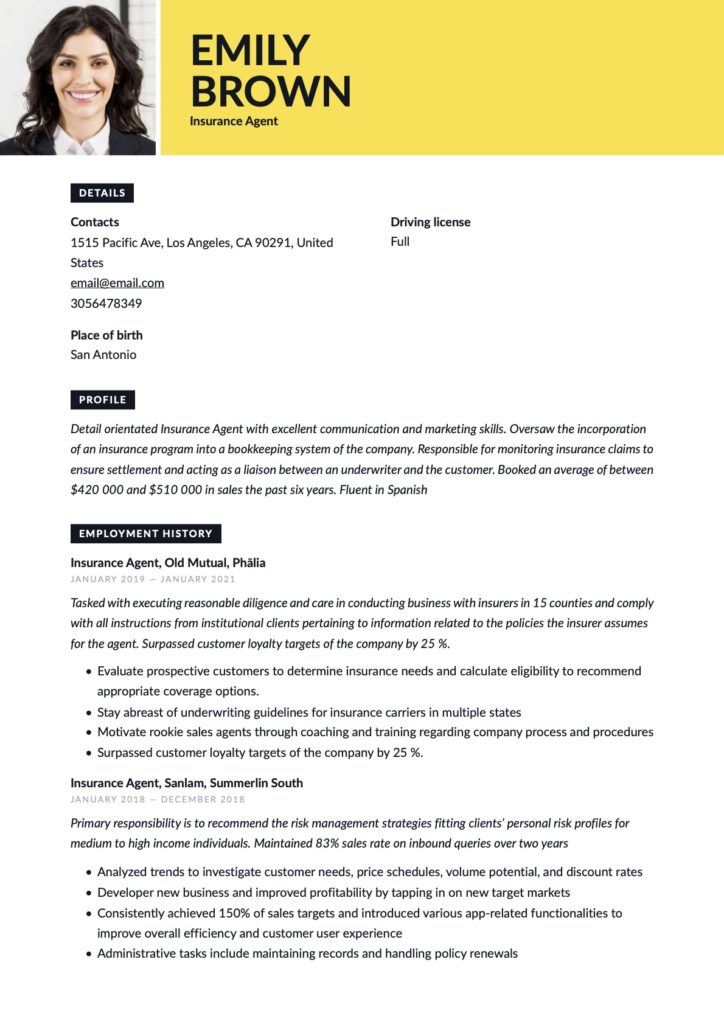

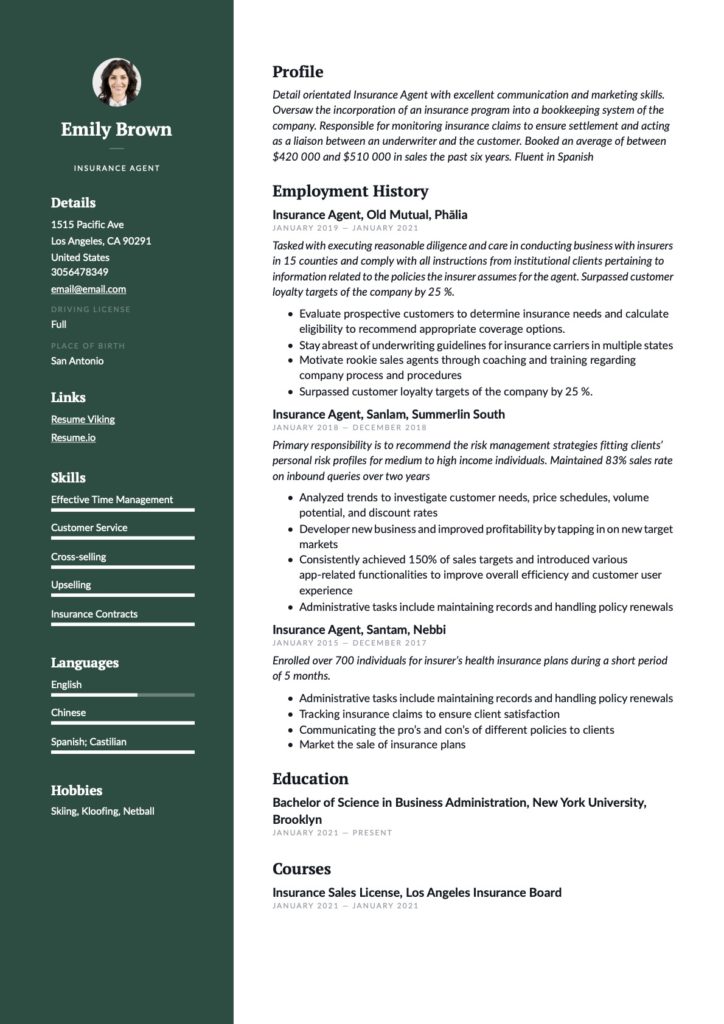

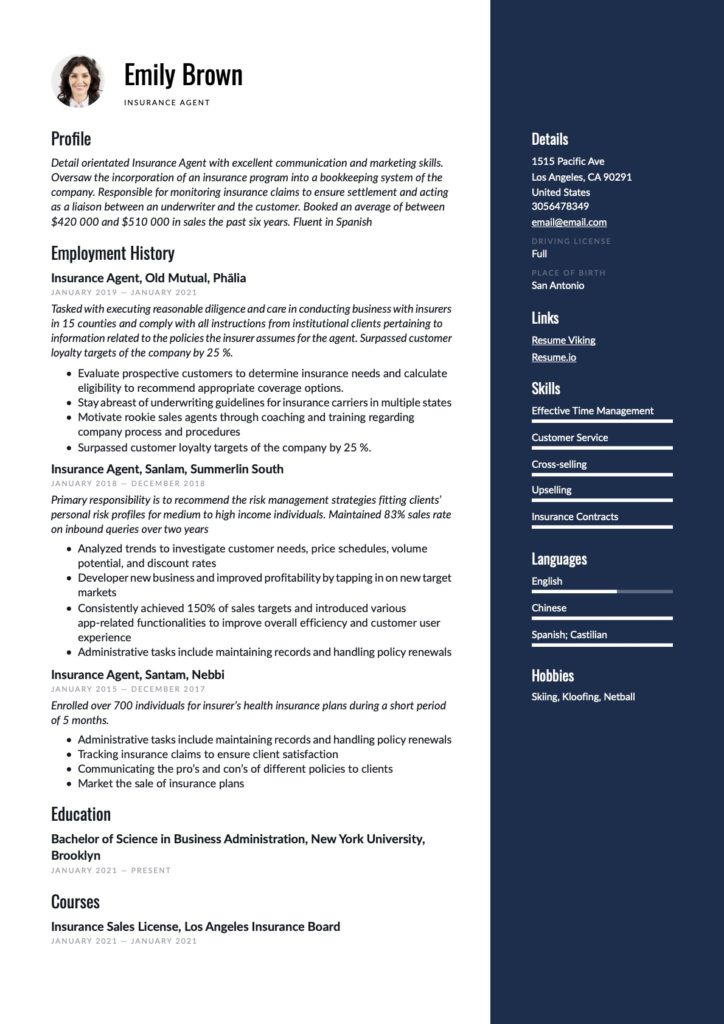

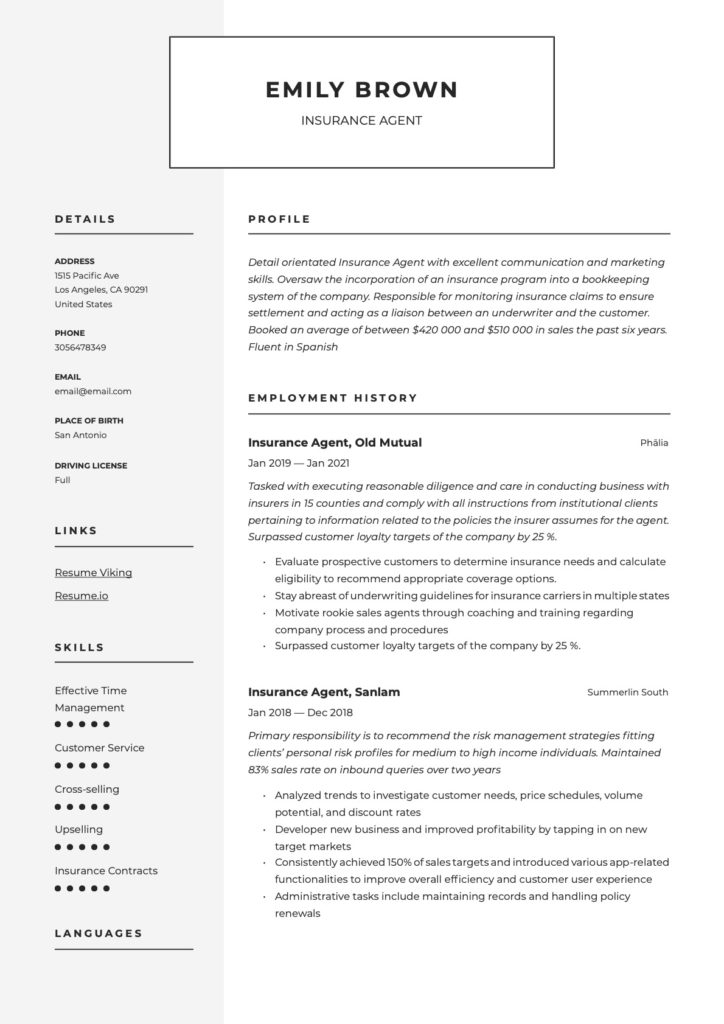

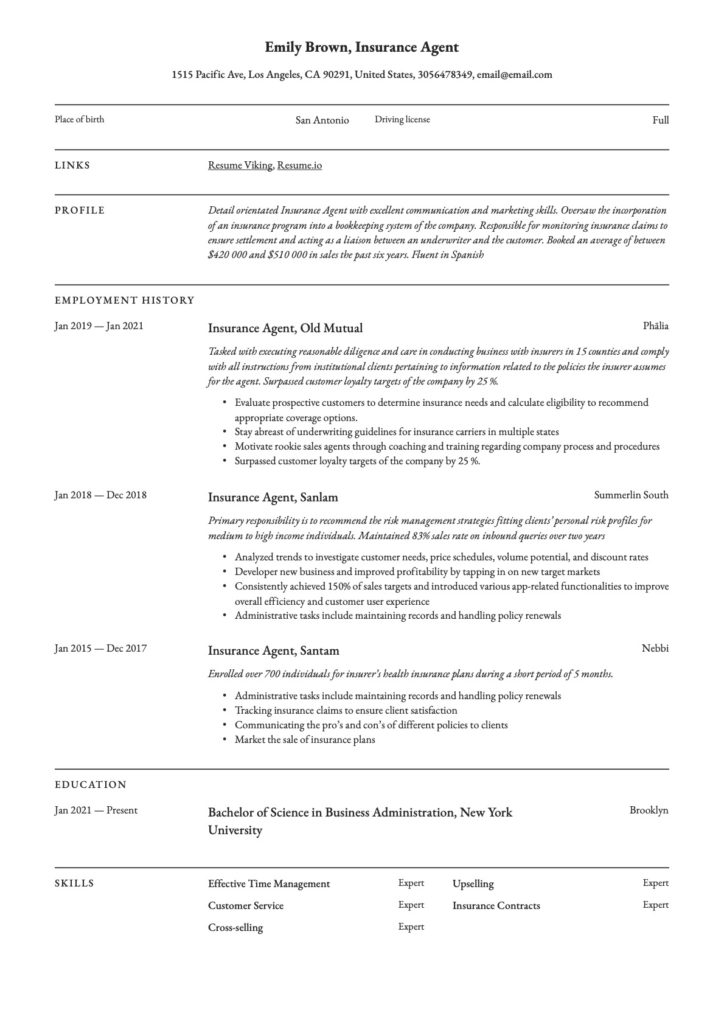

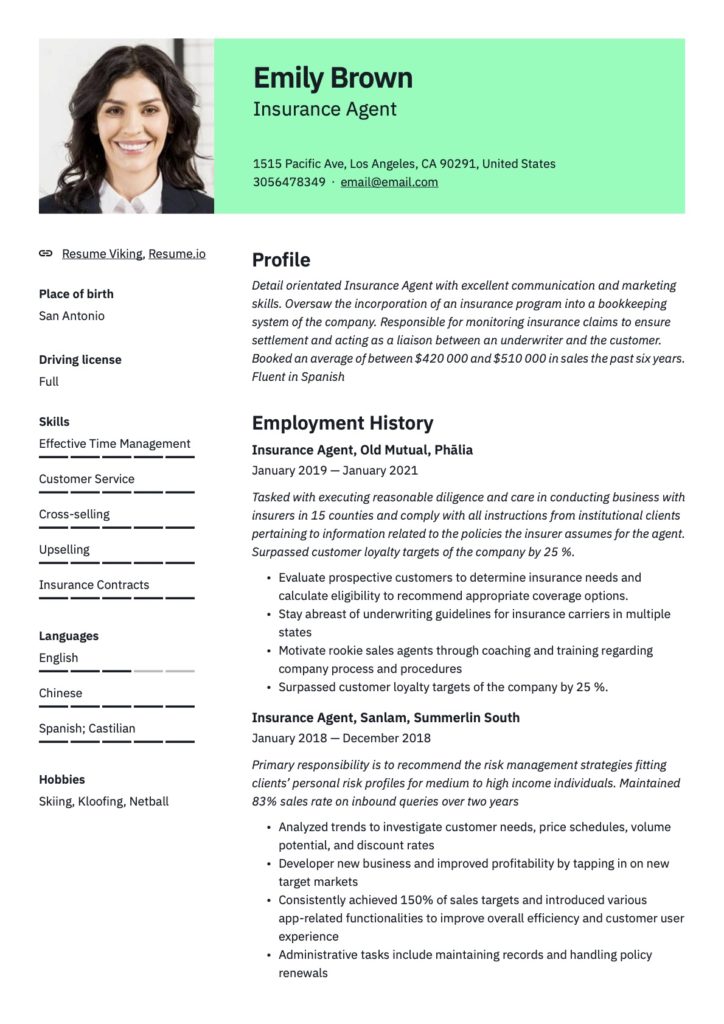

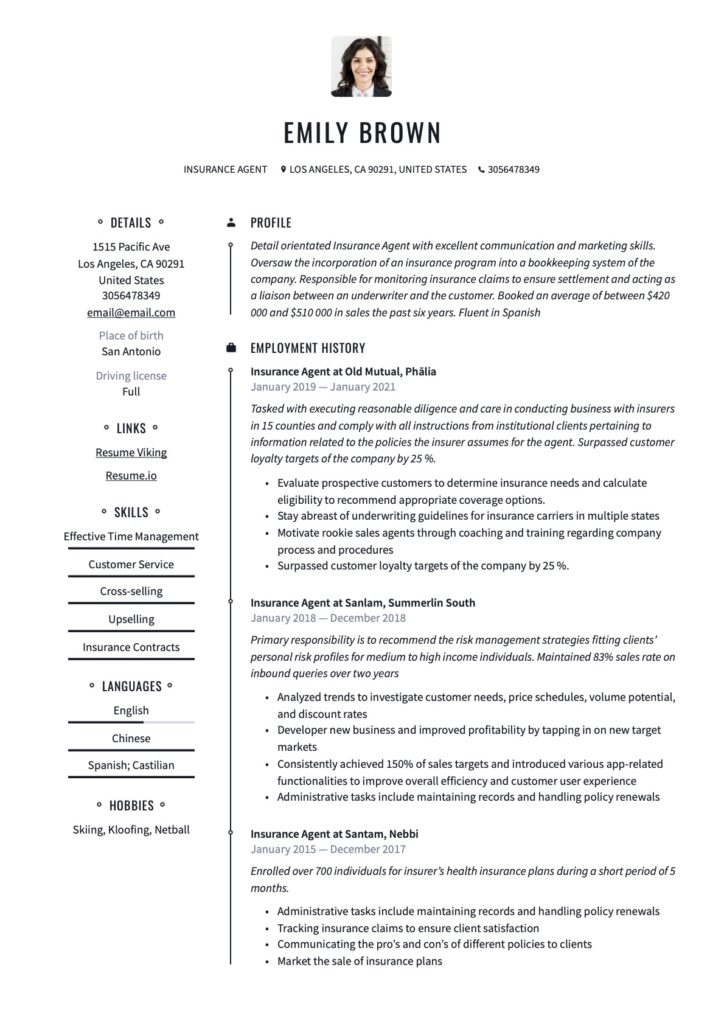

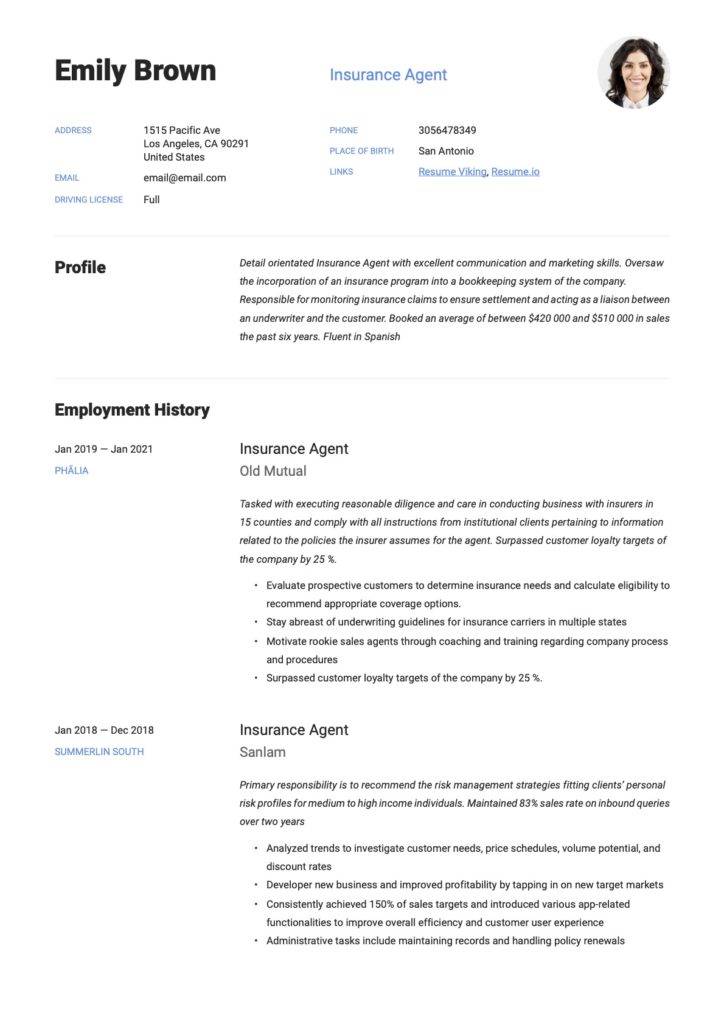

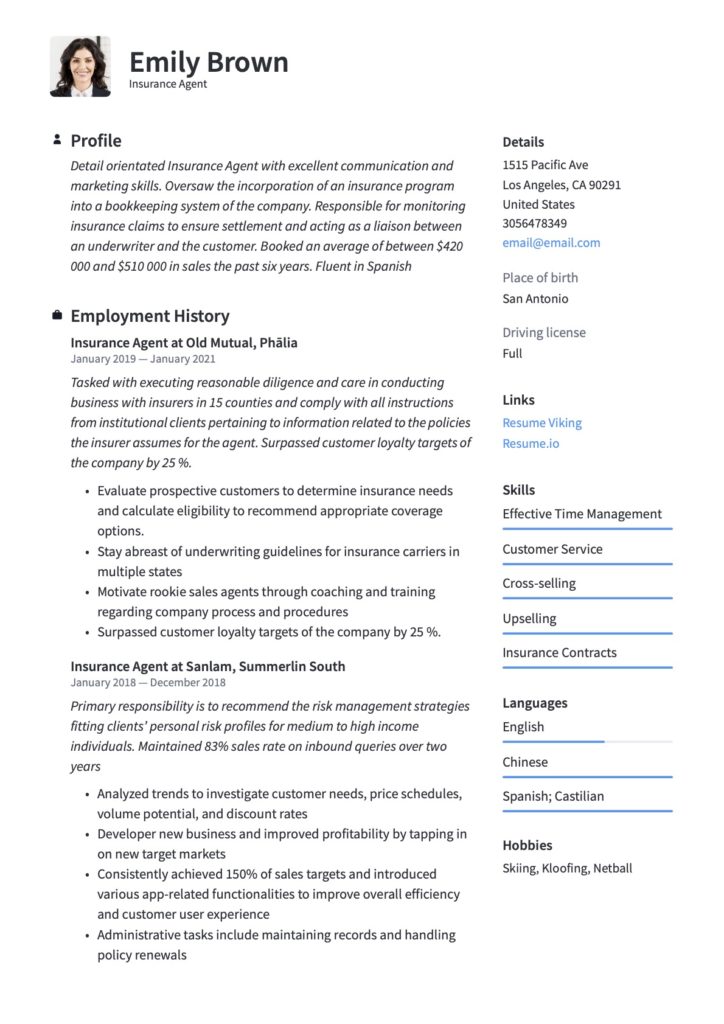

If you are considering a career as one or working in the field but looking for new opportunities, look at this stellar Insurance Agent resume sample we compiled.

We created this example with its primary purpose to guide and inspire once you start compiling your resume. It also gives an overview of a professional resume’s look and feels and advises on the best layout, different sections, and parts that recruiting agents find particularly important.

So let us help you write the best resume fitting your profile, personality, skills, and traits.

What you can read in this article

Insurance Agent Resume Examples

(Free sample downloads are at the bottom of this page)

Insurance Agent Resume Writing Guide

Resume Sections

1. Contact Information:

Name, Address, Phone Email. You need to be contactable via social media, like Messenger, Whatsapp, Facebook, and Twitter details.

2. Career Summary:

View this part of your resume as an introduction and overview of your career history.

Write 1-3 sentences explaining your background, work experience, and insurance areas you have had exposure to. If this is your first resume for a position in the insurance industry, list jobs and expertise relevant to the profession.

3. Qualifications Summary:

The minimum requirement to become an Insurance Agent is a high school diploma or GED and an insurance license from the state you reside in.

Keep in mind that licensing requirements vary depending on the state, and you will therefore write your state’s licensing exam.

A college education is also most valuable in the industry and can increase your chances of landing your dream job and positions that might require postsecondary education.

