Are you on the lookout for a new role as a Staff Accountant? If you are, you have come to the right place! Your passion may be numbers and statistics. Our passion is to ensure that you have the means to create the perfect interview landing resume. Before writing your resume, we recommend that you look through a top-notch Staff Accountant resume sample.

We will show you how to ensure that your resume stands out from the rest, is informative and entertaining to read, and does not overwhelm the reader. There is just one thing left to do, dive in and let us show you how to create an interview landing resume with our: How to Make a Resume Guideline for Staff Accountant Roles?

What you can read in this article

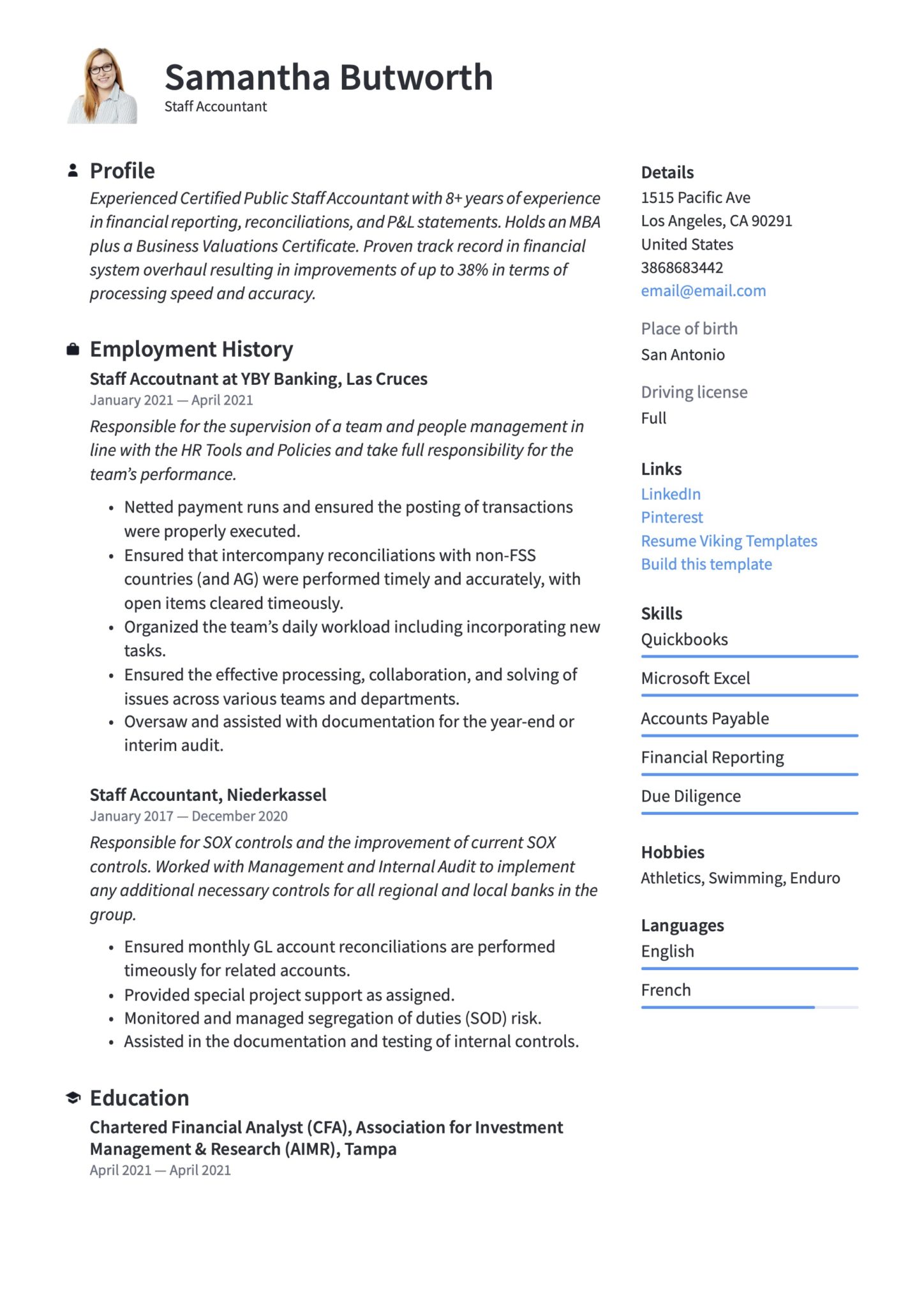

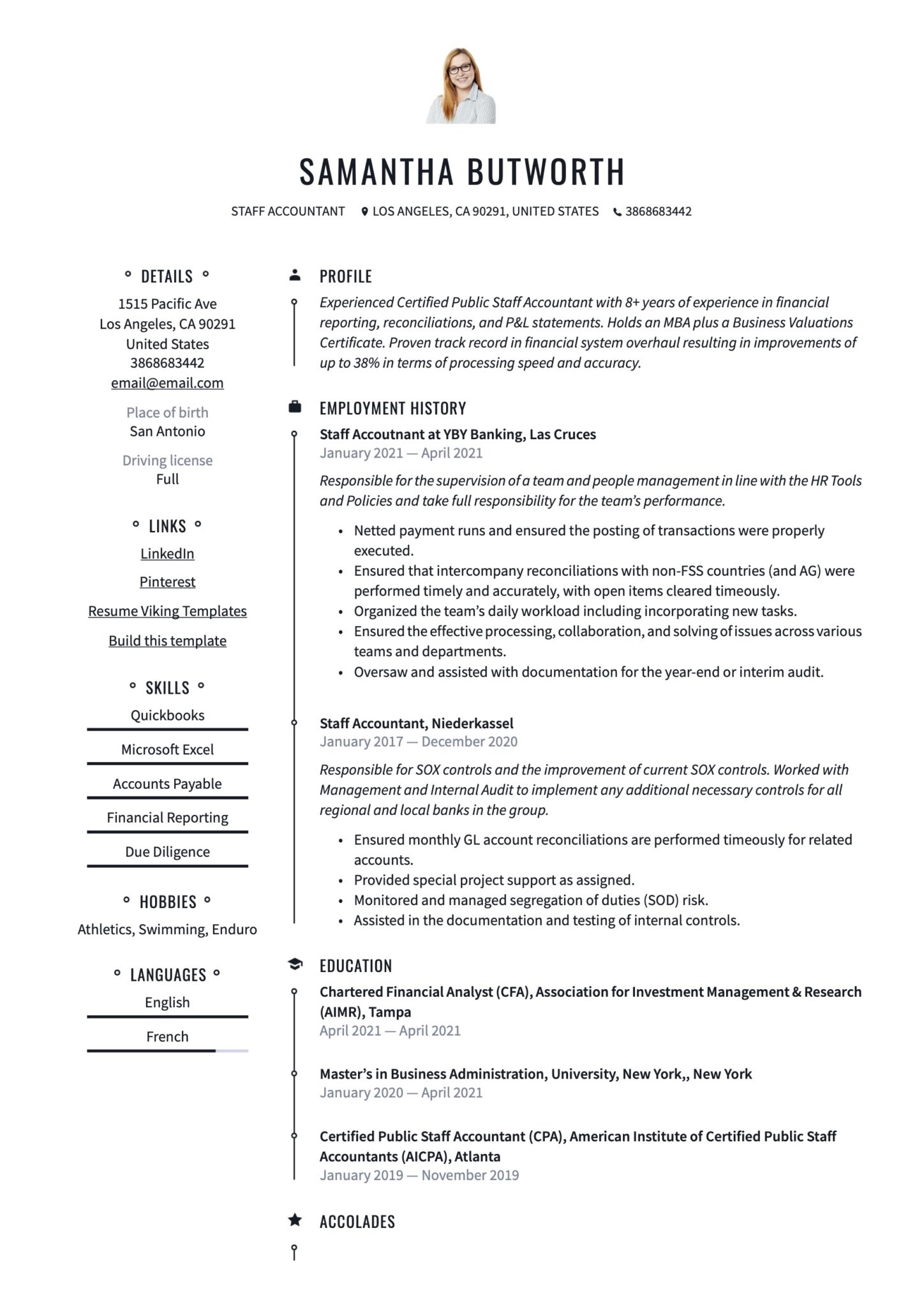

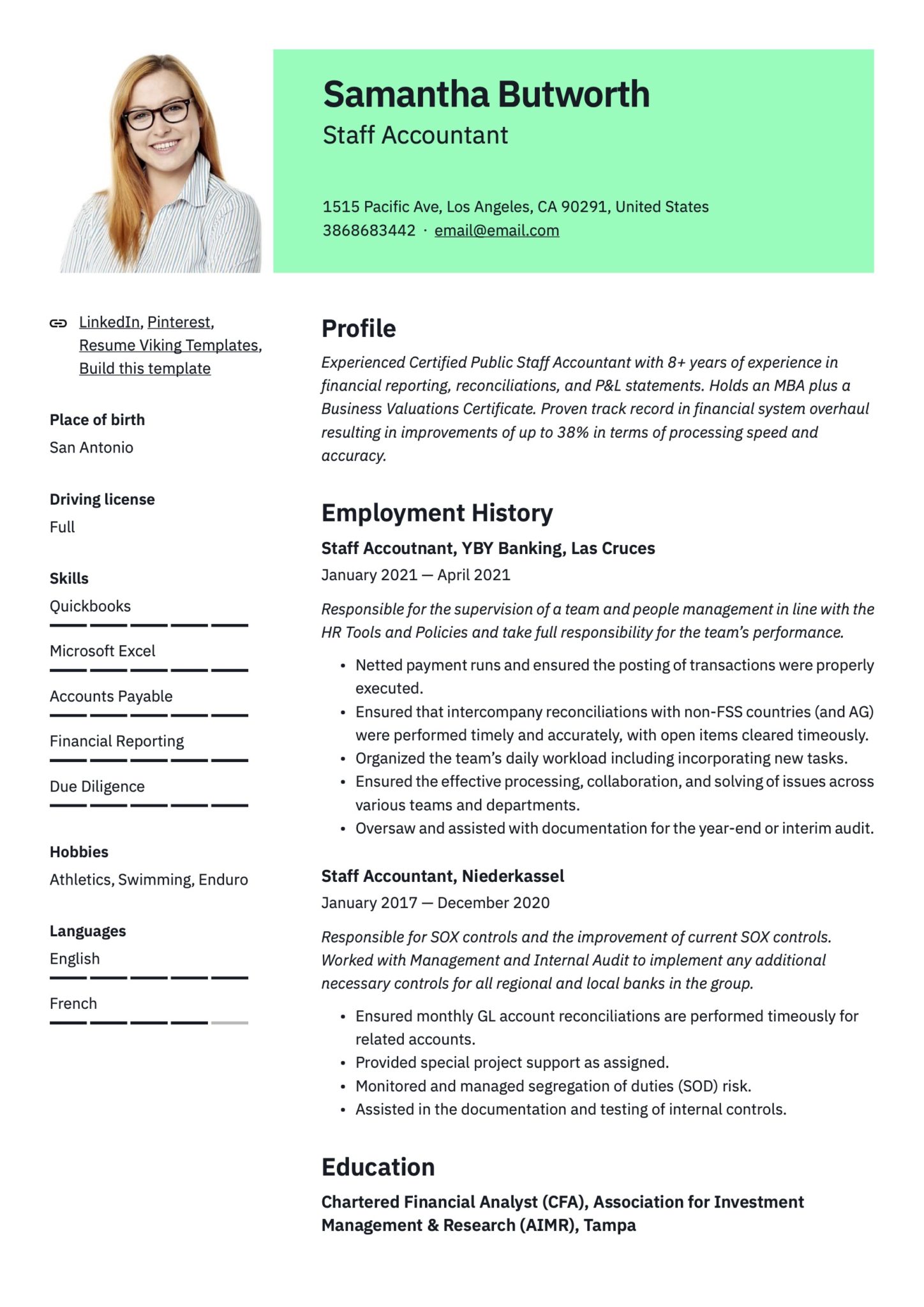

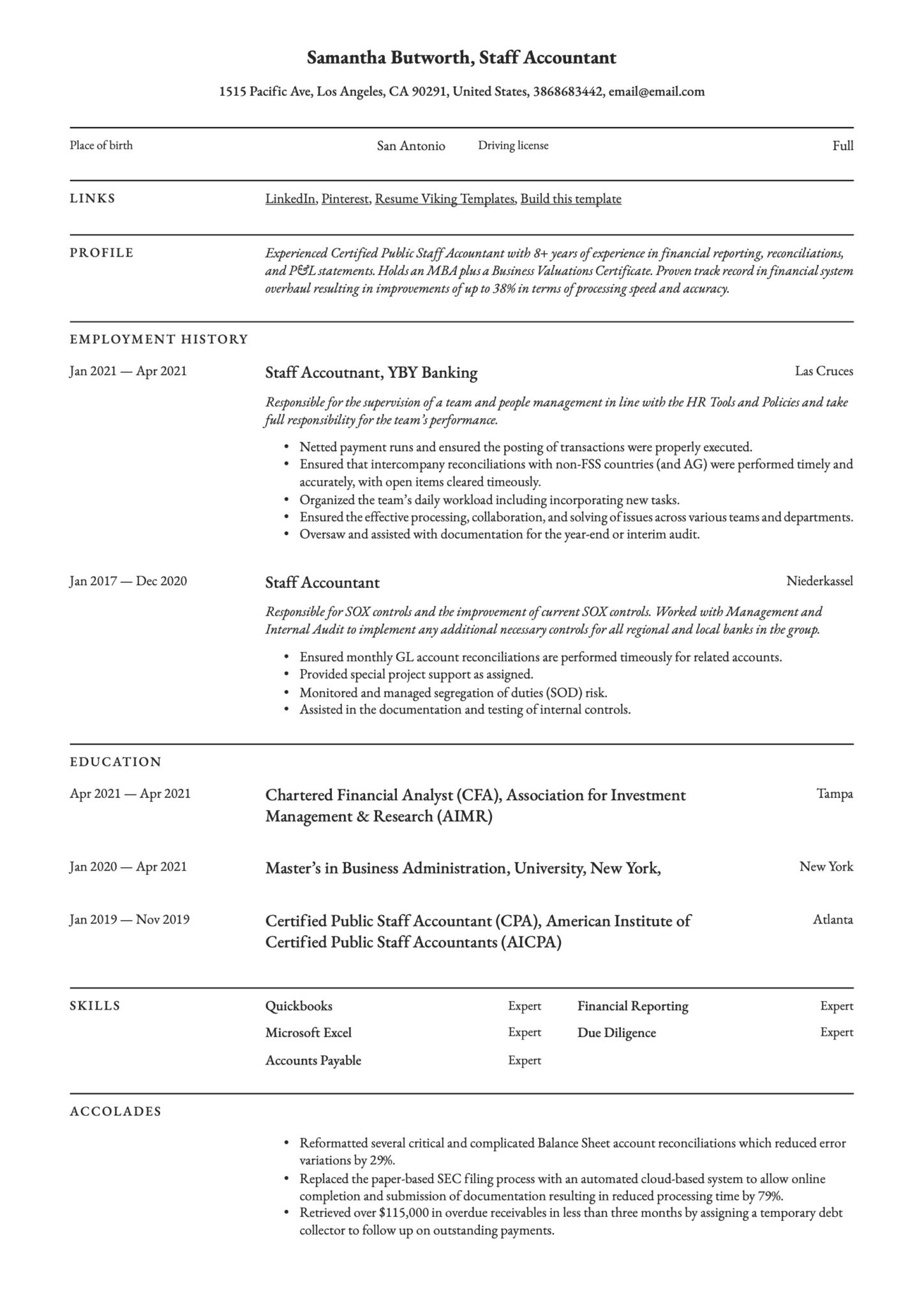

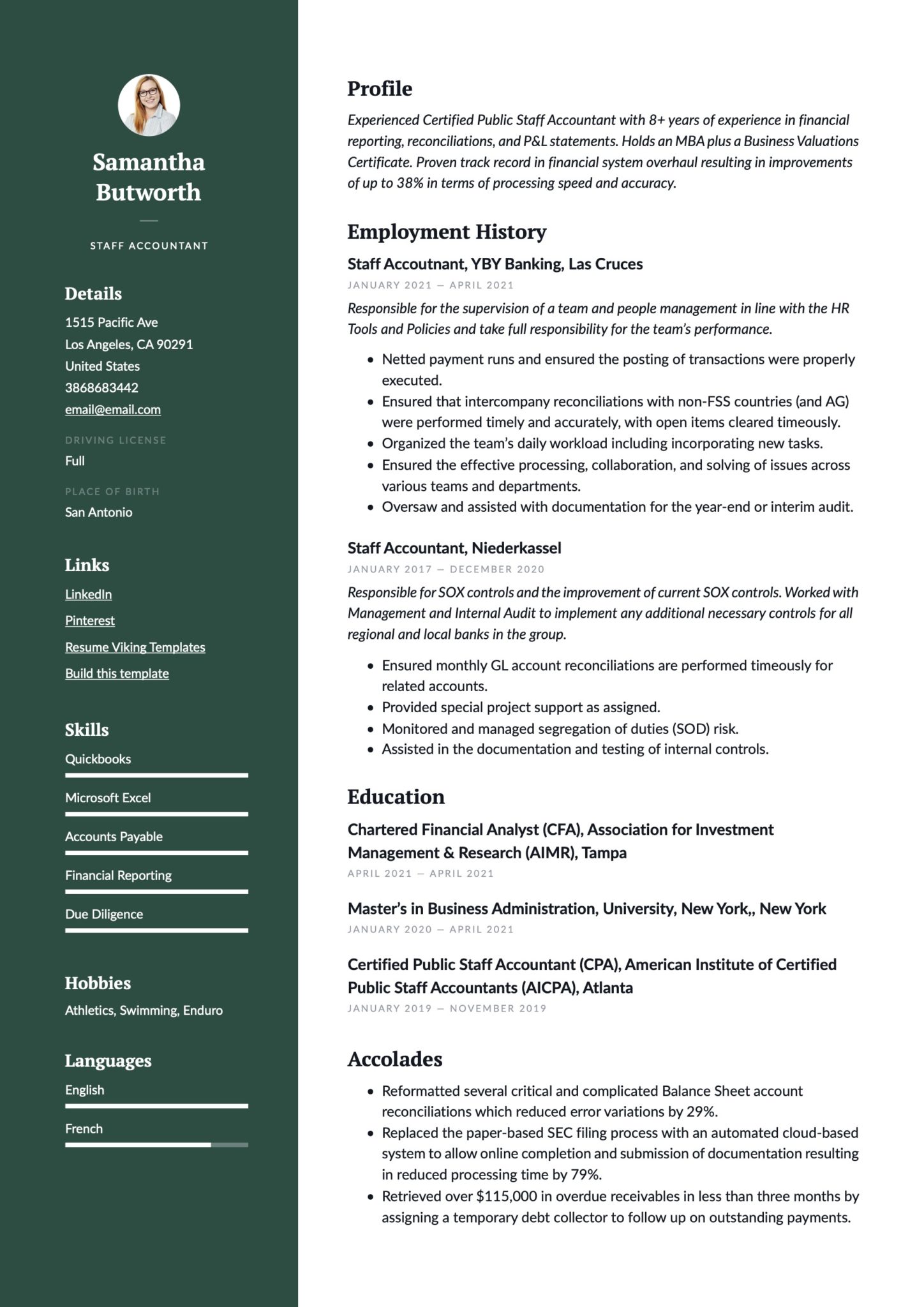

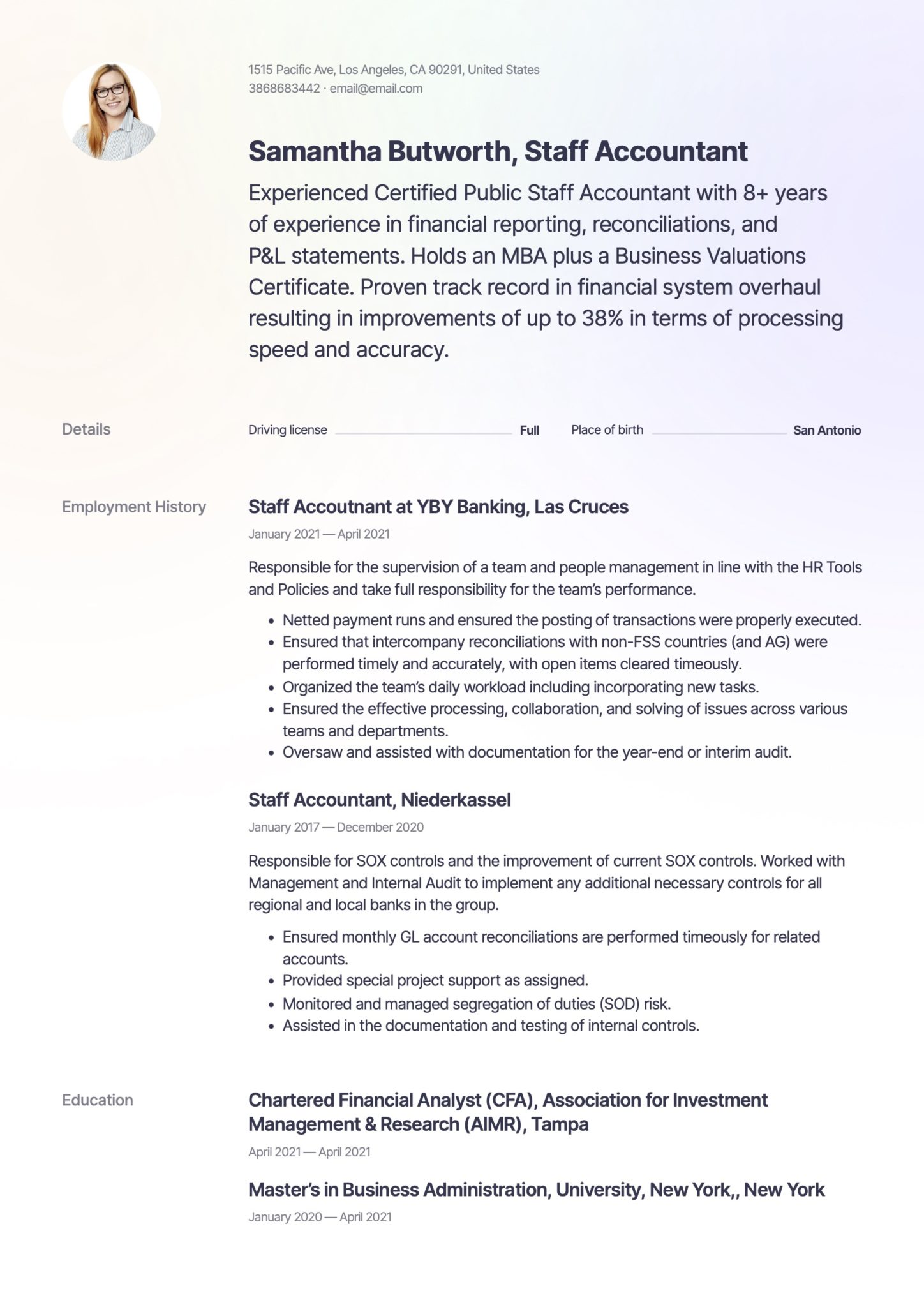

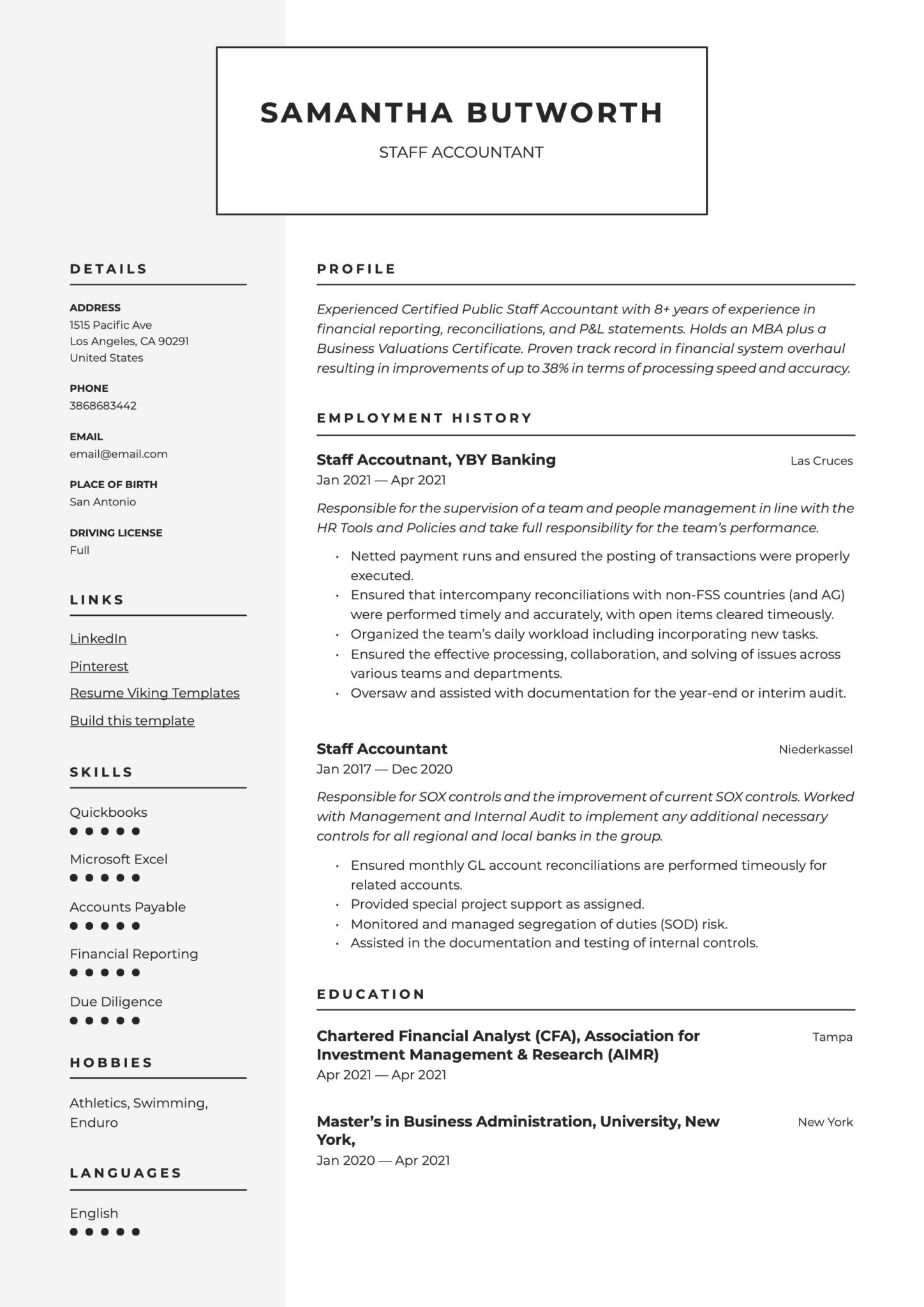

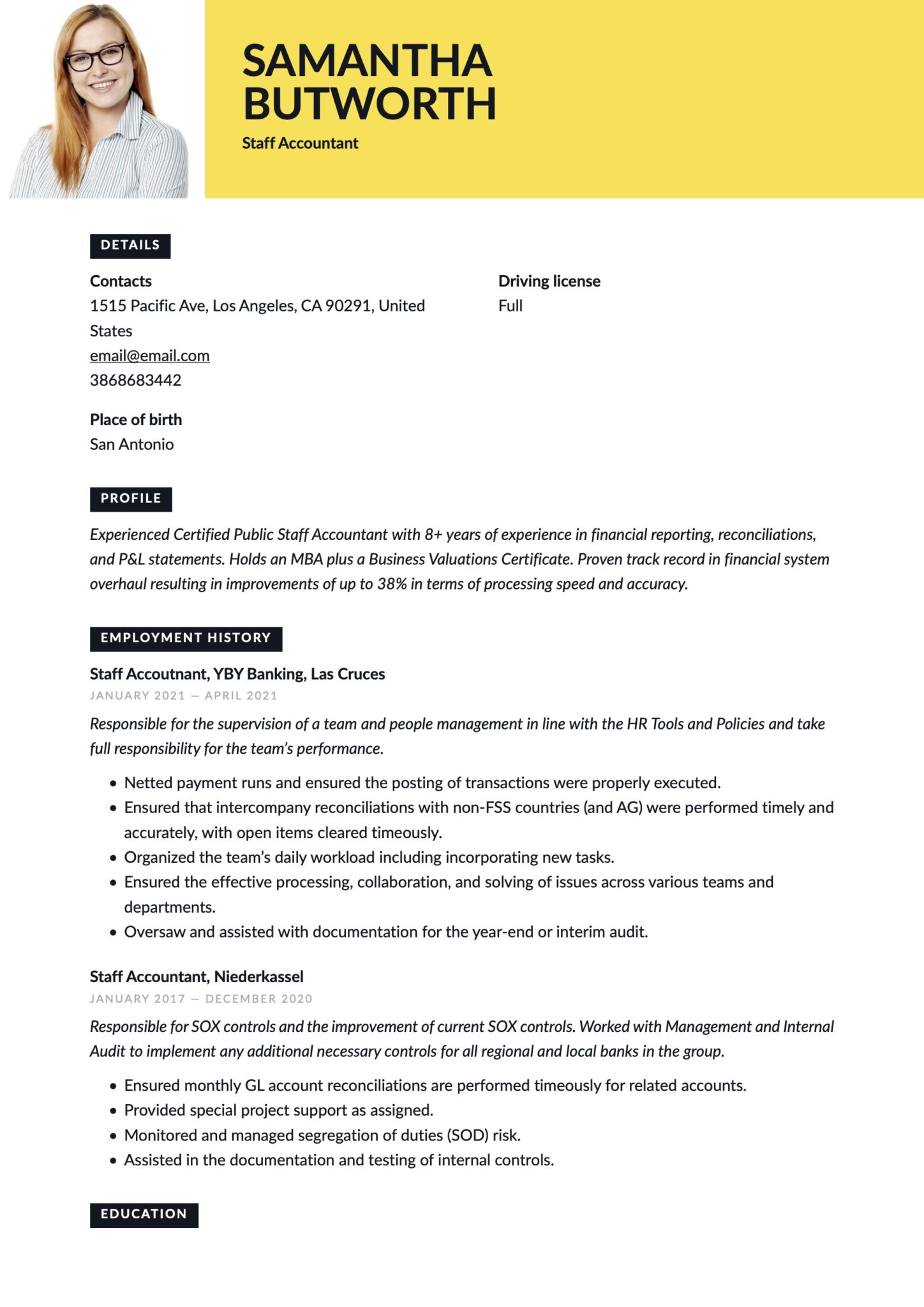

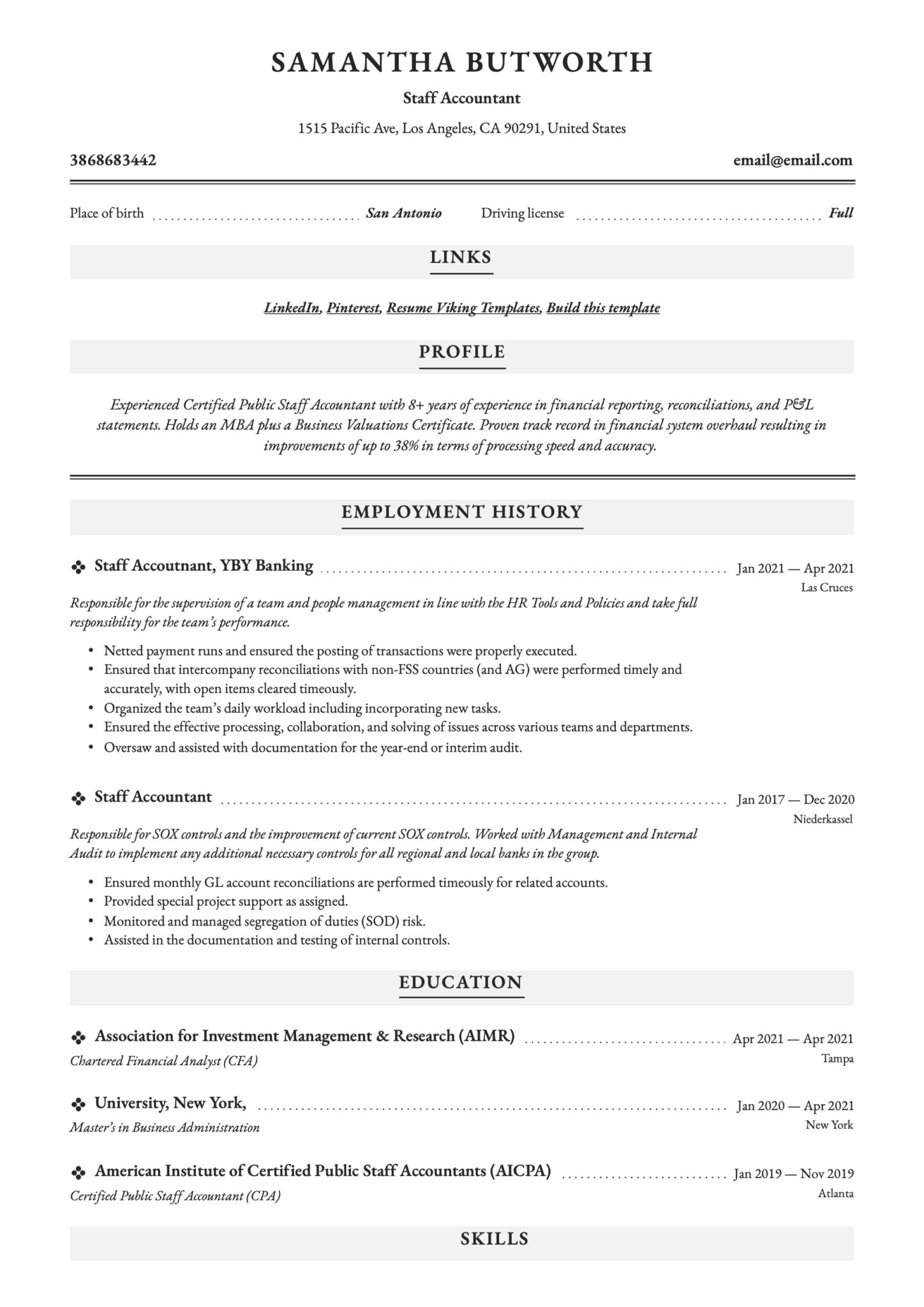

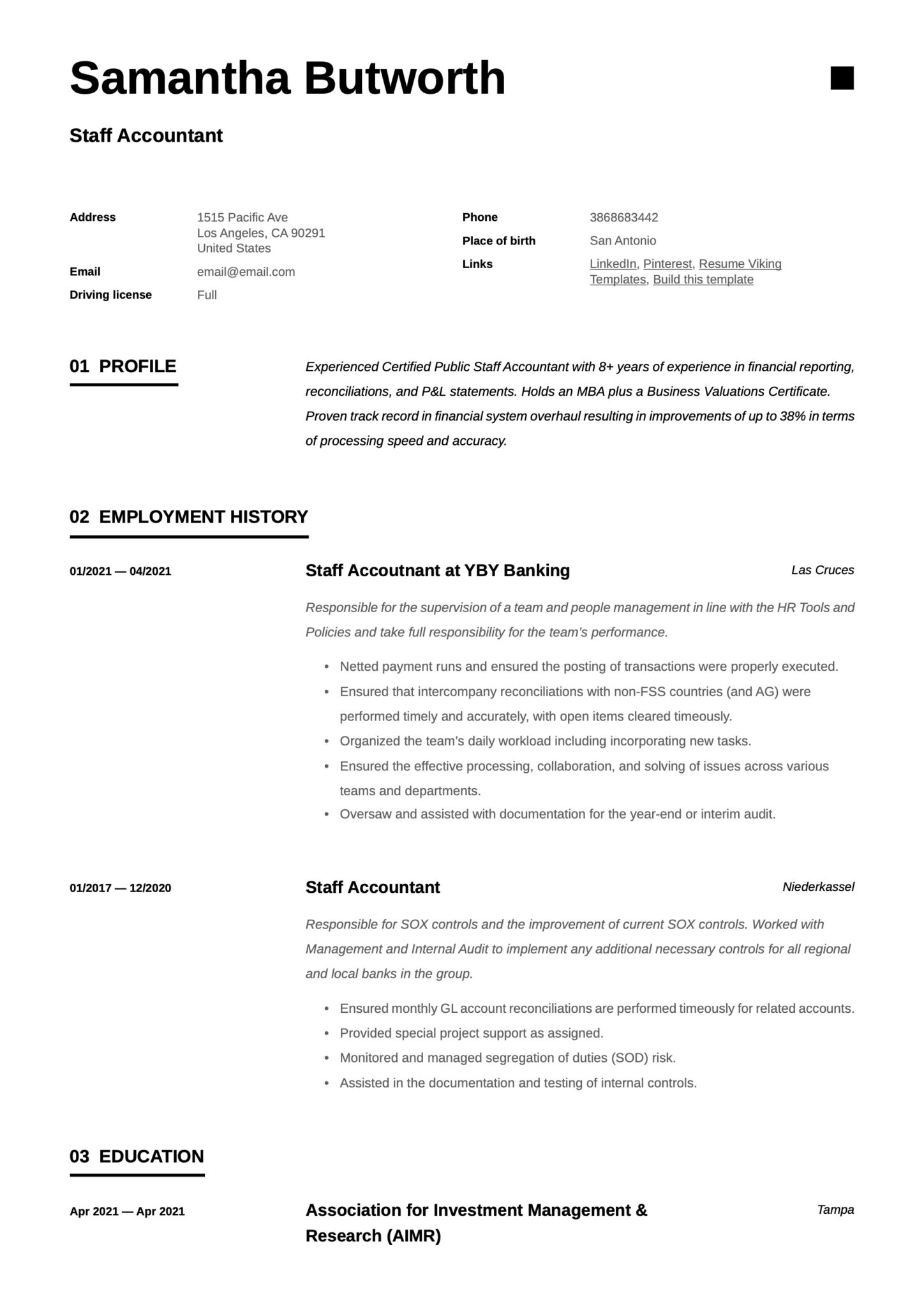

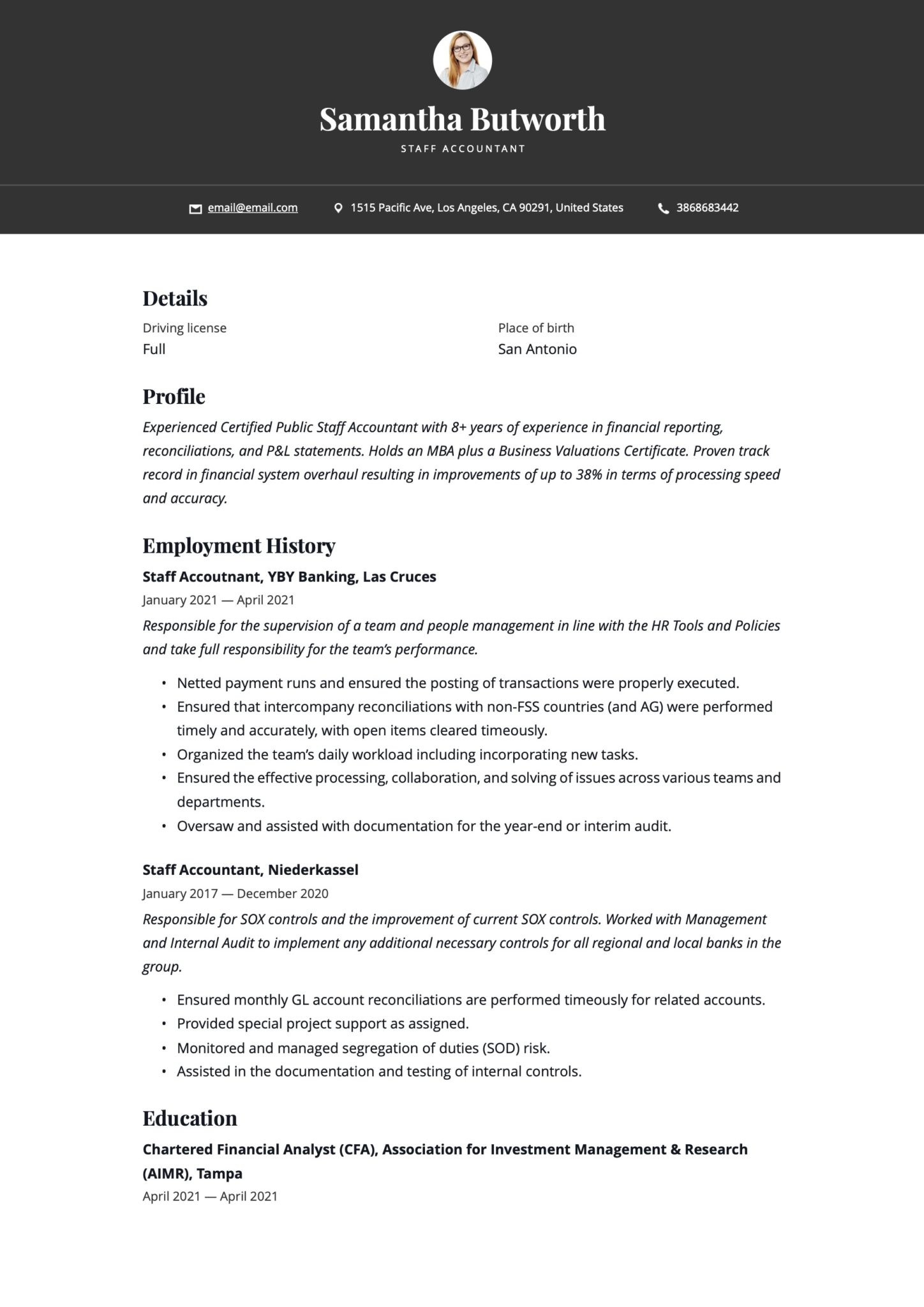

