Top Resume Tips for Accounting & Finance Candidates

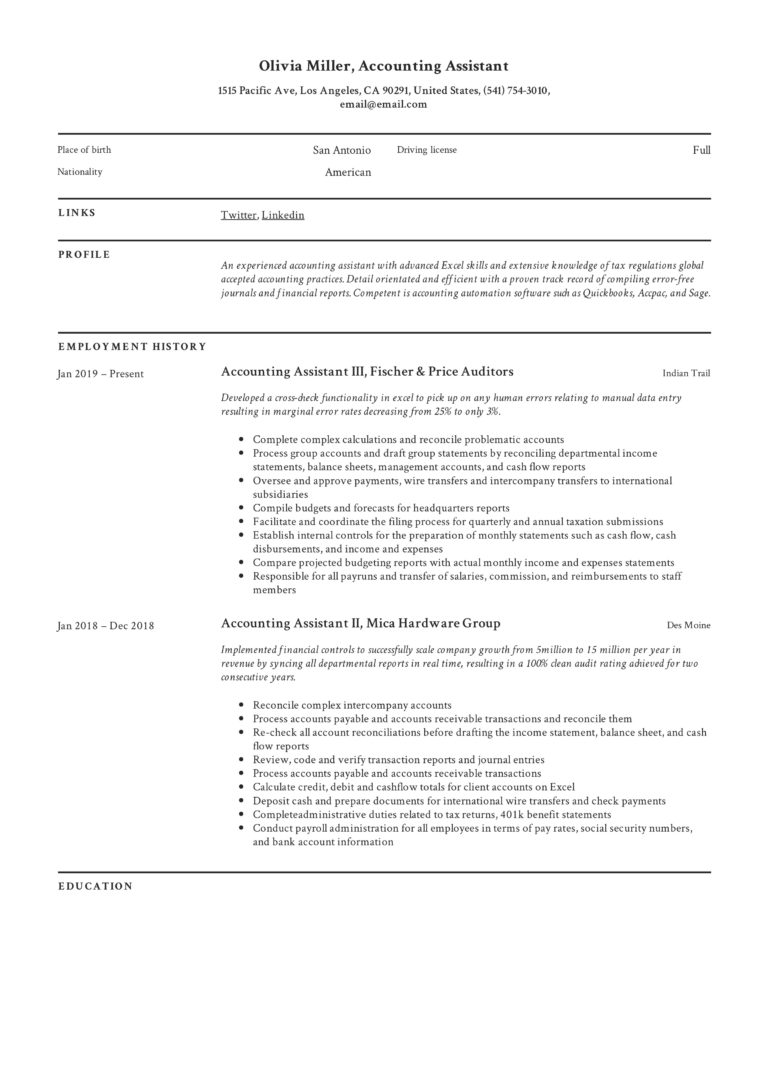

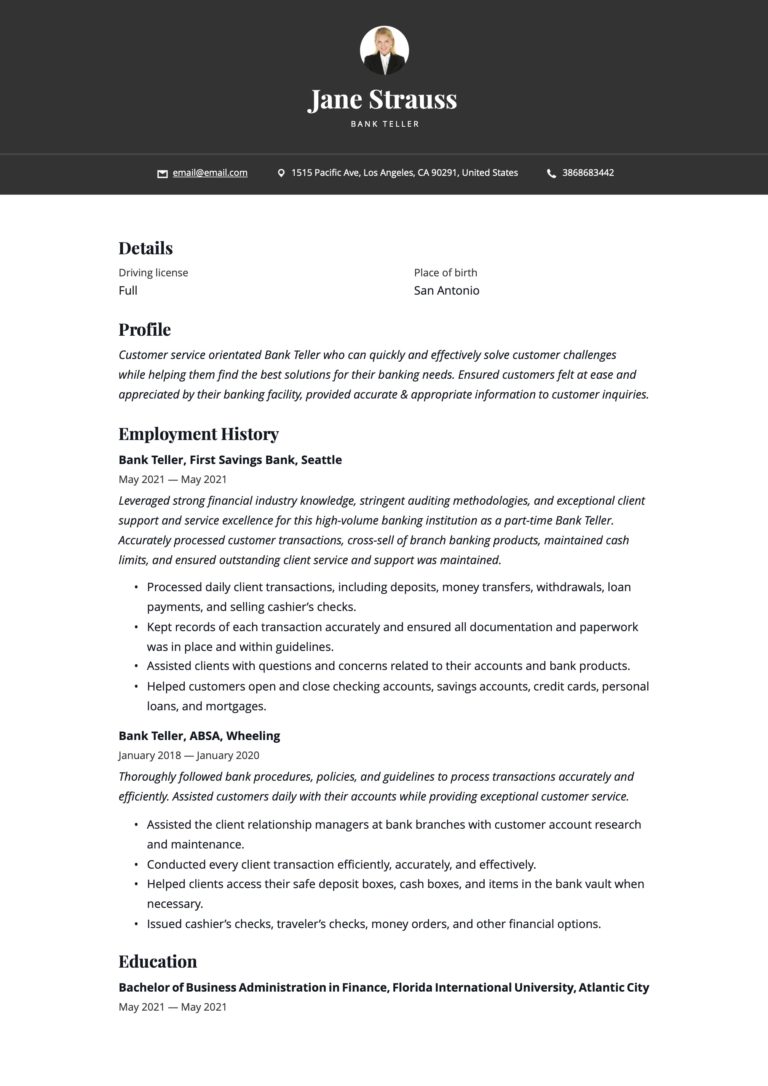

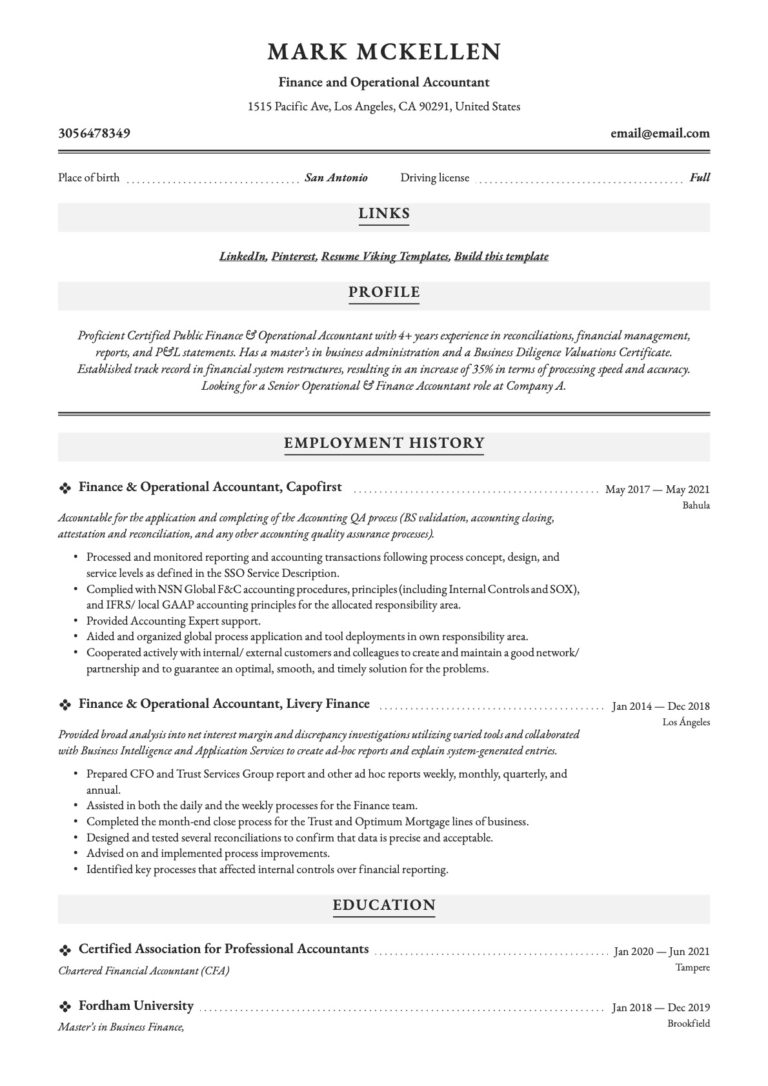

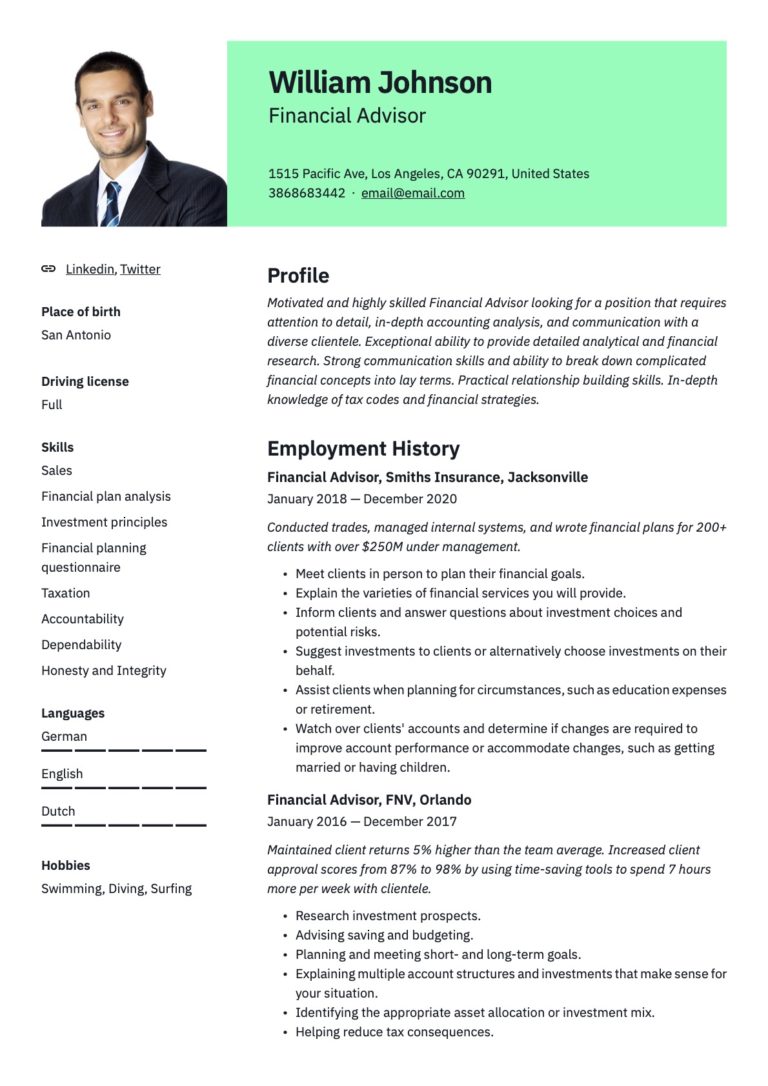

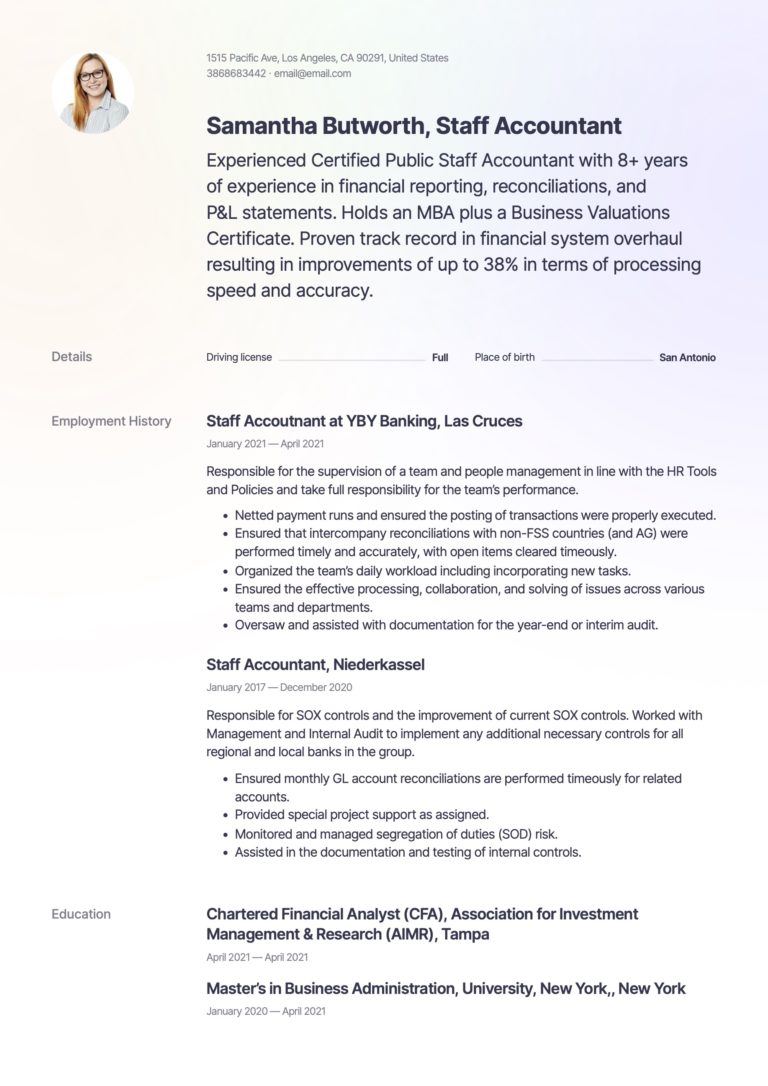

1. State the overall purpose of your role

In accounting and finance jobs, there are many focus areas, such as analyzing financial information and compiling reports for record-keeping of assets, liabilities, profit, and loss, calculating tax liabilities, conducting audits, performing cost accounting, management accounting, and investment accounting. As a financial candidate, you need to highlight the overall purpose of your role in your accounting & finance resume for recruiters to match you instantly to the jobs they have available.

2. How big is your scope of responsibility