Bachelor’s Degrees in Business Administration and Finance can be of great value for future career prospects. List your academic credentials in reverse chronological order with the most recent qualification first. It is also imperative that you include the most recent licensing attained.

4. Relevant Insurance Agent Experience:

To give your resume a considerable advantage to stand out, use specific duties, terminologies, and keywords that reflect those in the job description you are applying for.

A long and tiresome list of job duties won’t cut it. Keep to a maximum of five duties per employer and only cover the last decade of your career. Use bullet points for each task listed.

Using numbers and numerical proof to highlight your competencies is an excellent trick to give more color to your resume. For instance and cold calling records, numbers about your sales are clear indications of your productivity and success rate.

5. Other Employment Experience:

Suppose you do not have experience in the insurance industry. Other employment credentials may still come in handy if you can tailor those job descriptions to include duties that may be transferred easily onto an Insurance Agent role.

Different employment experiences outside the insurance sector can be of great value; for instance, if your past duties included communication, sales experience, networking, client interaction, and negotiating.

6. Skills Summary/Key Skills:

Weave keywords from the job advertisement into all areas of your resume, for example, in the career summaries, job descriptions, accomplishment statements, and skills sections. This adds much-needed credibility to your resume.

7. Education/Licenses/Certifications/Relevant/Coursework/Training:

You cannot sell insurance without getting your state licensing required for Insurance Agents.

The National Insurance Producer Registry has a list of state-specific licensing requirements, familiarize yourself with the information and make sure you list the relevant licensing and training documents.

What to Highlight in an Insurance Agent Resume

Insurance Agents sell, implement strategies, promote policies, network, facilitate, and generate new business. Part of the job also entails many administrative tasks like helping clients submit claims and adhering to legal requirements.

Regardless of your experience in the insurance industry, there are a few vital topics that employers and recruiters would expect to read in your resume.

The first up is to provide context because there are many different types of insurance that agents sell. Insurance Agents can sell insurance for property, car, casualty, disability, personal and other types. These are called “lines of authority,” explaining what kind of insurance you are selling, or planning to sell, is vital in your application.

Next up is detailing some of the targets and goals you have to achieve in your current position. Be specific and make sure to explain these in numeric terms. For instance, list the number of phone calls to clients you have to make in a month.

Your daily operations come next and should entail how you manage your tasks. Explain in short how you go about tracking claims and manage policy renewals. You also manage existing policyholders and regularly check to assist them in changes to their policies, for instance, beneficiaries.

You can then explain how you deal with your clients’ analysis and how you go about determining your clients’ most appropriate insurance coverage by doing a needs analysis, for instance. Hiring managers will therefore be critical in your efficiency to help your clients find the best solutions for them, and hence relationship building with them is part of the packaged deal.

Part of your job is also seeking new clients and networking to find new customers, for instance, by calling and explaining policies to potential policyholders. Hiring managers would love to read about your strategic planning abilities in landing new clients. This will include using referral networks with other professionals in related industries like lawyers, mortgage brokers, and financial planners.

Last but also essential to your profession is continued education and training. You need to highlight that you realize how important it is to stay at the top of your game and in your field by constant training and keeping in touch with new products, changes, rules, markets, and regulation. If you attend regular training programs and sessions given by insurance companies, make sure you highlight your desire to stay informed by mentioning how often you attend these.

Insurance Agent Resume Profile Summary

Cut to the chase in this section with a synopsis of your career of between 3 to 6 concise sentences. Get personal by describing yourself to hiring managers and potential employers and a glimpse of what you do. Focus on what the job advertisement requires from potential candidates to ensure you fit the profile.

You may use either a Career Objective or a Resume Profile Summary to place at the top of your resume. Highlight this paragraph in a different font for maximum impact. A summary is most suited when you have several years of experience under the belt. A career objective is often used by graduates, trainees, or candidates with less than five years of experience.

Many Insurance Agents work independently for insurance agencies or brokerages, and they sell multiple products available in the insurance market. There are also opportunities to work as captive agents employed by insurance companies to sell only their products. Therefore, you need to clearly state your line of authority in the sector and mention which route you are following or plan to follow.

Be mindful that this part can highlight your potential value. With a factual resume summary that dovetails with expectations set out in the job advertisement, you have a decent chance of being noticed by hiring managers.

In a summary or resume profile, you highlight credibility. In an objective, you concentrate on career aspirations and your intent to add value.

Use adjectives to describe one or two outstanding traits, and mention the value you add to your current employer.

Place the most relevant information, in the beginning, to attract the hiring managers’ attention when they scan through your resume.