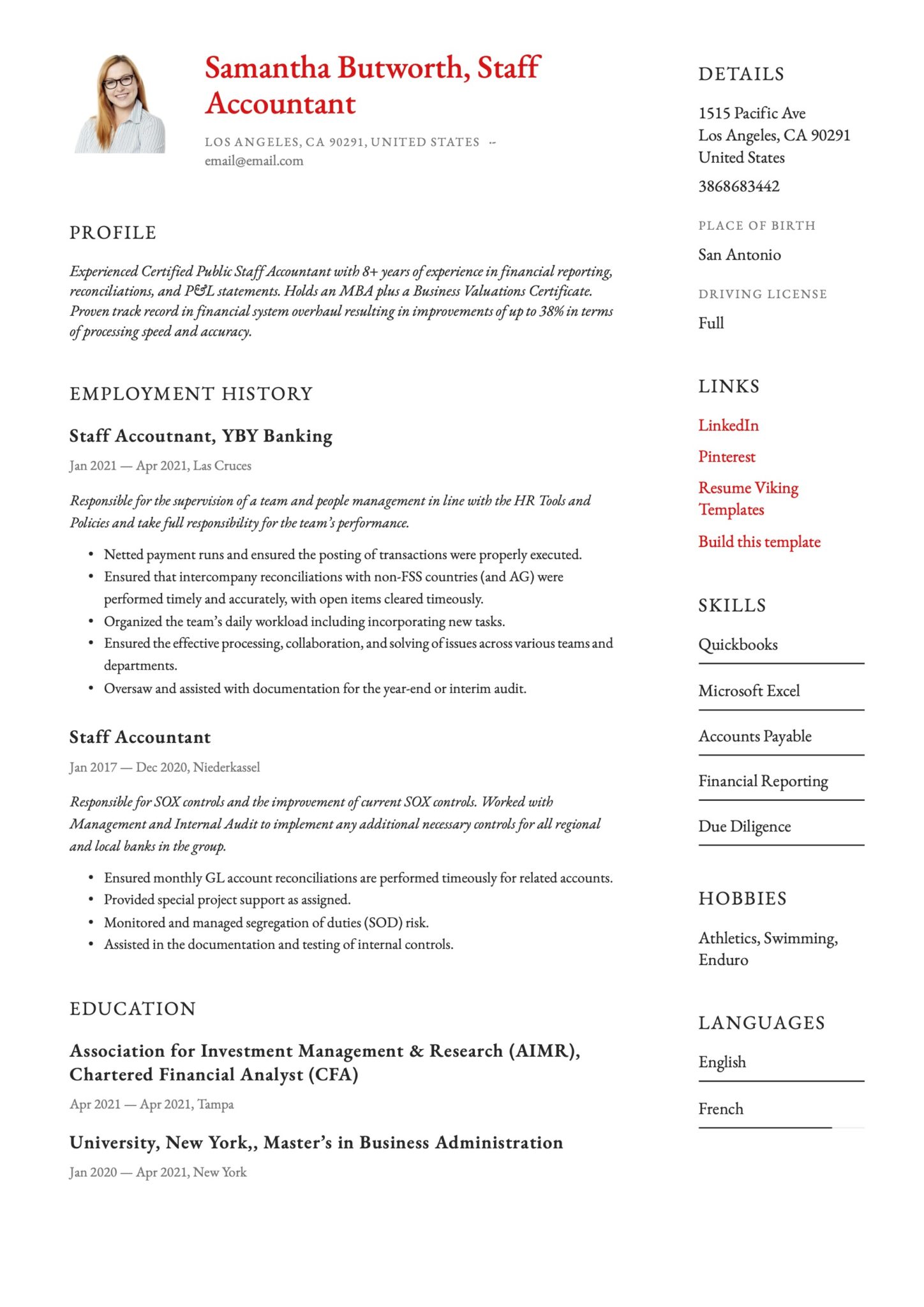

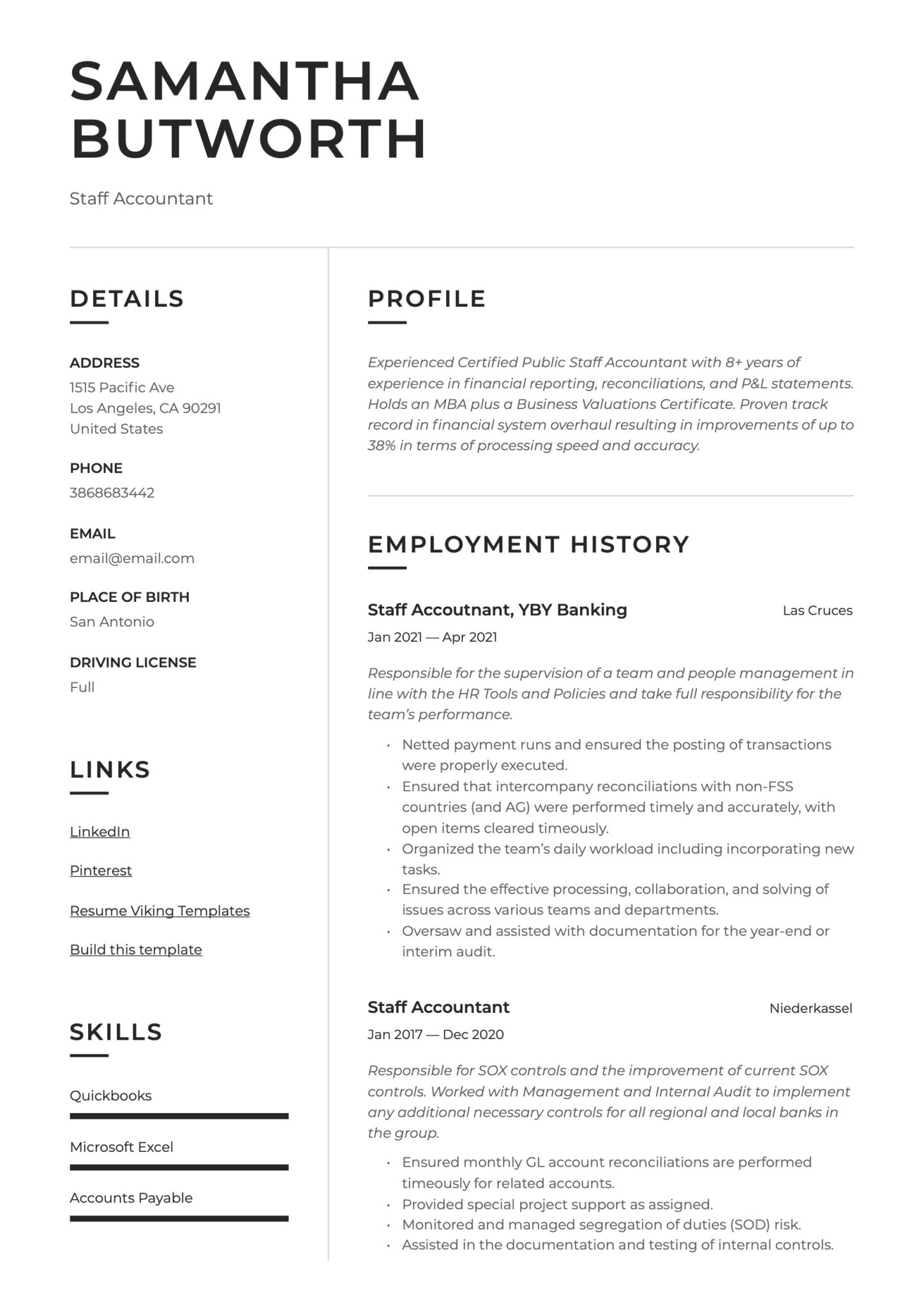

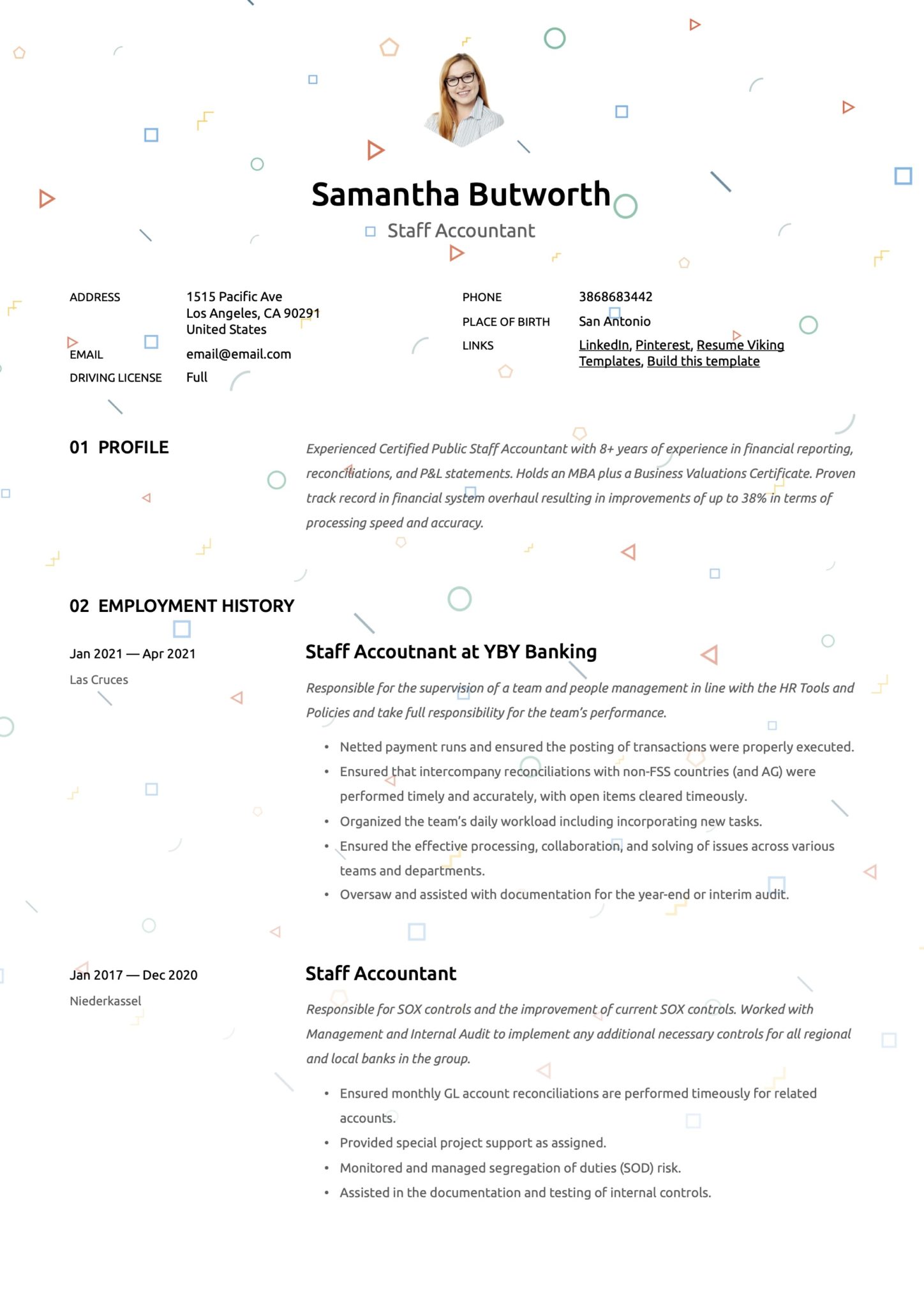

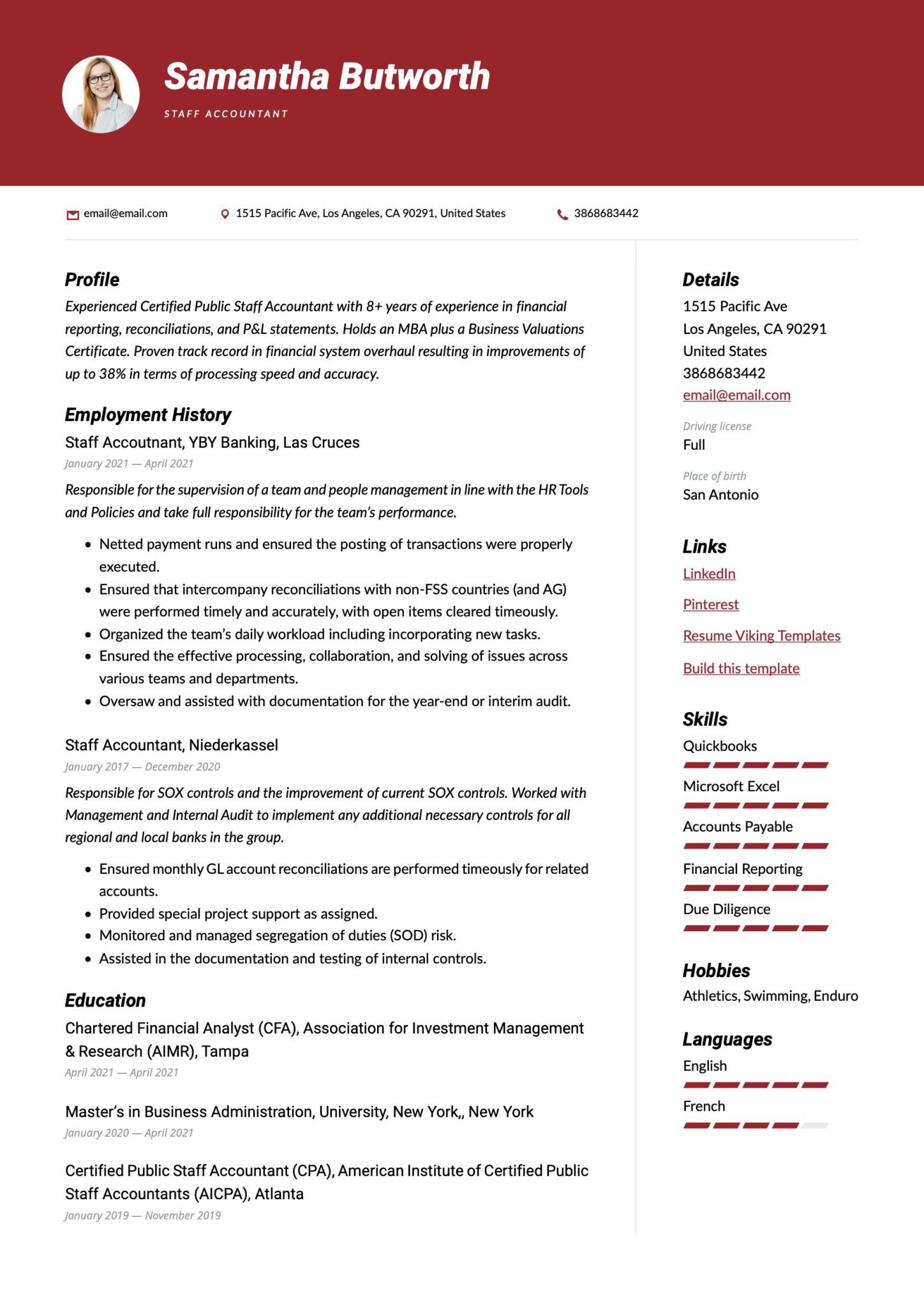

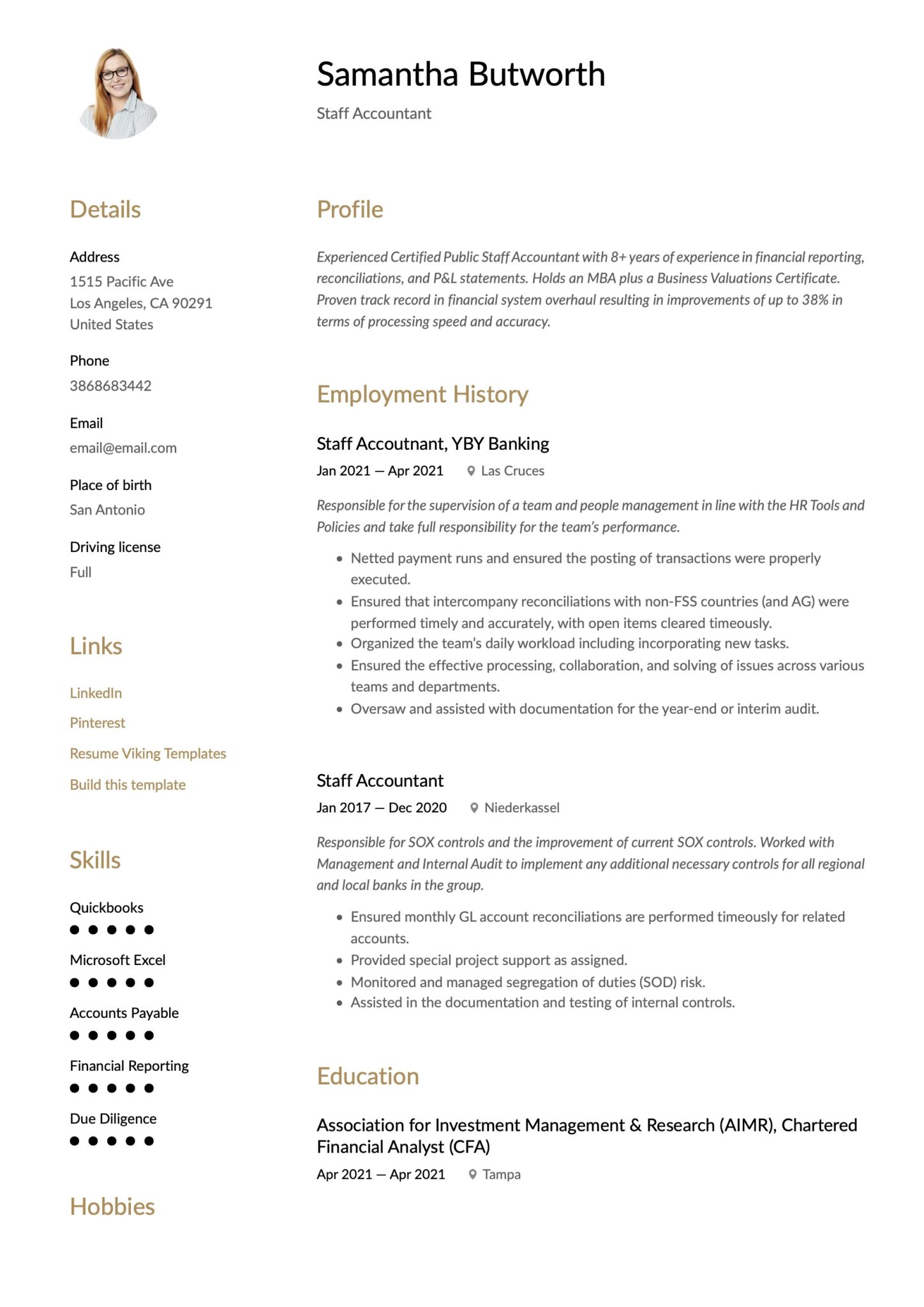

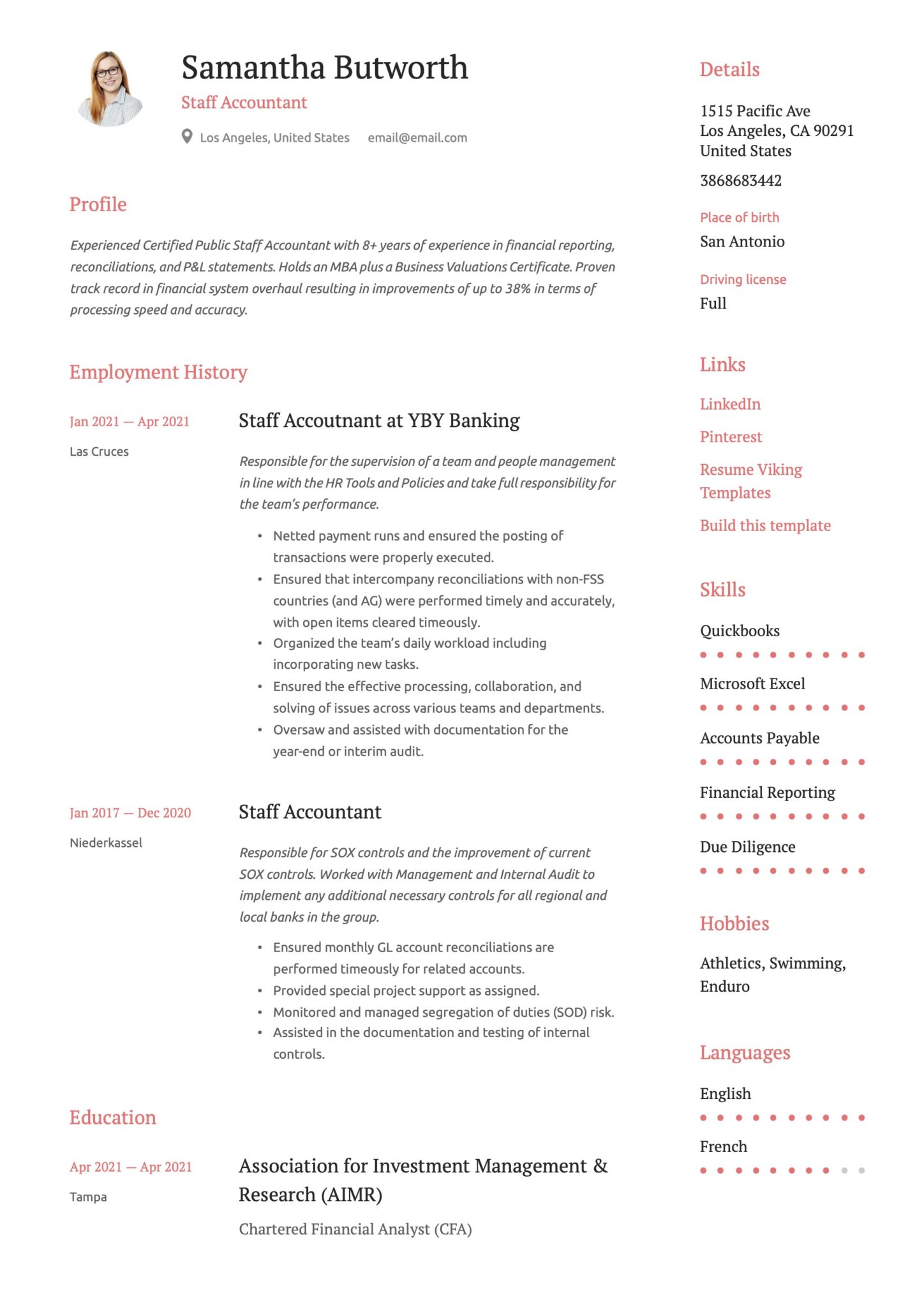

Staff Accountant Resume Examples

(Free sample downloads are at the bottom of this page)

Staff Accountant Resume Guide

Resume Sections

- 1. Contact information

- 2. Profile Summary

- 3. Employment History

- 4. Accomplishments

- 5. Education

- 6. Skill Section

- 7. Certification & licensing

- 8. Extras: Languages/Awards/Publications/Volunteering/hobbies

- > Professional information

What to Highlight as a Staff Accountant

Whether you are a seasoned professional Staff Accountant or just starting out, there are many crucial pieces of information that recruiters and employers need to see in an applicant’s resume to ascertain if they are the right fit for their company.

- Firstly, you need to highlight the scope of your role as an accountant. A Staff Accountant working for a small business is likely to have financial jurisdiction because they work so closely with the managing directors and owners. Alternatively, a Staff Accountant working for Fortune 500 could be part of a team of accountants, each responsible for a certain business section.