Another aspect of importance to recruiters is your scope of financial responsibility within your company. Accounting and finance professionals are found in global conglomerates, Fortune 500 companies, large corporations, and also in medium-sized and small businesses. The size or scope of the business in terms of turnover and employee count will determine your financial jurisdiction in the company, which may point recruiters to which jobs you will be suited for.

3. Tools & Tech

In the Fourth Industrial Revolution, the financial sector is largely dependent on digital tools and software applications. You need to showcase your competencies in this regard by mentioning the programs that you have experience in. Secondly, Accountants currently need to be tech-savvy to run the various software tools and accounting packages that the company uses. Examples include Sage, MS Excel, SAP, AccPac, QuickBooks, and FreshBooks. Other specialist applications worth mentioning include CRM systems (Oracle), warehousing and distribution tools (OrderHive), inventory management applications (InventPro), and even sales applications (SalesForce).

4. Education & Training Requirements

Academic credentials are paramount in the Accounting & Finance Industry. List your educational background by qualification/certification, year of completion, and institution. Typical qualifications in this industry include A Bachelors's or Master’s Degree in various financial disciplines, a postgraduate business qualification like an MBA, and certifications such as Certified Public Accountant, Certified Financial Analyst, or Certified Internal Auditor.

5. Skills to Highlight on a Finance & Accounting Resume

Budgets, Cash Flow Reporting, Strategic Forecasting, Research, Statistical Modeling, Analytics, MS Excel, Tax Reporting, Variance Analysis, Income Statement, Balance Sheet, Tax Returns, P&L Reporting, Investment Accounting, Reconciliations, Internal Auditing, Mathematics, Statistics, Activity Based Costing, Report Writing, Due Diligence, Mergers & Acquisitions, Forensic Accounting, SQL, Visual Basic,

6. Salary Range

The remuneration medians for Accounting and Finance Professionals may start as low as $35 000 each year right up to $200 000 every year if you are the CFO of a Fortune 500 company. Accountants are classified as level I, II, and III dependent on their years of experience and qualifications obtained. An Accountant I earns between $48,647 and $58,833 per annum, an Accountant II between $56,019 and $68,388 each year and an Accountant III between $70,366 and $86,175 every year.