Also, mention our credentials, education, and certifications, and if you can throw in a few numbers, by all means, do!

Three Examples of Insurance Agent’s career summaries:

Profile Summary 1

"Well-balanced individual, hard-working, and diligent Insurance Agent in the employment of one of the country’s largest insurance companies for five years. Passion for the insurance industry and helping people. Currently coaching four other agents in the company in sales best practice. Excellent written communication skills and proficiency in statistical analysis software. Achieved an average of 250 cold calls a week with at least six appointments per week."

Profile Summary 2

"Self-driven Insurance Agent with fifteen years of experience in Life Insurance. Instrumental in implementing training strategies to increase the effectiveness of junior colleagues and part of the mentorship program of the current employer. Active listener and excellent product knowledge. Maintaining a client base of 132 Casualty Company Clients. Holds a Bachelor of Science in Business Administration. GPA score of 3.5"

Profile Summary 3

Detail orientated Insurance Agent with excellent communication and marketing skills. Oversaw the incorporation of an insurance program into a bookkeeping system of the company. Responsible for monitoring insurance claims to ensure settlement and acting as a liaison between an underwriter and the customer. Booked an average of between $420 000 and $510 000 in sales the past six years. Fluent in Spanish"

Profile Summary 4

"Recent Marketing Graduate with a Bachelors Degree in Marketing Management completed Cum Laude. Looking to commence a career as an Insurance Agent at (Insert Company Name). Intent on adding value to the sales team by leveraging on extrovert personality and exceptional people skills."

Employment History

All Insurance Agents communicate and work with people of all walks of life, including colleagues, the public, potential clients, and even family and friends. Your resume needs to tell a story of an individual who understands that working with people is essential, someone who has impressive communication skills, and a caring person who values relationships.

A potential employer would also expect to read about your proven foundational duties and skillsets. In the job description below, we have provided a list of complete tasks to accommodate most of the responsibilities and responsibilities of Insurance Agents.

Be sure to add employment history for the last ten years in reverse chronological format, indicating dates of employment, job title, and company names. Below we have provided an example for you.

Examples

Senior Insurance Agent at Old Mutual

(Feb 2015 – Dec 2022)

- Evaluate prospective customers to determine insurance needs and calculate eligibility to recommend appropriate coverage options.

- Stay abreast of underwriting guidelines for insurance carriers in multiple states

- Motivate rookie sales agents through coaching and training regarding company process and procedures

Insurance Agent at Allan Gray

(Feb 2014 – Jan 2017)

- Analyzed trends to investigate customer needs, price schedules, volume potential, and discount rates

- Developer new business and improved profitability by tapping in on new target markets

- Consistently achieved 150% of sales targets and introduced various app-related functionalities to improve overall efficiency and customer user experience

Job Descriptions, Responsibilities, and Duties Examples

Examine the list and choose the ones that best describe you, and feel free to customize and add where you can.

Generic Responsibilities of an Insurance Agent:

- Administrative tasks include maintaining records and handling policy renewals

- Daily cold calling

- Tracking insurance claims to ensure client satisfaction

- Communicating the pro’s and con’s of different policies to clients

- Market the sale of insurance plans

- Create and implement marketing strategies competing with rivals and individuals

- Generate and follow up on leads

- Friendly and prompt customer support

- The input of quotes and renewals for customers

- Constant training to stay up to date with products and policies from multiple vendors when representing various vendors.

- Respond to clients’ questions and issues

- Networking

- Establishing rapport and collaborative relationships with prospective clients, clients, and referrals

- Recommend the risk management strategies fitting clients’ personal risk profiles

- Seek new clients as part

- Build relationships with business partners

- Service existing policyholders with their financial planning, educational plans, retirement, and other related issues

- Interview potential clients to record their needs

- Liaise between underwriter and customers

Legal Responsibilities of an Insurance Agent:

Below is a list of the legal responsibilities of an Insurance Agent. Because the industry is involved, there are opportunities to make mistakes; therefore, several duties and responsibilities exist to guide Insurance Agents and help them adhere to follow best practices and avoid common-law negligence.

- Protect the interest of the insured

- General duty to act reasonably as a prudent agent

- Be honest about insurance coverage, do not misrepresent

- Procure the requested insurance

- If procurement of the requested insurance is not possible, the agent has to notify the insured promptly

- Duty to use reasonable care to obtain adequate insurance to meet the needs of the insured

- Inform when a renewal policy contains coverage changes

- Inform insured of premiums up for renewal as well as expiry dates.