- Secondly, in today’s day and age, Staff Accountants need to be tech-savvy. There are many software tools and accounting packages that companies use, and you need to make it clear that you can adjust quickly to a new system or show your experience with different platforms. Examples of these platforms are MS Excel, SAP, Sage, QuickBooks, FreshBooks, and AccPac. Employers also expect you to be comfortable with CRM systems such as Oracle, Invent Pro, Order Hive, and SalesForce.

- Thirdly, Staff Accountants are responsible for a business’s operational record keeping, such as tracking production expense statistics and procurement transactions. These relate to travel accounting, equipment management, accounts payable, and HR expenses. Another area that falls under the heading of record-keeping is the preparation of financial records and statements from financial data sets. Staff Accountants will need to ensure accuracy of ledger accounts and reconciliations of bank statements to prepare balance sheets, income statements, and profit and loss reports. As a Certified Public Accountant, your responsibilities would include tax calculations and reporting on tax returns.

- Lastly, by analyzing revenues, current costs, and financial commitments, Staff Accountants can predict and help prevent finical crises through risk management. Part of this responsibility is approving expenses and budgets that can range from thousands to millions per month depending on the size of the organization and its annual turnover.

*Cool Tip for a stellar resume:

Think back to your previous positions were you able to save money for the company you were working for or prevented the loss of money. This is very attractive information, and something employers look for. Below are two areas to mention:

- Reducing Risk – Worked hard to increase the budget forecasting accuracy to 98% by collating expenditure statistics over the last three years and modeling future predictions based on actual historic values. This ensured cash flow stability at all times.

- Saved Money – Decreased product replacement costs by over half and improved on-time delivery from 83% to 96% using Kaizen methodology.

1. Contact information

- First Name and Last Name