- Investigate an insurer’s financial solvency to ensure coverage is placed with a solvent insurer

- Explain all policy terms and conditions

Compliance Responsibilities to the Insurance company:

Insurance Agents can be held liable to an insurance company for negligence or breach of contract. Therefore, several responsibilities are directed at ensuring a fair and honest relationship with the Insurance Company.

It may include:

- Reasonable diligence and care in conducting business with insurers

- Comply with all instructions

- Disclose pertinent information related to the policies the insurer assumes for the agent

- Complying with binding authorities granted by the insurer

- Comply with all other terms of the agreement between the agent and the company

But if you do not have formal insurance experience.

Then focus on relatable experience for example:

A marketing background can help you with sales and pitches to clients. If you had a stunt in public relations, your communication and negotiation skills would definitely come in handy.

So think outside the box and see where duties you performed in other industries and jobs might benefit those required for the position you have your eye set on landing.

Highlight Your Accomplishments

Stay clear from copying your list of duties as detailed in your job description. You have to write about what sets you apart from all the other applicants and what you are most proud of.

Focus on what you have accomplished in your previous roles and write action-packed statements to get hiring managers’ attention.

You are on the right track if you can answer the “How?”, “How many?”, “and “How many” questions about your accomplishments.

Present achievements and accolades in measurable terms that quantify your value to prospective companies.

First, examples of flat, dull statements that won’t spark the interest of the reader:

- Surpassed customer loyalty targets of the company

- Maintained an impressive sales rate on inbound queries

- Exceeded performance standards

- Converted leads into sales by matching the needs of the clients to products.

- Enrolled over a vast number of individuals for insurer’s health insurance plans during a short period

Consider a few examples where quantification was added:

- Surpassed customer loyalty targets of the company by 25 %.

- Maintained 83% sales rate on inbound queries over two years

- Exceeded second-quarter performance standards by 72% in sales

- Converted 78% to 89% of all leads by matching the needs of the clients to products.

- Enrolled over 700 individuals for insurer’s health insurance plans during a short period of 5 months.

Insurance Agent Education Section Example

The education section is an integral part of your resume, and you should focus on a list that showcases relevant-to-the-industry qualifications, certifications, and licensing.

Because state insurance boards require all agents to complete continuing education and training courses, make sure you highlight yours in this section.

Display your credentials by date completed, name of institution, qualification, and course curriculums. Also, include relevant licenses and industry memberships.

2020 – Current Bachelor of Science in Business Administration, New York University, NY

2017 – Insurance Sales License, Los Angeles

2012 – 2016 High School Diploma, Regis High School, New York, NY

- 3 GPA

Insurance Agent Resume Skills Section

Employers will be on the lookout for specific soft skills to indicate whether you are fit for the role they need to fill.

There are also technical skills needed, but soft skills are first and foremost sought after in this industry.

Soft Skills

| Communication | Management skillsTime-management | Multi-Tasking |

| Analytical | Reliable | Verbal communication |

| Initiative | Leadership | Enthusiasm |

| Integrity | Self-Control | Realistic |

| Attention to Detail | Empathy | Negotiation |

| Decision-Making | Excellent listening skills | Persuasion |

| Patience | Positive attitude | Problem solver |

Hard Skills

- Writing and Editing

- Gathering of data

- Compilation of data

- Prepare reports

- Upselling

- Cross-selling

- Sales

- Insurance quoting software

- Proficient in statistical analysis software

- Public Speaking

- Mentoring

Qualifications/Certifications associated with Insurance Agents

| Insurance Sales license | Highs School Diploma | Bachelor’s Degree |

| State license | Marketing Workshop | Sales Diploma |

| Business Law | Financial Accounting | Risk Management |

| Insurance Foundational Skills | Communication Training | Certified Insurance Agent |

Optional Extras for Insurance Agent Resumes

Your resume should also reflect your personality and give insight into the person you are outside of the working environment. Recruiters often use this section to determine whether you would fit into the company culture.

Show that with “other” sections that share your depth and passion.

- Volunteering Work

- Sports and Recreational Activities

- Extra-Mural Activities during University life

- Added education and training not related to insurance

- Awards and Accolades

- Leadership Roles

Professional information of Insurance Agents Sectors:

Long Term Insurance , Short Term Insurance, Medical Insurance, Property, Asset Management, Banking, Financial Services

Career Type: Sales, Marketing, Business Development, Account Management

Person type: Sales, Advisor, Supporter, Facilitator, Administrator, New Business Developer, Customer Service

Education levels: Bachelor’s Degree or Post School Certifications

Salary indication: Average Base Pay $ 58 025 (Indeed)

Labor market: Estimated 5% growth between 2019 and 2029 (BLS)

Organizations: Various