- Physical Address

- LinkedIn Profile / Portfolio Link

2. Summary & Profile

Hiring managers are very busy people who receive hundreds of resumes that they then need to screen. If your resume does not grab their attention early on, you can be sure that they will not keep reading.

The best way to grab their attention from the very start is with a well-written career summary or objective statement. This paragraph should be situated at the very top of your resume, right below your name and contact details, as it serves as a brief introduction about who you are and what you have to offer. Remember, this is only a brief introduction, so you need to keep it short (no more than six lines long).

Lastly, one of the most important things to do before writing any section of your resume is to read through the job description to outline the specific skills, qualities, and experience the employer is looking for.

- The Career Summary:

A career summary is a perfect choice for someone who has an extensive amount of Staff Accountant work experience. It allows you to highlight your years in the industry, your most impressive skills and qualities, and one or two of your best accomplishments. Begin your career summary with your years of experience in the industry and the main duties you performed. Next, using the job description as a guide, highlight the most impressive duties and responsibilities you were given in previous positions.

- The Objective Paragraph:

If you are just starting out and have not yet built up a serious amount of work experience, the career objective is the perfect choice for you. Rather than highlighting your experience, a career objective allows you to highlight your career goals and aspirations while still allowing you to highlight your most admirable skills and qualities. At the very end of your objective paragraph, highlight your most impressive academic qualifications and achievements.

Examples

Staff Accountant Summary 1

“Experienced Certified Public Staff Accountant with 8+ years of tenure in financial management, reconciliations, reports, and P&L statements. Holds a Masters in Business Administration plus a Business Diligence Valuations Certificate. Proven track record in financial system overhaul resulting in financial of up to 38% in terms of processing speed and accuracy.“

Staff Accountant Summary 2

“Dependable and meticulous Staff Accountant highly tenured incorporate and inter-company financial functions. Adept competencies in strategic revenue forecasting and budgetary targets for all global company offices and affiliates. Holds a Bachelor’s Degree in Accounting Sciences and a GRP (Global Risk Professional) qualification.“

Staff Accountant Summary 3

“Staff Accountant with four years of experience providing accounting and financial reporting and analysis during the board's financial and accounting statements. Performed work 100% error-free thanks to rigorous self-checking. Seeking employment within the banking industry.“

Staff Accountant Summary 4

“Staff Accountant well-tenured in working with cross-functional teams to synchronize month-end record-keeping. Used automation to cut 3.5 hours a week of meeting time for ten employees. Would like to secure a position with Two Oceans as a Senior Staff Accountant.“

3. Employment History

If you want to grab the reader’s attention, you can do so with your work experience. Whether you have years of experience or are just starting out, there are ways to create a captivating Employment History section.

- Use reverse-chronological order to list your employment. This allows your most recent experience to be viewed first.

- Use the job description and integrate keywords to make your information more compelling.

- Add a professional job title, the company’s name, and your dates of employment.

- Add 3–5 bullet points that show off your most admirable skills, duties, and achievements. Remember to add numbers to accomplishments like dollars, hours, or percentages to add quantification.

- Engage the hiring manager with action words.

Below we have added examples of employment history listings for Staff Accountants:

Staff Accountant at YBY Banking

(March 2016 – Current)

Responsible for the supervision of a team and people management in line with the HR Tools and Policies and take full responsibility for the team’s performance.

- Netted payment runs and ensured the posting of transactions was properly executed.

- Ensured intercompany reconciliations with non-FSS countries (and AG) were performed timely and accurately, with open items cleared timeously.

- Organized the team’s daily workload, including incorporating new tasks.

- Ensured the effective processing, collaboration, and solving of issues across various teams and departments.

- Oversaw and assisted with documentation for the year-end or interim audit.

Staff Accountant at Livery Finance

(Feb 2013 – Jan 2016)

Responsible for SOX controls and the improvement of current SOX controls. Worked with Management and Internal Audit to implement any additional necessary controls for all regional and local banks in the group.

- Ensured monthly GL account reconciliations are performed timeously for related accounts.

- Provided special project support as assigned.

- Monitored and managed segregation of duties (SOD) risk.

- Assisted in the documentation and testing of internal controls.

Job Descriptions Examples

There are several proven foundational skills and duties that employers expect to see in an applicant's resume. We have provided several examples for you below:

A Staff Accountant may:

- Assist with ledges, journal entries, balance sheet reconciliations, fixed assets, and P&L reporting.

- Reconcile main bank accounts and international subsidiary accounts.

- Prepare documents for annual tax returns.

- Work with external auditors during the audit reviews and compile all necessary documentation required during the investigation.

- Responsible for all intercompany accounts payable and accounts receivable reporting.

- Manage revenue, accounts receivable, accounts payable, and expense accrual accounts.

- Calculate the variances between budget and actual results

- Liaise with operations, production, and marketing departments to validate the accuracy of financial information and review financial data reports.

- Assist with migration of balance sheets from Oracle to SAP.

- Be responsible for cash disbursement.

- Engage with internal audit teams to complete documentation for SOX and Basel II.

- Oversee all financial reporting and accounting functions.

- Manage a team of 5 accounting clerks during the reconciliation of bank accounts, the analysis of periodic financials, and the preparation of budgets.

- Compile financial statements and submit them to the Financial Director.

- Reconcile T&E, Petty Cash, Amex, and Prepaid accounts.

- Verify all payments for invoices, accounts payable, and accounts receivable reports.

- Update and maintain budgetary reports, schedules, and expense report every 45 days.

- Responsible for the payroll function of 1600 employees.

4. Accomplishments

If you are thinking of simply reading through the job description and copying and pasting the job duties that you have performed into your resume, let us stop you right there. Doing this will show the hiring manager that you are unoriginal and lazy, qualities you do not want to be associated with. Rather, use the job description as a tool and write your accomplishment statements to compliment the duties that the job description is outlining. Your goal is to include information that sets you apart from other applicants and to communicate this information through compelling, action-packed statements.

Examples:

Flat, Simple Duty:

Focused on reducing expenses and improving cash flow reserves.

Accomplishment Statement:

Implemented a cash conversion model for seven branches and 13 ATMs that saved $45,000 a year in processing expenses.

Quantifying Your Resume

Quantification is vitally important, not only in your accomplishments section but throughout your entire resume. Without quantification, the reader has nothing to measure you against, and your statements become meaningless. Rather take the time to see if your statements answer the following questions: “How much?” or “How many?”. See the examples below:

- Scope and Budgets Size

- The amount of any investments you managed and how profitable they were.

- The net worth of the company you worked for and what your main duties were.

- The size of the investments you have reconciled.

Examples of statements without quantification:

- Reformatted several critical and complicated Balance Sheet account reconciliations, which reduced error variations.

- Retrieved significant amounts of overdue receivables funds in less than three months by assigning a temporary debt collector to follow up on outstanding payments.

- Completed month-end duties and reconciled balance sheet accounts. Found and fixed a recurring mistake, which accounted for a large saving.

- Used automation to save multiple hours a week of meeting time for a group of employees.

Examples of statements with quantification:

- Reformatted several critical and complicated Balance Sheet account reconciliations, which reduced error variations by 29%.

- Retrieved over $115,000 in overdue receivables in less than three months by assigning a temporary collector to chase up on outstanding payments.

- Completed month-end duties and reconciled income statements and balance sheet accounts. Found and fixed a recurring mistake, saving $1.3M annually.

- Worked closely with cross-functional teams to sync month-end record-keeping and reporting. Used automation to cut 3.5 hours a week of meeting time for 12 employees.

5. Education

Your education section is very important in your resume and an area that hiring managers and employers pay close attention to. When listing your qualifications, certifications, or industry licenses, you simply need to indicate When What, and Where. Do not forget to include any qualifications you are in the process of completing.

Completed Secondary and Tertiary Education must be listed as follows:

Begin with your commencement and completion date for diplomas, associate's degrees, and bachelor’s degrees. For courses, simply list the completion date. Next, write the full name of the qualification, the full name of the institution, and lastly, the City or abbreviated State name where the institution is situated. Your high school diploma details are listed similarly, but only include this when you have less than five years of working experience.

Here are some examples of a Staff Accountant Resume with more than five years’ experience:

2020 – Chartered Financial Analyst (CFA), Association for Investment Management & Research (AIMR), Tampa, FL.

2018 – Master’s in Business Administration, Fordham University, New York, NY.

2017 – Certified Public Staff Accountant (CPA), American Institute of Certified Public Staff Accountants (AICPA), Atlanta, Georgia.

2014 – 2016 Bachelor of Science in Accounting, Boston University, Boston, MA.

If you have less than five years’ experience, you may also add your majors, minors, GPA scores and accolades, and honors awards:

2020 – Current Certified Chartered Staff Accountant, Association of Chartered Certified Staff Accountants (ACCA), Online.

2017 – 2018 Associate’s in Applied Accounting Science, University of Menton, MA.

GPA: 3.8

Majors: Financial Reporting, Accounting

Minors: Information Management, Investment Accounting, Economics

Accolades: Deans Honors List

2015 – Certificate in Accounting Fundamentals, Merrick Business School, Baltimore, MD.

2014 – High School Diploma, Key North High School, Miami, FL.

Awards: Senior Member of the National Golf Society, 2010 – 2012

Leadership: Vice Council of the Maths and Innovation Club, 2011

6. Skills

A staff Accountants resume requires specific technical skills to ensure they work accurately and efficiently; however, employers look closely for soft skills to gauge whether you have the qualities needed for leadership and management.

These two skill sets allow the employer to gauge your competency and decide whether you are the right fit for their company. Remember to read through the job description again to outline the specific skills and qualities the employer is looking for.

If you have any of these, be sure to integrate them into all areas of your resume to make it more relevant and appealing.

*Pro Tip: If your experience is kind of balancing-a-checkbook-level, do not stress, rather pick transferable skills from the lists below and then prove them with accomplishments from non-accountant jobs.

Hard Skills

| Financial statements | Payroll taxes |

| Collections | Regulatory filings |

| Asset management | Account analysis |

| IT | MS Office |

| Payroll | Account reconciliation |

| Budgets | State tax law |

Soft Skills

| Interpersonal skills | MS Excel |

| Written and verbal communication | Attention to detail (detail-oriented) |

| Collaboration | Critical thinking |

| Business knowledge | Organization |

| Time management | Meticulous |

7. Qualifications & Certifications

| Bachelor of Accounting Sciences | Master in Business Administration | Chartered Financial Analyst (CFA) |

| Personal Financial Specialist (PFS) | Chartered Global Management Staff Accountant (CGMA) | Certificate in Project Management (CIPM) |

| Accredited in Business Valuation (ABV) | Certified in Financial Forensics (CFF) | Certified Information Technology Professional (CITP) |

| Certified in Entity and Intangible Valuations (CEIV) | Certified in the Valuation of Financial Instruments (CVFI) | Certified Public Staff Accountant (CPA) |

| Master Excel User | Certified Key Accounts Manager (CKAM) | Associates Degree in Accounting Management |

Optional Section for Staff Accountant Resumes

The trick of the trade when it comes to writing your resume is that the more relevant accomplishments you can include, the more impressive your resume looks to the reader. For this reason, utilize the optional extras section to include information about yourself that you may not have been able to include in previous sections.

Examples to include are:

- Activities

- Language skills

- Volunteer work

- Hobbies

- Achievements

- Professional associations

If your resume is still on the thinner side: Make sure to include the following details:

- The turnover, size, and expense budgets you are responsible for.

- Your GPA score if you have completed a bachelor's or associate's degree (only if it is higher than 3.6).

- The number of staff you are managing if you have junior Staff Accountants or bookkeepers assigned to you.

- The Sales Management Platforms and Customer Relationship Management (CRM) platforms you are familiar with.

- Communication and collaboration cloud-based systems like Slack, Asana, or even Skype, which you use to facilitate communication between team members.

Professional information for Staff Accountants

Sectors: All Sectors

Career Type: Auditing, Accounting, Taxation, Reporting, Financial Management, Auditing

Person type: Reporter, Creator, Investigator, Compiler, Investigator, Verifier, Processor, Vetter

Education levels: Bachelor’s to Masters’ Degree

Salary indication: An average of $ 56 280 (Salary.com)

Labor market: Average Growth of 4% between 2019 and 2029 (BLS)

Organizations: SME, Fortune 500, Commercial, Corporate, Government, NPO – Basically All Organizations

Download Staff Accountant Templates in PDF